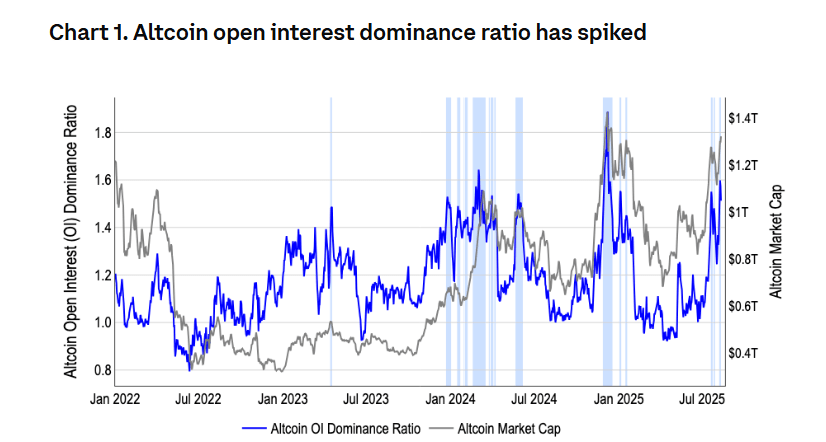

Coinbase’s suspicion is fueled by Bitcoin dominance dropping from 65% to 59%, rising altcoin market capitalization, and expectations of a September Fed rate cut that could unleash retail capital into high-risk assets. Historical signals, like Bitcoin dominance’s first monthly bearish cross since January of 2021, add weight to the bullish case. Ethereum is leading the charge, with US spot ETH ETFs pulling in over $3 billion in the first half of August, including a record $1 billion in a single day. ETH prices surged nearly 20% this week, topping $4,765, as institutional inflows hit record highs.

Altseason Buzz Builds

Coinbase suggested that current market conditions could be setting the stage for a full-scale altcoin season as early as September, with certain key indicators already pointing toward a potential shift in momentum away from Bitcoin. In its latest monthly outlook, David Duong, Coinbase Institutional’s global head of research, said that the firm defines an altcoin season as a period in which at least 75% of the top 50 altcoins by market capitalization outperform Bitcoin over a 90-day period. While this threshold has not been reached just yet, several factors suggest the market is moving in that direction.

Coinbase monthly outlook

One of the main drivers is the large amount of retail capital that is currently parked in money market funds. Duong argued that the Federal Reserve’s expected September interest rate cut—odds of which have climbed to 92% after the latest Consumer Price Index data showing inflation steady at 2.7%—could unlock more retail participation in crypto markets. A lower interest rate environment typically boosts high-risk assets like altcoins by drawing in fresh liquidity.

Bitcoin’s market dominance also fell from over 65% in May to around 59%, its lowest since January. Duong said this decline signals the early stages of capital rotation into altcoins. Other traders like Ito Shimotsuma noticed that Bitcoin dominance just formed its first monthly bearish cross since January of 2021. Back then, altcoins rallied for four months after the signal, and a similar move could trigger gains through December 2025.

(Source: Coinbase)

Additionally, altcoin market capitalization surged by over 50% since early July, and while altcoin season indexes from CoinMarketCap, Blockchain Center, and CryptoRank are still below the 75 threshold, they have been steadily rising.

Institutional interest in Ethereum is playing a major role in driving momentum, supported by stablecoin adoption and digital asset treasuries. However, Joanna Liang of venture capital firm Jsquare explained that the market still awaits a strong new narrative to fully ignite altseason, similar to how ICOs, Layer-1 blockchains, and DeFi/NFT booms fueled past cycles.

With the supportive macroeconomic backdrop, falling Bitcoin dominance, and a compelling narrative converge, analysts believe a mature altcoin season could emerge over the next few months.

Ethereum ETFs Head for Record-Breaking Month

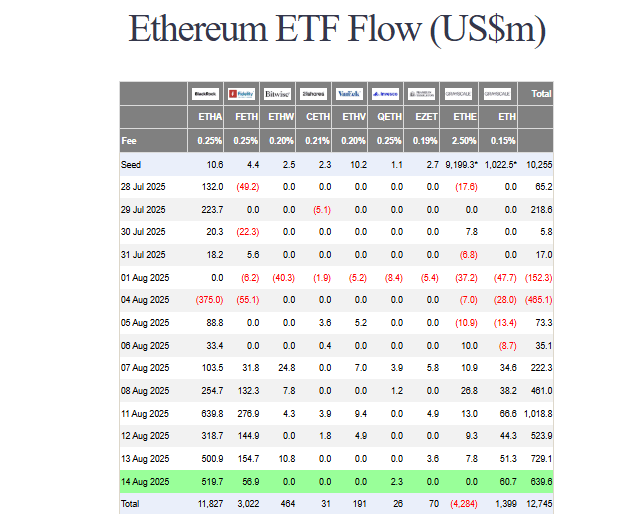

On altcoin that is picking up steam is Ethereum. In fact, spot Ethereum exchange-traded funds (ETFs) in the United States attracted over $3 billion in net inflows in just the first two weeks of August, setting the stage for their second-strongest monthly performance since launch.

Data shows that spot Ethereum ETFs are on track to record their strongest week ever, with inflows exceeding $2.9 billion. The momentum has been particularly strong this week, averaging over $700 million in daily inflows since Monday. Monday alone saw a record-setting $1 billion in inflows, which was the highest single-day figure for the asset class.

ETH ETF flows (Source: Farside Investors)

The surge in ETF demand took place alongside a robust rally in ETH’s price this month. On Thursday, ETH climbed to a yearly high of $4,765.83 before experiencing a sharp drop below $4,500, only to recover and trade above $4,600 at press time. This means that ETH was able to climb by nearly 20% throughout the past week. The wave of capital also pushed total net assets across all spot Ethereum ETFs to a record $29.22 billion.

ETH price action over the past week (Source: CoinMarketCap)

Since their launch, spot Ethereum ETFs accumulated $12.73 billion in cumulative net inflows and are on pace for a five-month inflow streak heading into September. Thursday’s trading day alone brought in $639.61 million, led by BlackRock’s iShares Ethereum Trust (ETHA) with $519.68 million, followed by the Grayscale Ethereum Mini Trust with over $60 million and Fidelity’s Ethereum Fund with nearly $57 million.

This week’s strong performance follows Wednesday’s $729 million in net inflows, which was the second-highest daily inflow for spot Ethereum ETFs after Monday’s record. With Ethereum’s price surging and institutional demand climbing, market strategy firm Fundstrat is turning increasingly bullish.

Chief information officer Thomas Lee described ETH as the “biggest macro trade” of the next decade, while head of digital asset research Sean Farrell projected the asset could reach between $12,000 and $15,000 by the end of 2025.