XRP fell below the $2.50 support level during Tuesday’s trading session, dropping 5% to $2.47 as institutional selling intensified across major exchanges. This dip confirmed a significant shift in market structure after weeks of tight consolidation, with volume and chart patterns suggesting a shift towards a more pronounced corrective phase.

News Background

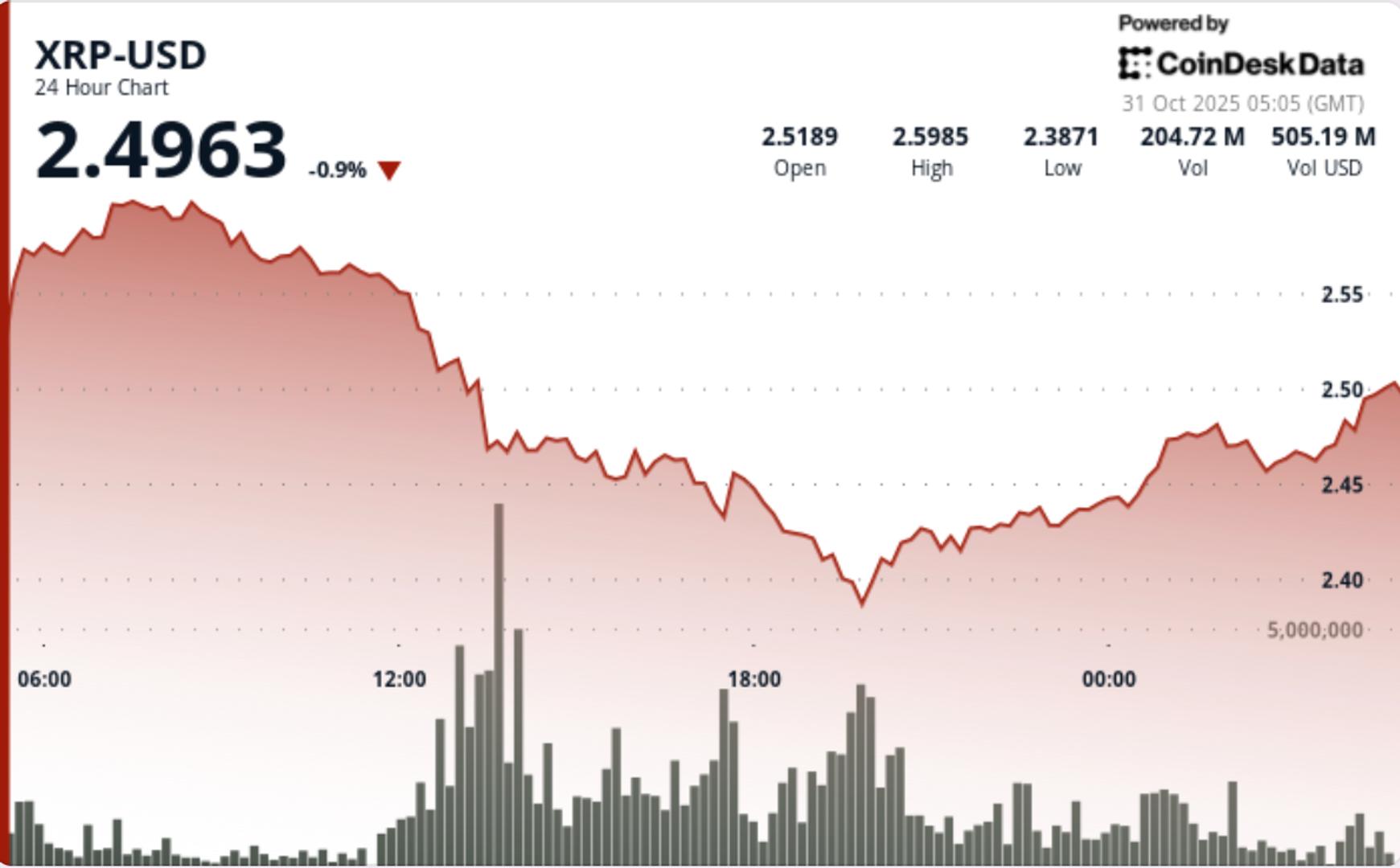

- In the 24-hour session, prices plummeted from $2.60 to $2.47, representing one of the steepest single-day declines this month.

- The breach of the $2.50 psychological support triggered substantial algorithmic and institutional selling, resulting in trading activity of 169 million tokens, a 158% increase from the 24-hour average.

- XRP’s weaker performance contrasts with broader crypto trends, indicating a potential rotation away from altcoins as risk appetite diminishes amidst declining speculative interest.

- This breakdown reinforced strong overhead resistance at $2.60, with numerous rejections in recent weeks limiting upward momentum.

Price Action Summary

- The sell-off unfolded in structured phases throughout Tuesday’s trading. The initial breakdown started at 13:00 UTC, with heavy selling driving the price decisively below the $2.50 support, leading to intraday lows near $2.38.

- Price stabilized between $2.43 and $2.46, indicating the early formation of a potential consolidation base.

- Short-term momentum indicators signaled exhaustion as volume decreased towards the close, a pattern that often precedes temporary pauses in declining trends.

- On the microstructure level, 60-minute data revealed two distinct distribution waves as XRP declined from $2.472 to $2.466.

- Hourly volume spikes of 2.8M and 2.6M tokens—each surpassing 300% of normal hourly averages—demonstrated ongoing institutional control over intraday market activity.

Technical Analysis

- XRP’s breakdown continues its pattern of lower highs and lower lows established after the unsuccessful retest of the $2.60 resistance level.

- The session’s 8.8% volatility range highlights aggressive liquidation and profit-taking by larger holders, consistent with on-chain signals of exchange inflows.

- Momentum indicators, including RSI, have moved into neutral-to-bearish territory, while MACD illustrates increasing downside divergence. The $2.40–$2.42 range now serves as immediate technical support, and a close below this area could lead to further declines towards $2.30–$2.33.

- Volume analysis is crucial—the 169M turnover during the breakdown confirms institutional involvement rather than retail panic, while decreasing late-session activity suggests that most distribution may already be concluded.

What Traders Should Watch

- Traders are keeping an eye on whether the $2.43–$2.46 range can develop into a stable accumulation zone or if a clear break below $2.40 will accelerate selling.

- A reclaim of the $2.50 level is necessary to neutralize short-term bearish momentum and establish a constructive setup targeting $2.60.

- Until then, upward movements toward resistance are likely to encounter selling pressure from trapped long positions and short-term profit-takers.

- Overall market sentiment remains cautious due to a risk-off approach, with derivatives positioning showing reduced open interest and slight increases in short exposure across perpetual futures markets.