The narratives around Bitcoin’s corporate treasuries and its mining sector have become defining features of this cycle. From (Micro)Strategy’s MSTR billion-dollar purchases to the emergence of MetaPlanet and the rapid expansion of bitcoin mining firms, institutional and industrial adoption have established robust structural support for the network. However, after years of consistent accumulation and superior market performance, the data suggests we are approaching a crucial turning point—one that could dictate whether Bitcoin’s corporate treasuries and mining stocks continue to lead or start to lag as the next phase of the cycle unfolds.

Bitcoin Treasury Accumulation

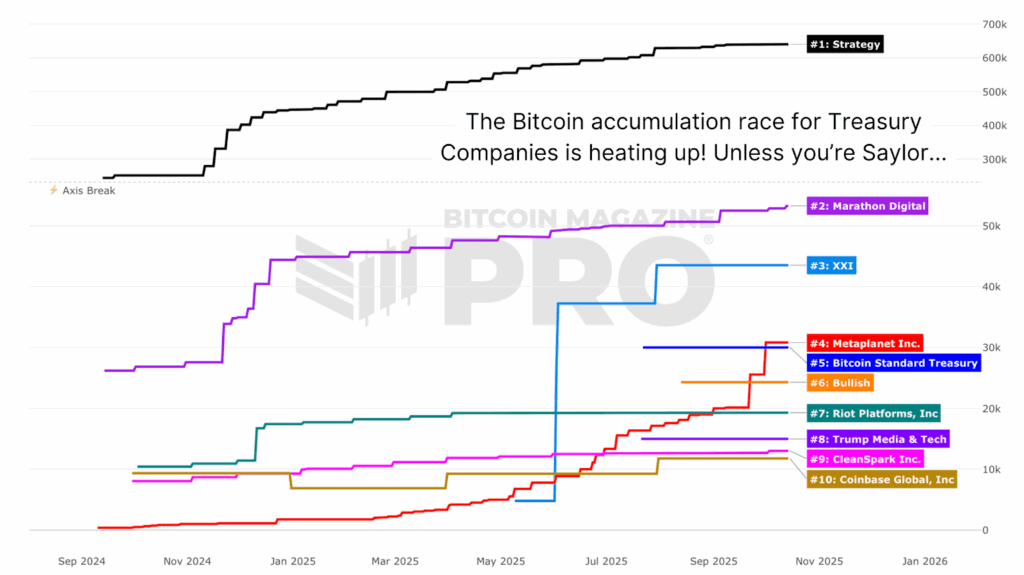

Our updated Bitcoin Treasury Tracker offers daily insights into the Bitcoin holdings of key public and private treasury companies, tracking when they have accumulated and how their positions have changed. Currently, these treasuries hold over 1 million BTC, a remarkable figure that constitutes over 5% of the entire circulating supply.

The magnitude of this accumulation has been foundational to Bitcoin’s strength in the current cycle. Nonetheless, some of these companies are now experiencing increased pressure as their equity valuations struggle to reflect Bitcoin’s price movements.

Valuation Compression Across Bitcoin Treasuries

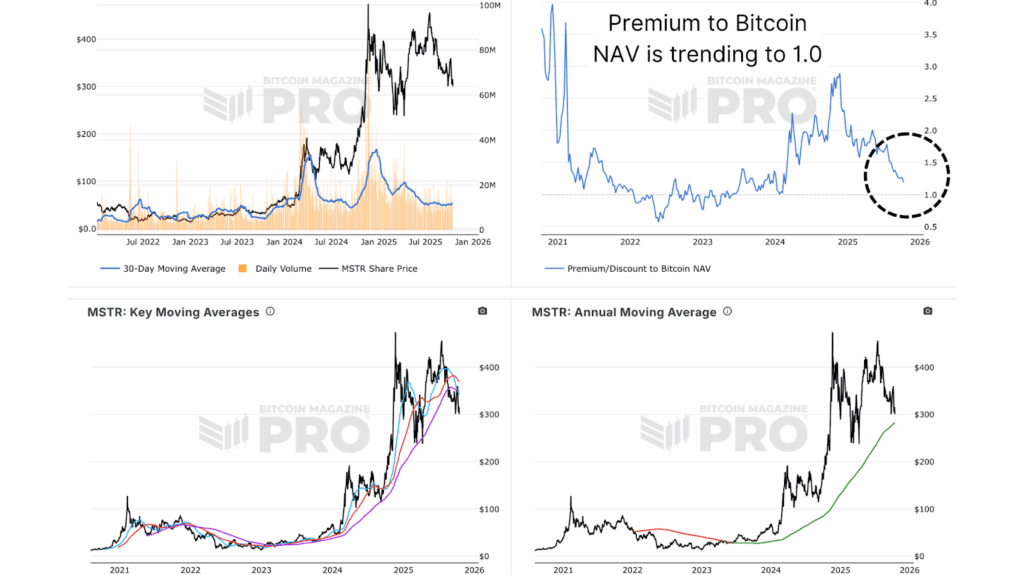

(Micro)Strategy / MSTR, a pioneer in corporate Bitcoin adoption, is still the largest publicly traded Bitcoin holder. Yet, in recent months, its stock has lagged behind Bitcoin’s performance. While Bitcoin has remained stable within a broad range, MSTR’s share price has declined more sharply, narrowing its Net Asset Value (NAV) Premium, the ratio of its market valuation to the underlying Bitcoin it holds, to nearly parity at 1.0x.

This compression indicates that investors are valuing the company more in line with its direct Bitcoin exposure, with little additional premium for management, future leverage, or strategic innovation. In prior cycles, MSTR enjoyed a significant premium as markets responded positively to its leveraged exposure. The current trend towards parity suggests a diminishing speculative appetite and reflects how similarly this cycle’s market sentiment resembles earlier late-stage expansions.

A Cycle-Defining Inflection for Bitcoin and Bitcoin Mining Stocks

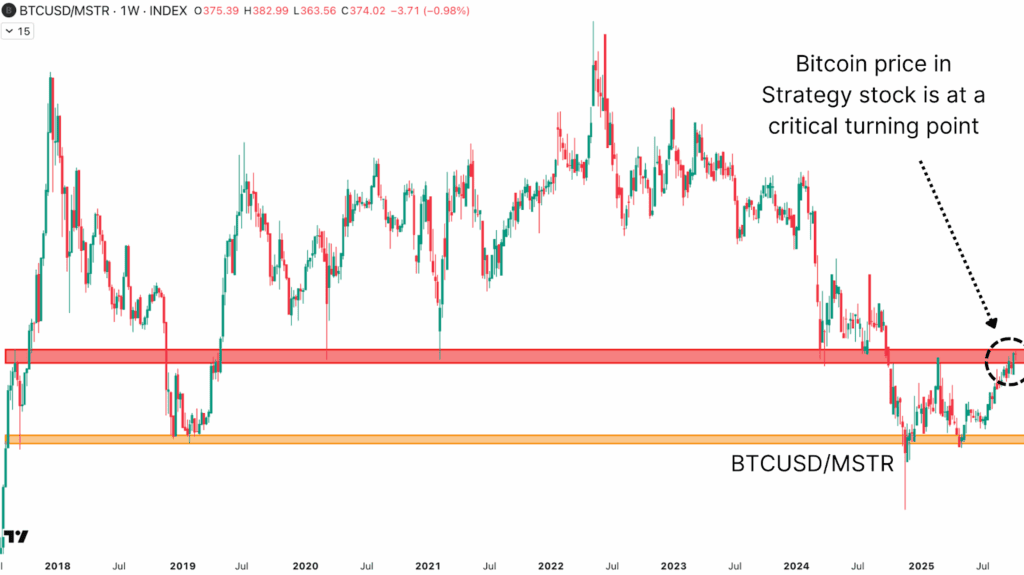

The most telling perspective comes from the BTCUSD to MSTR ratio, which essentially shows how many MSTR shares can be acquired with a single Bitcoin. Currently, the ratio is around 350 shares per BTC, placing it at a crucial historical support level that has previously marked price action turning points.

This chart currently rests at a pivotal point. A sustained movement above the 380–400 range would indicate renewed Bitcoin dominance and potential MSTR underperformance. Conversely, a drop below 330 would imply that MSTR might reestablish itself as a leveraged leader in the upcoming leg of the bull market.

Bitcoin Mining Stocks Take the Lead

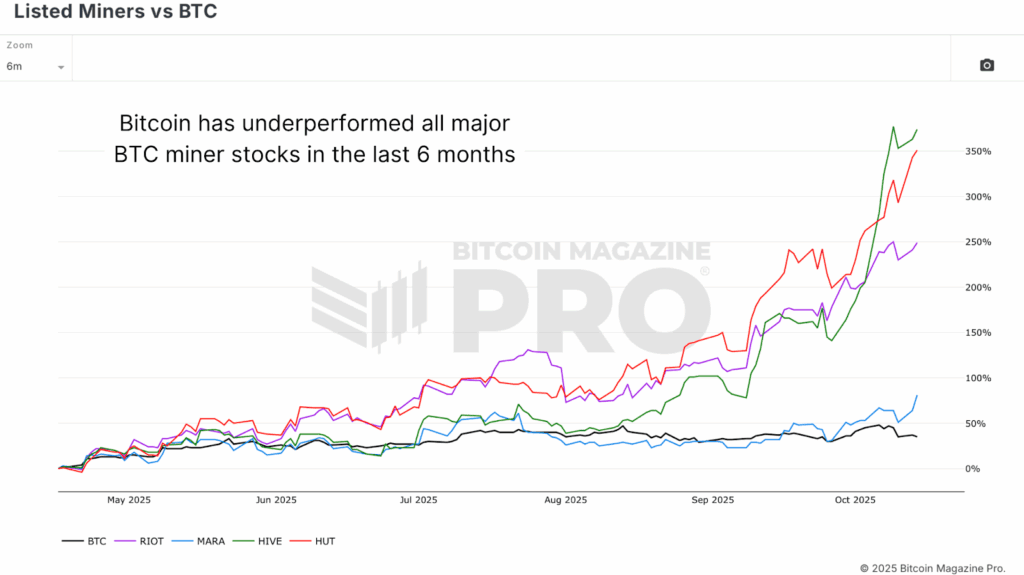

In contrast to the underperformance exhibited by treasury companies, Bitcoin miners have been thriving. Over the last six months, Bitcoin itself has appreciated by roughly 38%, while Listed Miner equities have soared: Marathon Digital (MARA) is up 61%, Riot Platforms (RIOT) has surged by 231%, and Hive Digital (HIVE) has skyrocketed by an incredible 369%. The WGMI Bitcoin Mining ETF, which includes major listed miners, has outperformed Bitcoin by about 75% since September, highlighting the sector’s renewed momentum.

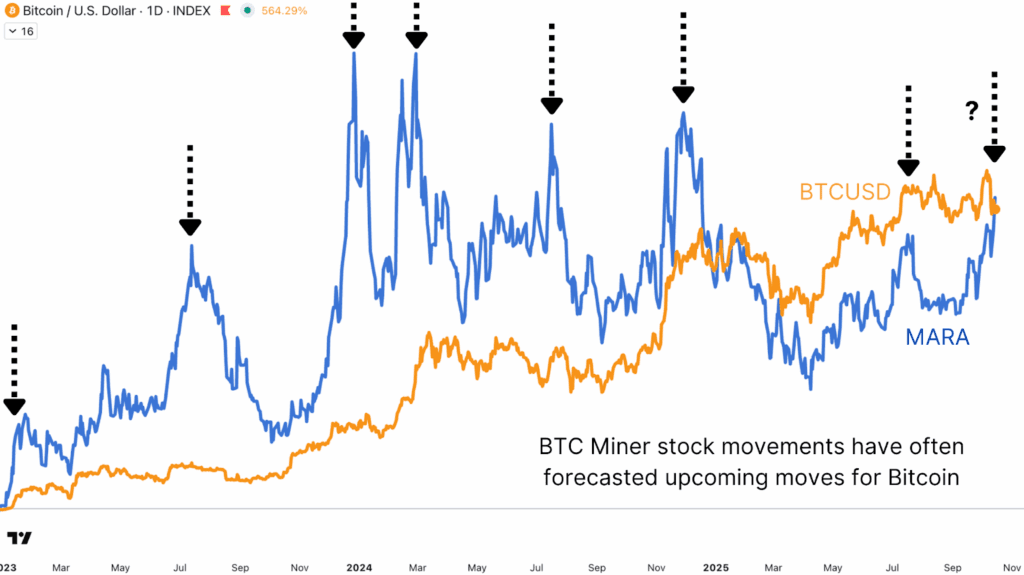

Focusing on Marathon Digital, the largest publicly traded Bitcoin miner, provides further insights. Historically, the MARA chart has proven to be a reliable leading indicator of market inflections. For instance, at the tail end of the 2022 bear market, MARA jumped over 50% just before Bitcoin embarked on a multi-month rally. Such patterns have emerged multiple times this cycle.

Bitcoin Mining Stocks and Corporate Treasuries: Diverging Paths in Bitcoin Market Leadership

With over 1 million BTC held in corporate treasuries, their impact on Bitcoin’s supply-demand dynamics is significant. However, the balance of leadership seems to be shifting. Treasuries like Strategy and MetaPlanet, while structurally bullish for the long term, are currently at crucial ratio inflection points and are struggling to outperform spot BTC. Meanwhile, miners are enjoying one of their best periods of relative performance in years, often a sign that broader market momentum may soon follow.

As always, our aim at Bitcoin Magazine Pro is to cut through the market noise and offer data-driven insights across all aspects of the Bitcoin ecosystem, from corporate holdings to miner activities, on-chain supply, and macroeconomic liquidity. Thank you for reading, and I look forward to reconnecting in the next one!

For a more in-depth examination of this topic, check out our latest YouTube video here: Now Or Never For These Bitcoin Stocks

For more detailed data, charts, and professional insights into bitcoin price trends, visit BitcoinMagazinePro.com.

Subscribe to Bitcoin Magazine Pro on YouTube for more expert market insights and analysis!

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your own research before making any investment decisions.