The price of Dogecoin is currently in a technical bear market, having decreased by 55% since reaching its peak in November of last year. Technical indicators and derivatives data suggest further declines may be expected in the upcoming days.

Summary

- The future of Dogecoin prices appears uncertain as demand in the futures market diminishes.

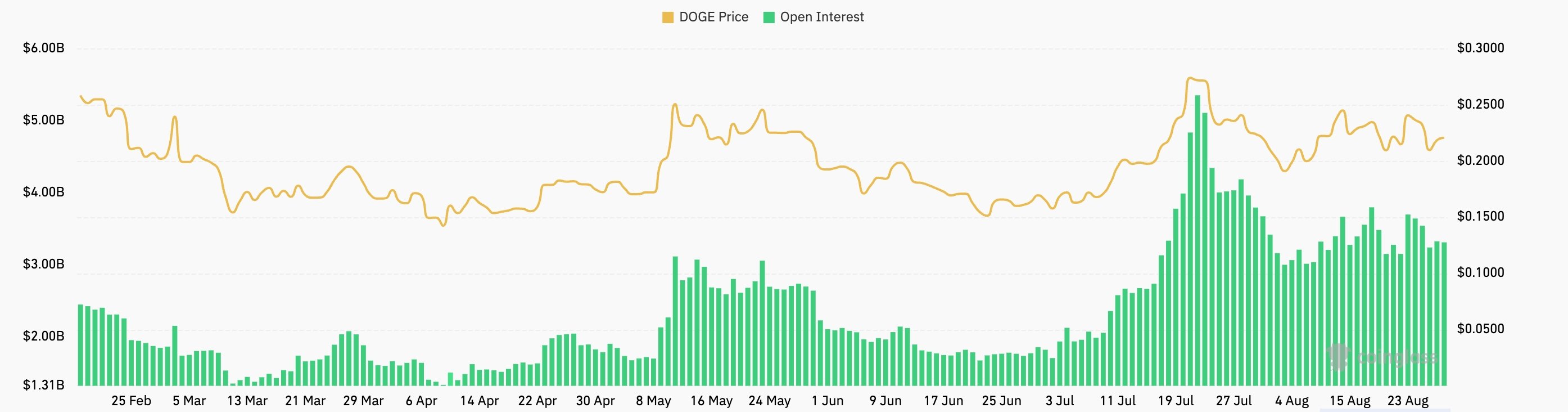

- Open interest in futures has declined nearly 40% from its peak in July.

- A bearish pennant pattern has emerged for DOGE on the three-day chart.

As of August 27, Dogecoin (DOGE) was trading at $0.2200, continuing to lag behind major cryptocurrencies like Ethereum (ETH) and Bitcoin (BTC), which are close to their all-time highs.

Derivatives Market Indicates Weak Demand for Dogecoin

The demand for Dogecoin has decreased in recent weeks, perhaps as investors shift their focus to other high-performing cryptocurrencies like Ethereum and Bitcoin. Additionally, a distinct catalyst to enhance Dogecoin’s performance seems to be lacking.

According to CoinGlass data, the open interest for DOGE’s futures has been declining since July, sliding from a peak of $5.3 billion on July 22 by almost 40%.

Futures open interest serves as a crucial metric for tracking outstanding futures contracts that remain unsettled. A downturn in open interest typically signals reduced demand and liquidity.

The current trading volume in the derivatives market also reflects weak demand for Dogecoin. CoinGlass data indicates that today’s traded volume stands at $4.7 billion, a significant drop from last month’s peak of $14.5 billion.

Technical Analysis of Dogecoin Price

The three-day chart reveals that the DOGE price is at risk of further declines, potentially hitting the year-to-date low of $0.1360.

Dogecoin seems to be gradually forming a symmetrical triangle, with its two lines nearly converging. The lower line tracks the lowest swings since April, while the upper trendline connects the highs in February and August.

This triangle pattern has evolved following the coin’s drop from its November peak of $0.4935, indicating the presence of a bearish pennant pattern.

Currently, Dogecoin is trading near the 61.8% Fibonacci retracement level, as well as the 50-day and 100-day exponential moving averages.

Thus, the most probable forecast for DOGE prices may involve a drop to the year-to-date low of $0.1362, which is roughly 40% below current levels.

Conversely, a breakout above the upper triangle boundary would disprove the bearish outlook for Dogecoin.