Investors pulled almost $200 million on Monday. The withdrawals were led by BlackRock and Fidelity, and was a sharp reversal from the $3.7 billion inflows that were seen over the prior eight sessions. Alongside ETF redemptions, Ethereum’s staking ecosystem is also under pressure, with over 910,000 ETH queued for unstaking. Despite the pullback, ETH ETFs continue to gain ground relative to Bitcoin ETFs, and analysts still predict they could surpass BTC products in terms of supply percentage by September. Meanwhile, a retail trader turned $125,000 into $7 million through leveraged ETH longs, even as whales sold off their holdings.

Ethereum ETFs Hit by Outflows

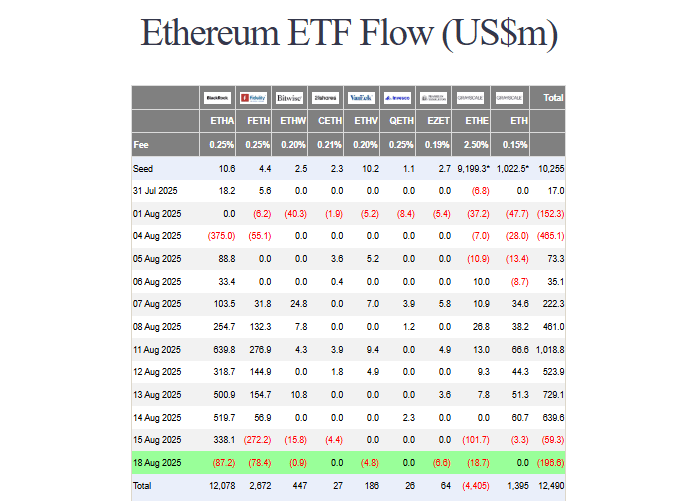

Spot Ethereum exchange-traded funds (ETFs) began the week with a sharp downturn, and recorded close to $200 million in outflows on Monday as part of a sell-off trend that started late last week. Investors pulled $196.7 million from Ethereum ETFs, which was the second-largest single-day outflow since the products launched. Monday’s withdrawals followed Friday’s $59 million, bringing the two-day total to $256 million.

ETH ETF flow (Source: Farside Investors)

The scale of the recent outflows stands in contrast to the massive inflow streak that came before them. In the eight trading sessions before Friday, Ethereum ETFs brought in a record $3.7 billion, with some single days seeing more than $1 billion in fresh inflows. Despite the reversal, appetite for Ethereum through regulated investment vehicles is still quite strong when compared with historical levels.

Among the issuers, BlackRock and Fidelity experienced the largest investor pullbacks on Monday, with outflows of $87 million and $79 million, respectively. The outflows followed Fidelity’s big $272 million withdrawal from its Ethereum Fund on Friday. BlackRock’s iShares Ethereum Trust ETF (ETHA), which is one of the largest Ethereum funds, held about 3.6 million ETH valued at $15.8 billion as of Friday. By Monday, its dollar value slipped to $15.6 billion after ETH’s price dropped by about 6.5%.

At the same time, Ethereum’s staking ecosystem is showing signs of strain. ValidatorQueue data indicates that the Ether unstaking line reached a record 910,000 ETH, worth almost $3.9 billion, with validators now facing wait times of more than 15 days to exit. Some analysts see the trend as potentially bearish.

Bitcoin advocate Samson Mow said that while “the flippening will never happen, the unstakening is coming.” He also suggested that ETH’s price relative to Bitcoin could fall to 0.03 BTC or lower, down from the current 0.036 BTC.

Even so, Ethereum ETFs have been gaining ground on their Bitcoin counterparts in terms of overall adoption. Data from Dragonfly’s Hildobby showed that as of Monday, Bitcoin ETFs held about 6.4% of the total BTC supply, compared with 5% for Ethereum ETFs. If current trends continue, analysts predict Ether ETFs could surpass Bitcoin ETFs in terms of supply percentage by September.

ETH Trader Turns $125K Into $7M

While the crypto space is keeping an eye on ETH ETF flows, a crypto investor made headlines after transforming a $125,000 Ethereum trade into millions. This happened despite the market’s recent volatility and profit-taking by large holders.

According to blockchain data platform Lookonchain, the trader deposited his initial stake onto the decentralized exchange Hyperliquid and skillfully compounded profits by continuously rolling gains back into his long position. Over four months, this strategy built an enormous $303 million position and pushed his peak paper gains above $43 million before the latest downturn.

While the broader market pulled back, the investor exited all positions on Monday, locking in a net profit of $6.86 million. The return equates to an impressive 55-fold gain on the initial $125,000 investment.

The win happened as other Ethereum whales began reducing exposure after last week’s ETF outflows, which triggered expectations of a deeper correction. On-chain data from Nansen showed that wallet “0x806,” which is ranked among the top 100 Ether traders, sold more than $9.7 million worth of ETH on Monday. This was the second-largest Ethereum transaction in 24 hours. Another whale wallet, “0x34f,” sold $1.29 million, while numerous others also locked in millions in profits.

Market analysts suggested that Ethereum’s strong rally over the past few weeks invited a wave of profit-taking, dampening immediate upward momentum and instead pointing toward potential consolidation. Ryan Lee, chief analyst at Bitget exchange, warned that Bitcoin and Ethereum are still vulnerable to sharp swings given the heightened leverage in derivatives markets. He added that macroeconomic signals from the US Federal Reserve are also very crucial. Any hawkish rhetoric or a delay in expected rate cuts could put more pressure on crypto assets.

For now, CME Group’s FedWatch tool indicates an 82% chance that the Fed will keep rates unchanged at the upcoming Sept. 17 meeting.