US-listed Ethereum exchange-traded funds (ETFs) experienced their first week of outflows in 15 weeks, marking a break in a previously consistent trend of institutional inflows.

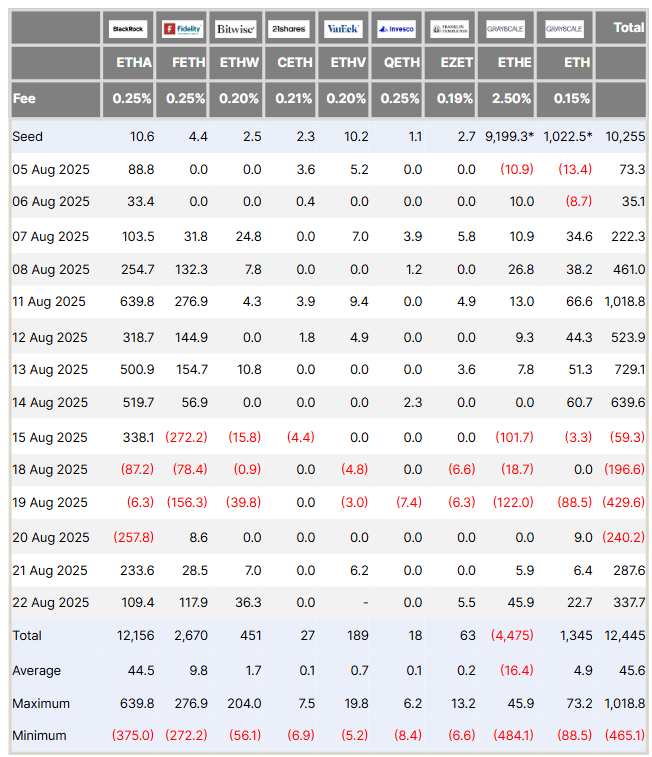

According to data from Farside Investors, $241 million was withdrawn from these products during the week of August 22, despite a late-week uptick in demand that mitigated the overall effect.

Ethereum ETFs Face Uncommon Setback with $241 Million Outflow

The week commenced with significant selling pressure, as the nine funds collectively saw an outflow of $866.4 million from Monday to Wednesday.

Notably, Tuesday alone saw $429 million in redemptions, marking the second-largest daily outflow since these products launched.

However, by Thursday, the sentiment began to improve. The funds saw two consecutive days of inflows totaling $625.3 million.

While this change lessened the magnitude of the outflows, it wasn’t sufficient to completely offset the previous losses, resulting in a net weekly outflow of roughly $241 million.

This shift mirrored broader macroeconomic signals and Ethereum’s market dynamics. The early-week selloff was driven by concerns over US inflation data, which increased speculation about the Federal Reserve’s upcoming policy moves and fuelled expectations of a short-term price dip in ETH.

Later in the week, Fed Chair Jerome Powell conveyed a more dovish stance, alleviating fears of extended tightening. Ethereum reacted with a rally to a new all-time high, which contributed to the late-week inflows.

Despite the setback, Ethereum ETFs maintain a stronger relative performance compared to Bitcoin ETFs.

In contrast, Bitcoin ETFs experienced over $1.1 billion in outflows last week, highlighting the differing investor interest in these two leading cryptocurrency products.

Nate Geraci, president of investment advisory firm The ETF Store, noted the broader trend.

Since August began, spot Ethereum ETFs have attracted $2.8 billion in inflows, whereas spot Bitcoin ETFs have seen $1.2 billion in outflows. Looking back to July, Ethereum garnered $8.2 billion compared to Bitcoin’s $4.8 billion.

This trend reflects a significant shift in institutional positioning, with investors демонstrating an increased propensity to switch to Ethereum products despite ongoing market volatility affecting weekly flows.

The post Ethereum ETFs Post First Weekly Outflows After 3 Months appeared first on BeInCrypto.