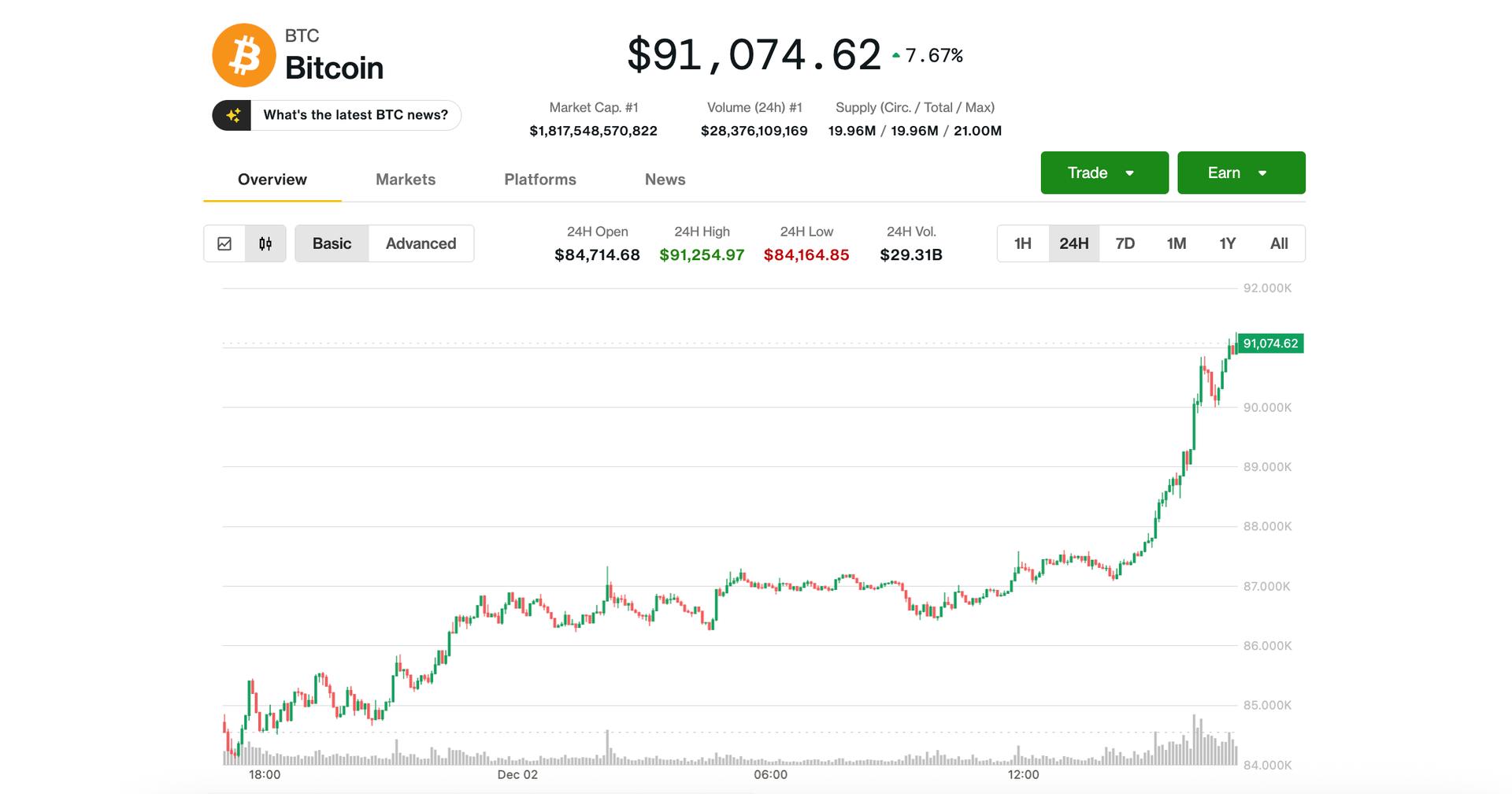

Bitcoin climbed back above $90,000 during Tuesday’s U.S. morning hours, recovering nearly all of its sharp drop from Sunday to Monday that took it below $84,000. The leading cryptocurrency was recently trading at $91,180, marking an 8% increase over the past 24 hours, which boosted the wider digital asset markets.

Ethereum’s ether rose above $3,000, witnessing a 9% increase in the same timeframe. Major altcoins also followed suit: , Solana’s SOL , rose by 7%–10%, recovering from their recent lows.

These gains coincided with $11 trillion asset management leader Vanguard lifting its longstanding restriction against crypto, now permitting its clients to access digital asset ETFs. Meanwhile, Bank of America has authorized its wealth managers to recommend a 1%-4% allocation to the spot bitcoin ETFs.

Japan yield shock could impact bitcoin significantly, analyst warns

Mark Connors, founder and chief macro strategist of bitcoin advisory Risk Dimensions and former head of risk advisory at Credit Suisse, cautions that a rise in Japan’s 10-year yield could draw capital away from global markets, hitting crypto—particularly bitcoin—hard due to its links with Asian capital flows and vulnerability to leverage. Binance, which handles nearly 50% of crypto volume and offers leverage up to 50x, is especially susceptible to yen and yuan fluctuations.

Connors also noted that bitcoin seems to be dragging the S&P 500 down. This trend may persist until both the Federal Reserve and the Bank of Japan hold their policy meetings later this month. If markets continue to weaken, he anticipates some form of intervention, as has often occurred in previous years during periods of stress.

Nonetheless, not all indicators point to weakness. Jasper De Maere, desk strategist at Wintermute, stated bitcoin derivatives are showing a “clear lean toward bullish, short-vol behavior.” Traders are offloading downside puts around $80,000–$85,000 while selectively acquiring upside further out.

“The mix indicates a market that sees $80,000–$85,000 as supported and is comfortable taking long positions into year-end while earning carry along the way,” De Maere explained. In other words, despite short-term pressures, traders appear poised for a rebound.

Read more: On Thin Ice: Crypto Daybook Americas