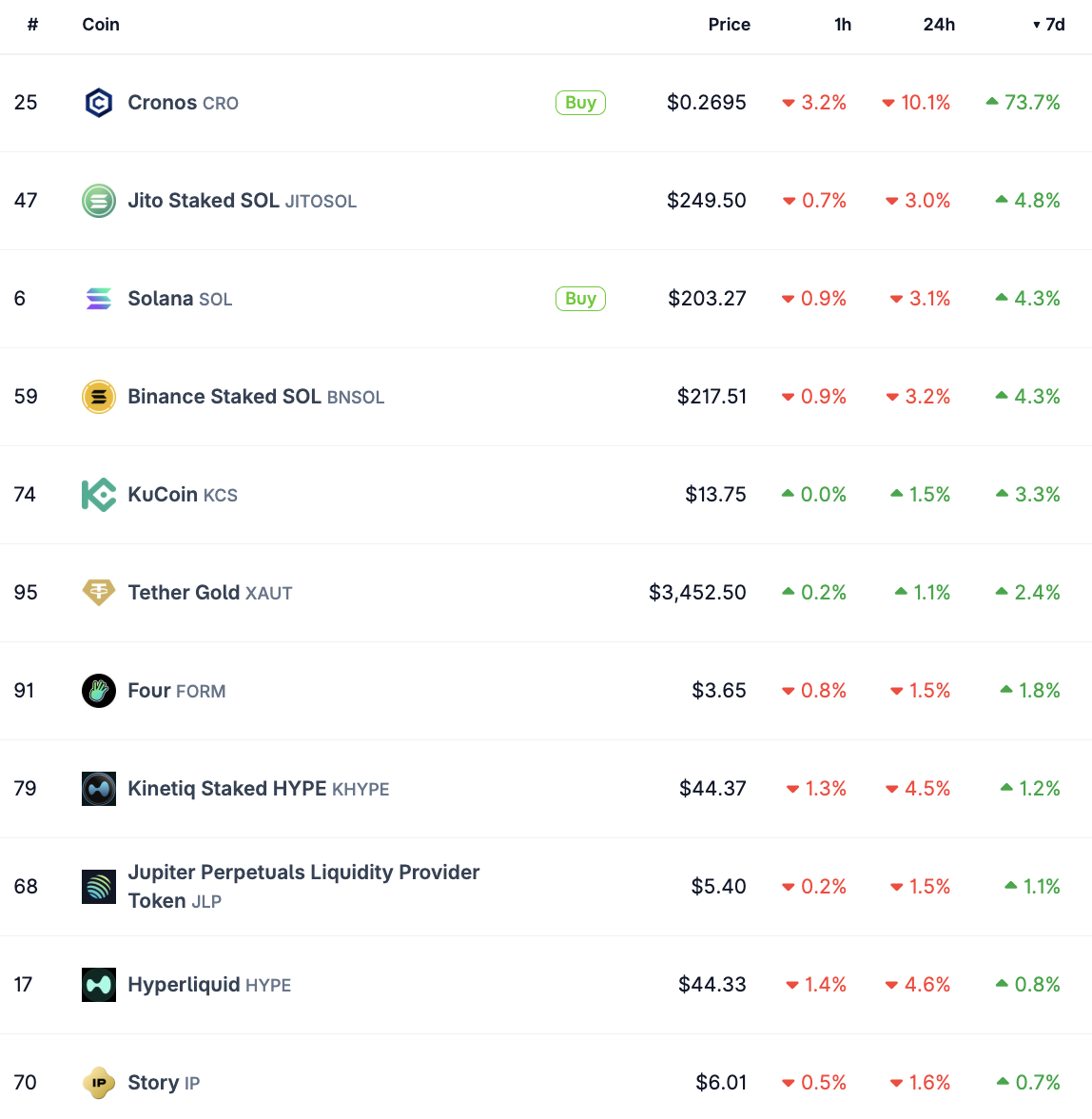

Bitcoin is under downward pressure, while Ethereum remains stable, and altcoins such as CRO, SOL, KCS, HYPE, and IP are positioned for a potential rebound in the upcoming week.

Summary

- CRO sees a significant drop of almost 20% after a 90% rally over the last seven days.

- Solana is targeting a rebound to $250, currently staying above the $200 support level on Friday.

- KuCoin token has registered close to 12% gains over the past week.

- Hyperliquid has experienced a 10% increase this week.

- IP has risen nearly 6%, maintaining a position above the $6 support level.

Bitcoin (BTC) has declined nearly 5% today, hovering near the $108,000 support level. The leading cryptocurrency has lost almost 4% of its value over the past week.

Ethereum (ETH) remains stable above the $4,300 support level, showing a 3% increase in the same period.

Cronos token (CRO), Solana (SOL), KuCoin (KCS), Hyperliquid (HYPE), and Story (IP) have gained between 6% and 90% in the last week.

Top 5 altcoin seven-day gains

Cronos

Cronos is currently trading at $0.2713, approaching the significant $0.2552 level. CRO has formed support at two critical levels: $0.2013 and $0.2552. CRO might test resistance at $0.3878, as illustrated in the daily price chart below.

Key indicators, RSI and MACD, favor a recovery outlook; RSI is at 69, and the MACD shows green histogram bars above the neutral line, indicating positive momentum in CRO’s price trend.

Solana

Solana maintains support above $200 as it aims for a re-test of the $250 resistance, assuming the upward trend continues. Solana has consistently outperformed Ethereum in DEX metrics but lags behind in total value locked on the blockchain.

Momentum indicators for Solana on the daily timeframe support a bullish outlook, with the price less than 25% away from re-testing the $250 resistance.

KuCoin

KuCoin’s KCS token continued to gain on Friday, August 29, showing nearly 12% growth over the past week. The nearest resistances are at $14.30 and $14.60, while support is found around $13.

RSI and MACD suggest that KCS may continue its upward trajectory in the following week.

Hyperliquid

Hyperliquid’s HYPE token is approaching a re-test of resistance at $51.189. The daily price chart indicates positive momentum in HYPE’s ascent; however, this may fluctuate as the size of the green histogram bars gradually diminishes.

HYPE may seek support at either $42 or $35, which are the token’s two primary support levels.

Story Protocol

The IP token from Story Protocol may need to gather liquidity and could face a drop to $5.30, the nearest support level, before making another break from its consolidation phase. A daily close below $5.30 might lead to a drop to $4.

Technical indicators on the daily timeframe suggest a bearish outlook for the token.

However, if the momentum shifts positively and IP extends its recent gains, it might face resistance at $7.50, which is 25% higher than the current price. The next significant resistance is at $9, indicated as R2 on the daily price chart.

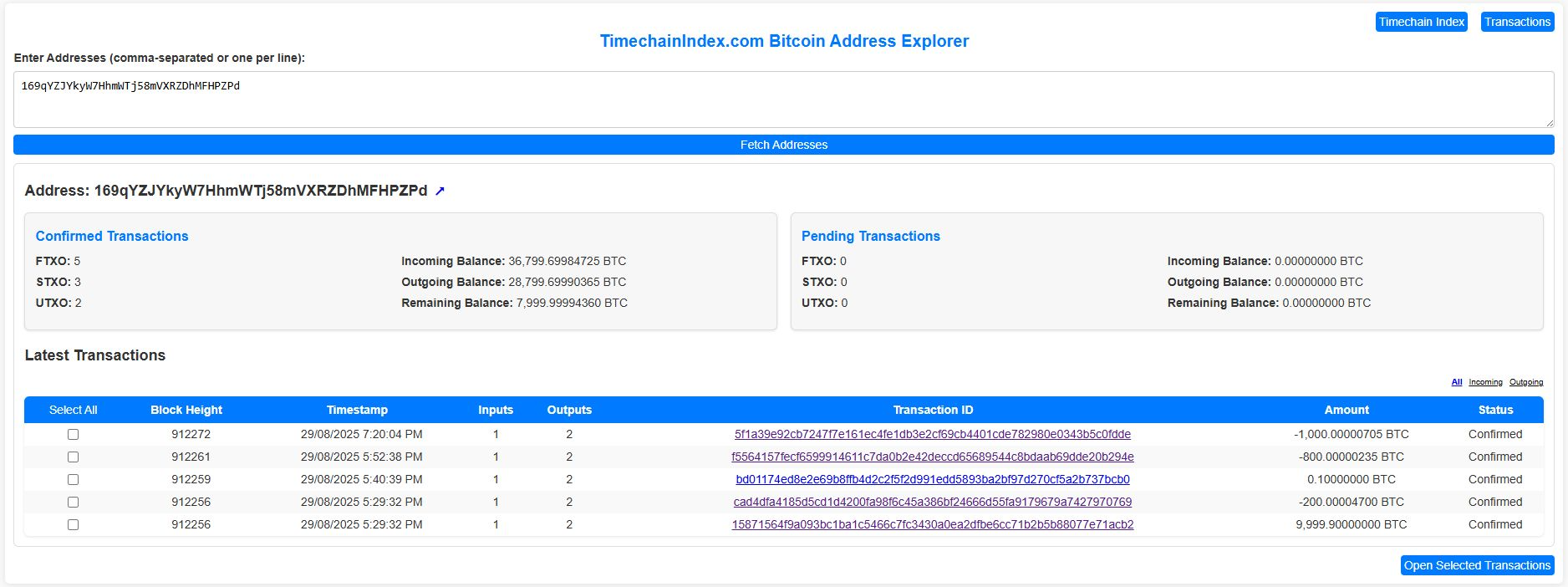

Bitcoin whale movement

The future trends in altcoins hinge on crucial factors like Bitcoin’s price trajectory and selling pressure on exchanges. Although Bitcoin has not made significant moves over the past week, on-chain data reveals recent activities from a whale.

This whale sold 24,000 Bitcoin last week and is recorded transferring funds from the same wallet. A transfer of 10,000 BTC has been noted on-chain, with 2,000 BTC sent to an exchange.

Data from a Bitcoin address explorer indicates a potential increase in selling pressure on Bitcoin over the next week unless buyers engage to absorb the additional BTC being directed to exchange platforms.

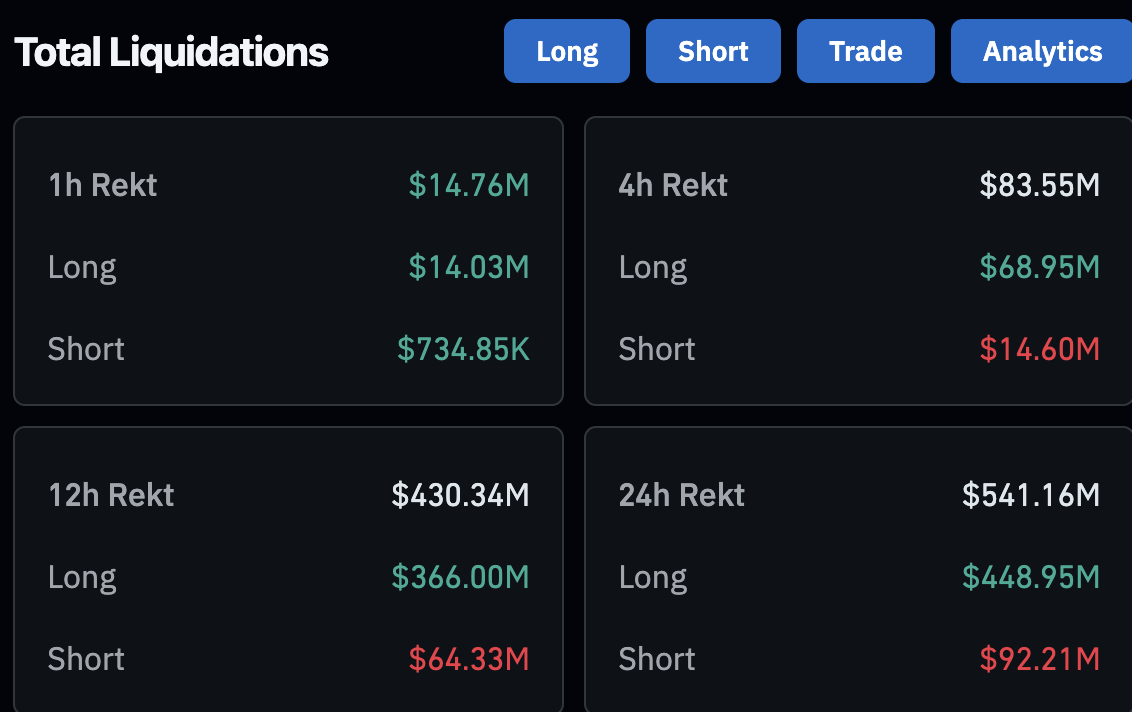

Derivatives data analysis

According to Coinglass, the crypto market faced over $540 million in liquidations, primarily impacting long positions as bearish traders profit from the downturn in top cryptocurrencies.

The open interest has decreased to $200 billion, a 3% drop within a 24-hour span.

Derivatives data suggests that further corrections are probable in the market, and additional deleveraging may occur before tokens begin to recover.

Disclosure: This article does not represent investment advice. The content and materials presented here are strictly for educational purposes only.