Cronos has released its roadmap for 2025-2026, detailing plans to introduce a comprehensive tokenization platform for various asset classes.

Summary

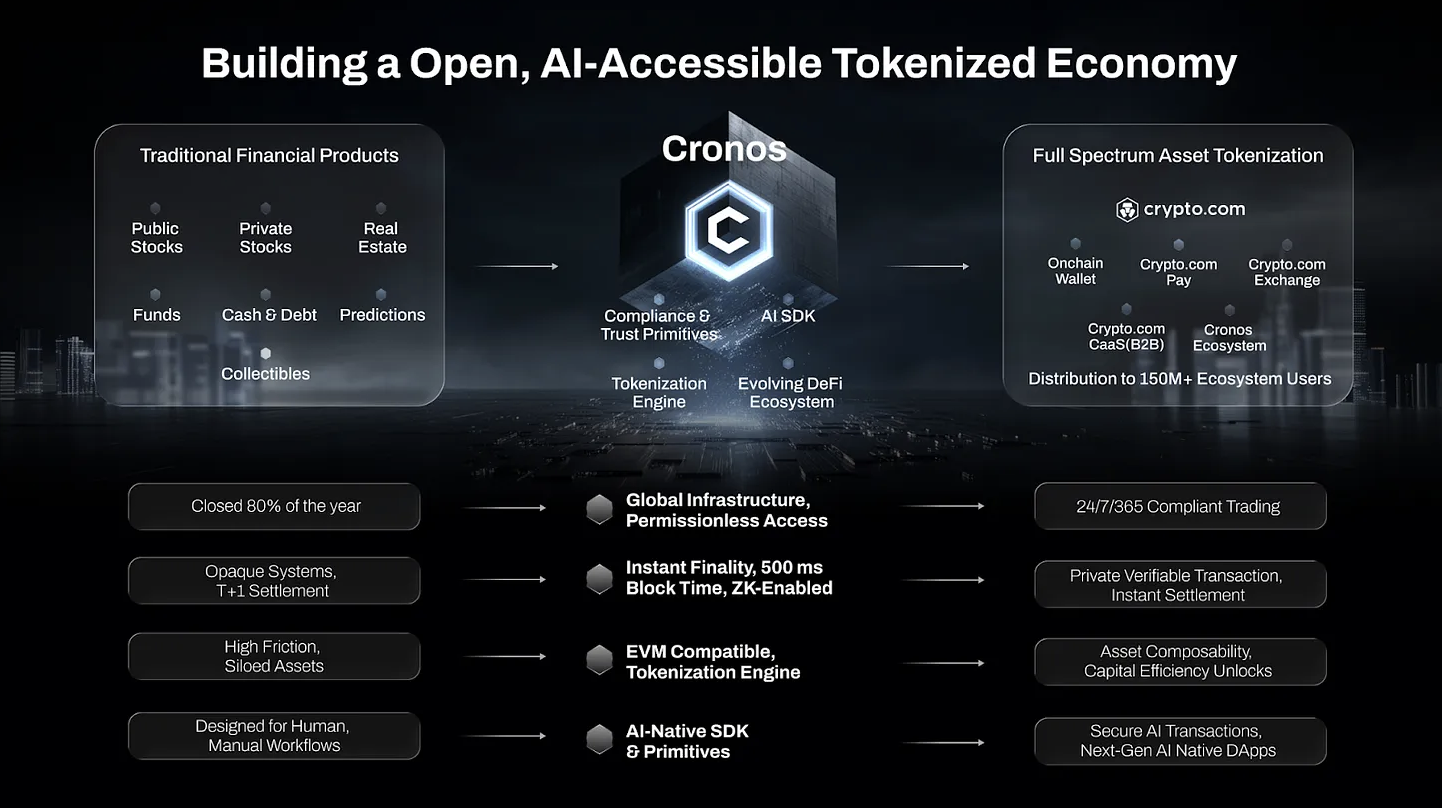

- Cronos will provide a full-service tokenization platform featuring instant settlement, yield generation, lending, and DeFi integration.

- The integration with Crypto.com will play a crucial role in adoption, offering Cronos access to over 150 million users and 10 million merchants.

Cronos (CRO) has revealed its 2025–2026 roadmap, aiming to establish itself as a core provider of infrastructure for tokenized assets and AI-driven finance.

According to the announcement, Cronos will launch a comprehensive tokenization platform over the next 12 to 18 months, covering a vast range of asset classes—including equities, real estate, commodities, funds, insurance, and forex. The platform will provide instant settlement, yield generation, lending, and DeFi application integration.

To ensure AI-native infrastructure, Cronos will introduce a new AI Agent SDK and a Proof of Identity standard, enabling AI agents to interact directly with on-chain financial systems.

The partnership with Crypto.com is anticipated to be a significant catalyst for adoption, granting direct access to over 150 million users and 10 million merchants.

Cronos to enhance institutional adoption through ETFs and treasuries

Alongside boosting retail adoption, Cronos aims to increase institutional demand by continuing to facilitate the development and expansion of CRO ETFs in U.S. and European markets. Collaborators such as 21Shares, Canary Capital, and Trump Media Technology Group are already contributing to these ETFs to drive CRO adoption.

Moreover, Cronos will support digital asset treasuries that integrate CRO into their investment strategies. This initiative comes at a time of growing institutional interest, underscored by the recent $6.4 billion SPAC merger involving Trump Media and Crypto.com, which seeks to establish a dedicated CRO treasury and validator.

By the end of 2026, Cronos aims to achieve $20 billion in CRO demand from public market vehicles, tokenize $10 billion in real-world assets, and attract 20 million users across both centralized and decentralized platforms.