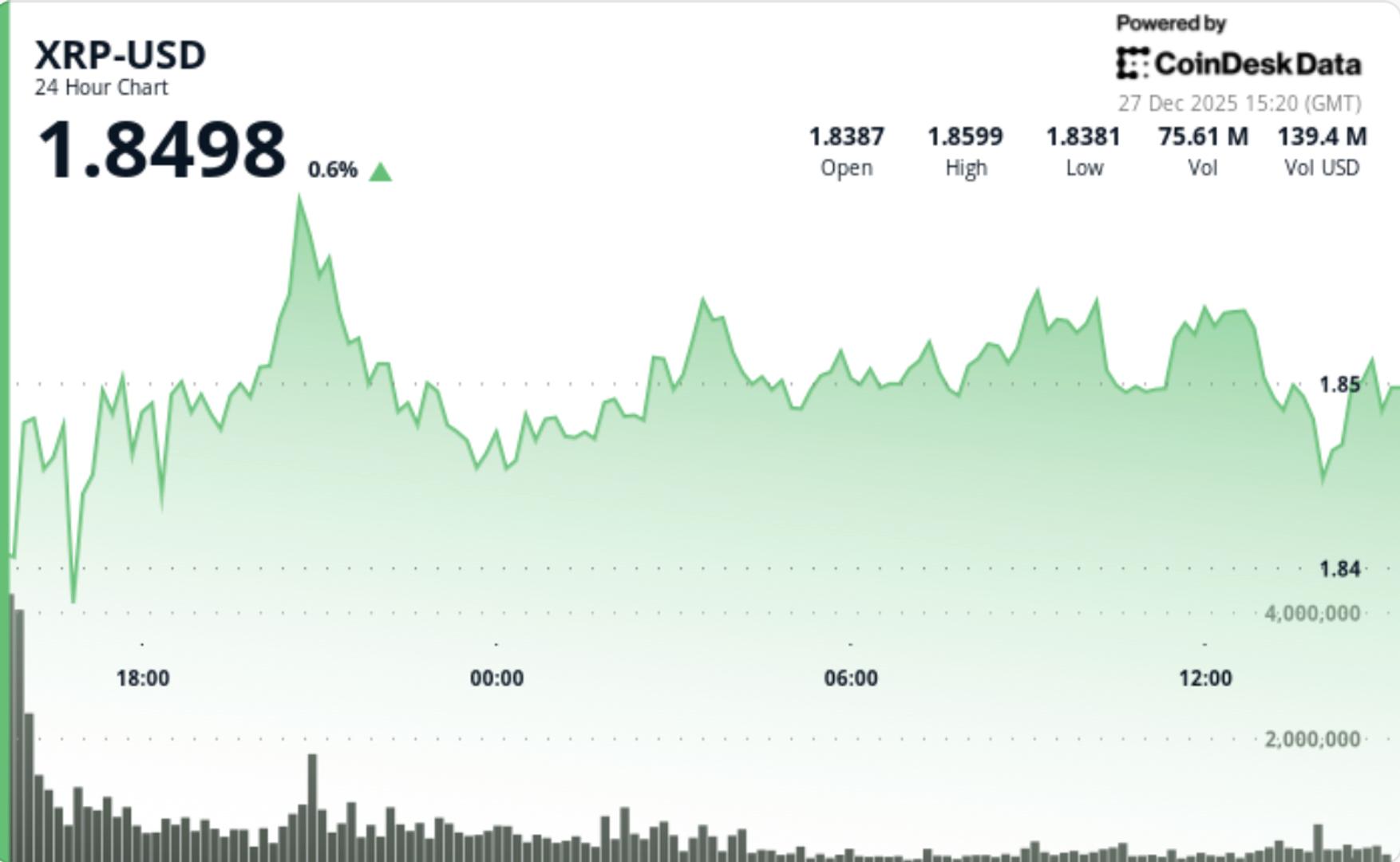

XRP dipped to $1.86 as traders continued selling during rallies, even with consistent spot ETF demand and total ETF-held assets rising to $1.25 billion — indicating the market is still grappling with supply at critical technical levels.

News overview

Institutional interest in XRP exposure has grown through exchange-traded funds, with investors contributing $8.19 million in recent sessions. This increase brought total ETF-held net assets to $1.25 billion, suggesting that professional investors prefer accumulating positions through regulated vehicles rather than chasing spot momentum.

This flow trend reflects a broader institutional crypto allocation pattern: portfolio managers are increasingly opting for structured products that mitigate custody and compliance challenges, particularly when liquidity is plentiful and regulatory clarity is advancing. XRP’s depth across exchanges and solid ETF interest has sustained long-term demand, despite volatile short-term price movements.

In the larger market context, bitcoin’s attempted rebound lacked momentum during U.S. trading hours, leaving major cryptocurrencies in a risk-averse, range-bound state where flows matter but technical levels dictate daily trades.

Technical analysis

XRP fell from $1.88 to $1.86, remaining within a $1.85–$1.91 range as sellers consistently defended the $1.9060–$1.9100 resistance area. Volume surged during the session’s most active period, with 75.3 million traded — about 76% above average — during the rejection, indicating this is not a low-liquidity drift. The market is encountering substantial offers overhead.

The price briefly broke out of its $1.854–$1.858 consolidation zone and tested $1.862 on a surge of activity that spiked roughly 8–9x compared to typical intraday flow. However, the move lacked sustainability, and XRP retraced back to $1.86 as supply re-emerged.

The continued defense of $1.90+ implies that sellers are using that zone to distribute into strength. Conversely, bids around $1.86–$1.87 have consistently appeared to prevent the market from collapsing — leading to a tightening coil where the next breakout is likely to be significant.

Price action recap

- XRP fell from $1.8783 to $1.8604, remaining locked within a $1.85–$1.91 range

- The strongest selling pressure occurred near $1.9061 resistance on above-average volume

- Bulls retained the $1.86 level on multiple retests, limiting further downside

- A brief surge above the previous consolidation range failed to lead to a sustained move

What traders should consider

Two competing forces shape the narrative: ETF flows remain supportive in the background, but near-term traders treat $1.90–$1.91 as a selling zone.

The levels are straightforward:

- If $1.87 holds and XRP reclaims $1.875–$1.88, the next challenge will be the significant supply cluster at $1.90–$1.91. A close above this level could trigger short-covering and drive the price towards $1.95–$2.00.

- If $1.86 fails, the market would likely decline to the next demand area around $1.77–$1.80, where historical buyers have defended and where “fear” sentiment often peaks.

Currently, the market appears to be consolidating with distribution overhead — but with ETF flows acting as a stabilizing force, making any downturns more tedious unless bitcoin sharply declines again.