On-chain analytics firm Glassnode has detailed how the Bitcoin price trend remains favorable as long as the asset stays above the short-term holder cost basis.

Bitcoin Continues to Stay Above Short-Term Holder Realized Price

In a recent post on X, Glassnode discussed the Realized Price for Bitcoin’s short-term holders. The “Realized Price” refers to an indicator that tracks the cost basis of the average investor or address on the BTC network.

When this metric exceeds BTC’s spot price, it indicates that investors are, on average, realizing some net unrealized profits. Conversely, when it sits below the asset’s value, it signifies that the overall market is facing net losses.

In this context, the Realized Price of a specific user segment, short-term holders (STHs), is particularly noteworthy. This group consists of investors who acquired their tokens within the last 155 days.

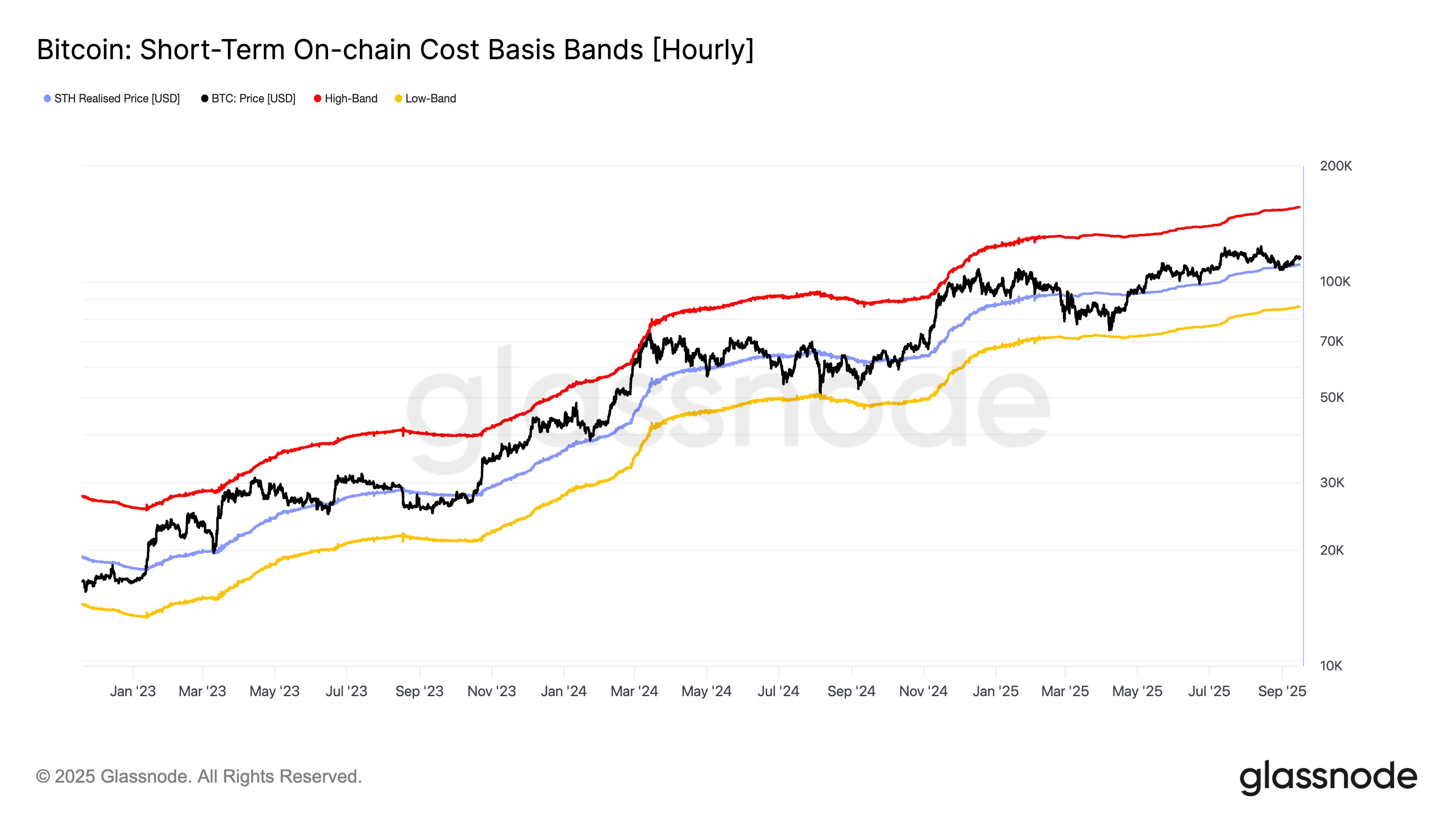

Here is the chart shared by Glassnode that illustrates the trend in the Bitcoin Realized Price for STHs over recent years:

The graph above shows that Bitcoin retested the STH Realized Price at the beginning of the month, finding support there. Since then, the coin’s price has experienced a recovery.

This trend of the STH Realized Price serving as a support level has been observed multiple times throughout this bull market, possibly reflecting investor psychology.

Statistical data suggests that the longer an investor holds their coins, the less inclined they are to sell in the future. However, since STHs have a relatively short holding period, they tend to act swiftly, often making panic moves during market fluctuations.

STHs can be particularly prone to panic when the cryptocurrency tests their break-even level. In a bullish market, their response usually manifests as buying, viewing drawdowns to their cost basis as opportunities to purchase at dips.

Conversely, during bearish trends, STHs are likely to sell when the price approaches their Realized Price, anxious that a further decline could push them into a loss.

Currently, Bitcoin is trading above the STH Realized Price. “As long as the price maintains this level, the overall trend is considered constructive,” states the analytics firm. “Falling below this support historically aligns with episodes of contraction or pullbacks.”

BTC Price

As of writing, Bitcoin is hovering around $116,200, marking an increase of nearly 5% over the past week.