News Background

- On August 24–25, a whale transferred 900 million DOGE (over $200 million) into Binance wallets, raising concerns about potential sell-off. Prices dipped from $0.25 to test $0.23 support on increased trading volumes.

- However, on-chain data reveals whales accumulated 680 million DOGE throughout August, indicating a struggle between distribution and accumulation.

- Futures positions weakened, with open interest decreasing by 8% following the transfer, reflecting diminished speculative leverage.

- The overall meme-coin sentiment is influenced by macroeconomic signals, with Powell’s remarks at Jackson Hole sparking a brief rally across the sector.

Price Action Summary

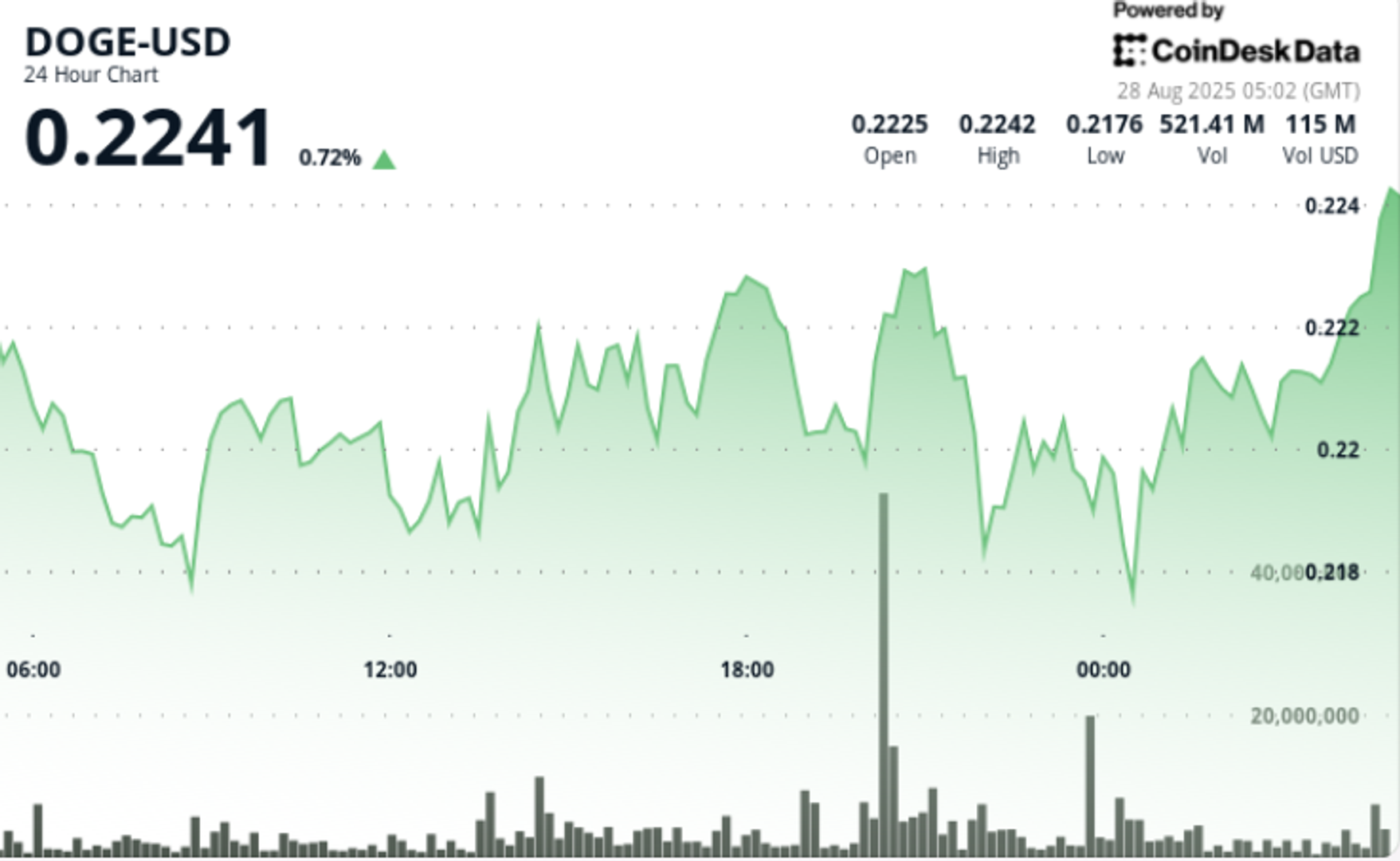

- From August 27 at 03:00 to August 28 at 02:00, DOGE fluctuated within a narrow $0.01 (3%) range, stabilizing around $0.22.

- Peak institutional involvement occurred at 20:00 GMT on August 27, with DOGE rising from $0.219 to $0.224 on 1.26 billion volume — nearly four times the hourly average.

- Late in the session (01:20–02:19 GMT on Aug. 28), DOGE surged from $0.219 lows to $0.224 intraday highs before profit-taking pushed it back into the $0.220–$0.221 range.

Technical Analysis

- Support: A robust bid interest around $0.219–$0.220 has established a new support floor.

- Resistance: The $0.224–$0.225 level continues to hinder short-term rallies after multiple rejections.

- Momentum: RSI remaining in the mid-50s indicates stability rather than an acceleration of trends.

- Volume: An institutional surge to 1.26 billion tokens at $0.22 signaled accumulation interest, yet an overall decline in activity suggests consolidation.

- Patterns: The tight trading range denotes a compression phase; a resolution could lead to a directional breakout.

- Risk Gauges: An 8% decrease in futures open interest signifies lighter positioning, which minimizes immediate volatility but also dampens breakout confidence.

What Traders Are Watching

- The stability of $0.219 support against further whale distribution.

- A breakout above $0.225 as a potential trigger towards $0.23–$0.24.

- Continued corporate accumulation around $0.22 as a sign of treasury desks preparing for wider market movements.

- Indications of renewed leverage in futures markets that could enhance DOGE’s next directional shift.