After yet another failed attempt to reach a new all-time high (ATH), Bitcoin (BTC) fell to a weekly low of $110,820 on the Binance exchange yesterday. The leading cryptocurrency by market capitalization has clearly entered a pullback phase, with $105,000 becoming the key support level closely monitored by traders.

Bitcoin Declines To $110,000 During Market Retracement

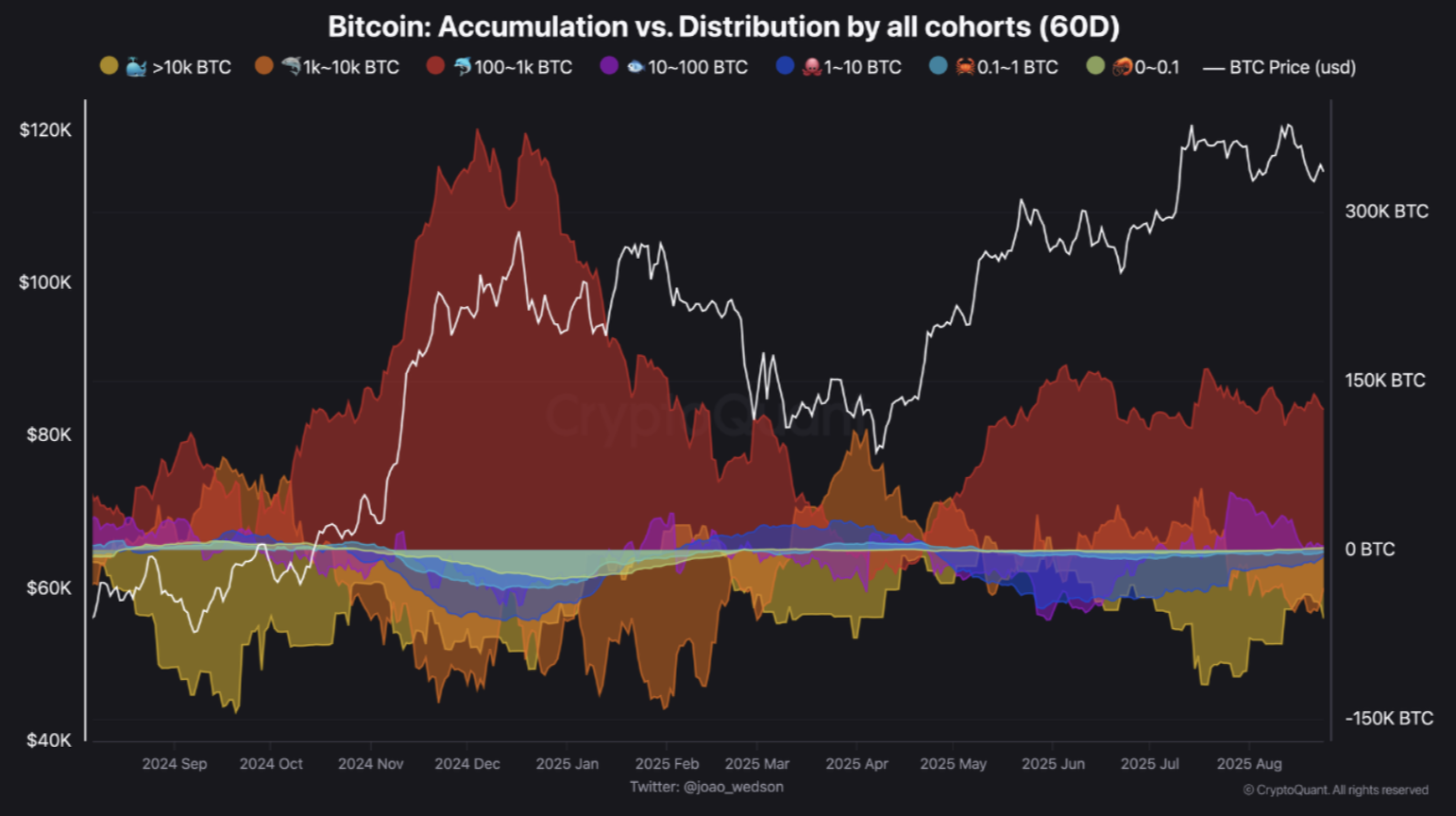

As highlighted in a CryptoQuant Quicktake by contributor BorisD, Bitcoin’s current distribution phase may last for several more days. Accumulation and distribution trends within wallets indicate increased sell-offs among BTC whales, raising concerns about short-term price stability.

Related Reading

For context, Bitcoin whales refer to individuals or entities that possess substantial amounts of BTC, often thousands of coins, which grants them significant influence over market movements. Their trading activities can considerably impact prices, making whale activities a critical factor for traders and analysts.

Notably, smaller wallet groups are displaying contrasting behavior. Wallets holding 0–0.1 BTC have recently reverted to accumulation mode as the market seeks direction. These smaller holders generally follow price trends rather than dictate them.

Wallets containing 0.1–1 BTC initiated accumulation even at ATH prices. This trend indicates that retail investors maintain confidence in Bitcoin’s long-term outlook.

Conversely, wallets with 1–10 BTC ceased selling around the $107,000 mark and have resumed accumulation. This indicates that mid-tier holders perceive current prices as attractive buying opportunities, despite the broader market challenges.

BTC Whales Persist In Selling

Larger holders are exhibiting more careful behaviors. Wallets containing 10–100 BTC halted their accumulation at $118,000 and have since transitioned into distribution.

BorisD highlighted that wallets with 100–1,000 BTC are the most crucial group to monitor. While generally engaged in accumulation, this cohort has displayed a balance between buying and selling. The analyst remarked:

They have maintained a balance between accumulation and distribution since $105,000, indicating indecision. This level represents a significant support-turning zone.

Meanwhile, wallets with 1,000–10,000 BTC have continued their sell-off following the ATH of $124,474 reached on August 13. The largest wallets, those holding over 10,000 BTC, also began selling at those highs and have continued to distribute, albeit at a slower pace, as prices retract, indicating a decrease in distribution pressure.

Related Reading

The analyst emphasized that although distribution is still the prevailing trend, its intensity is diminishing. The $105,000 support area now stands as the most vital threshold. A decisive break below this level could undermine market confidence and trigger widespread fear among investors.

Another CryptoQuant contributor, Julio Moreno, recently noted that the CryptoQuant Bull Score Index has shifted into neutral territory. However, it must maintain trading above $112,000 to prevent a sharper price correction.

Prominent crypto analyst Tony “The Bull” Severino stated that BTC’s trajectory towards $183,000 remains intact. As of press time, BTC is trading at $111,349, a decline of 2.7% over the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com