XRP: Trading Sideways with a Warning Signal

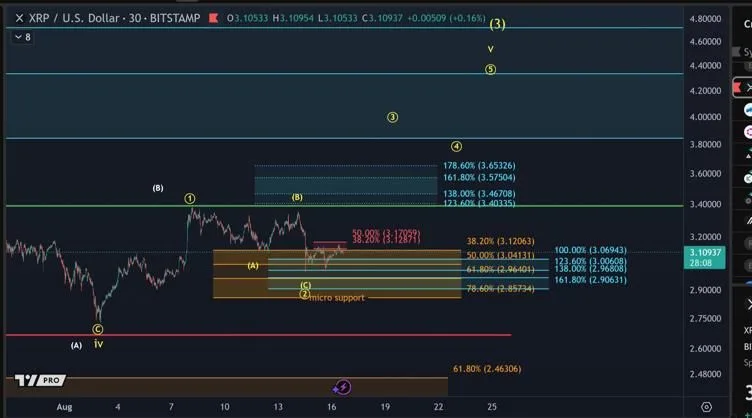

According to crypto analyst DavidTheBuilder, XRP has been oscillating between $2.90 and $3.40, showing no decisive breakout in either direction. This range-bound behavior reflects a period of market indecision.

Notably, a red flag is flashing on the weekly charts because of the emergence of a bearish divergence. XRP is pushing higher highs while the relative strength index (RSI) slips into lower highs, a textbook warning that bullish momentum is weakening.

Why This Setup Matters

This isn’t the first time XRP has exhibited such a divergence. The last occurrence, back in late 2020, preceded a notable pullback, as XRP ultimately surrendered a significant portion of its gains in the months that followed. While history doesn’t guarantee repetition, the parallel is too striking to ignore.

Today’s chart also paints a similar story since analysts are highlighting resistance forming in the upper range near $3.26–$3.40, and strong support around $2.90–$3.00.

Market commentator Justcryptopays noted that XRP is eyeing the $3.13–$3.17 resistance zone. A decisive breakout above $3.17 could ignite the next rally toward $3.40.

A breakdown below that support could open the door to deeper losses, potentially toward the $2.75, $2.55–$2.62 zones.

DavidTheBuilder pointed out, “In the short term, XRP may consolidate between $3.00–$3.20 until a clearer breakout emerges. A move above $3.40 would confirm bullish continuation, while losing $2.90 could open the door to deeper downside toward $2.75 or even $2.55.”

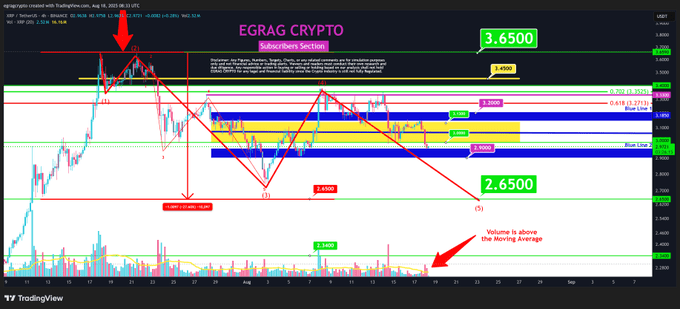

Renowned market analyst EGRAG CRYPTO shared similar sentiments that a full-body 4H candle close below $2.90 could confirm a 5-wave structure, opening downside toward $2.65. On the upside, $3.65 remains the key breakout level to watch.

At the time of this writing, XRP was trading at $3.00, according to CoinGecko data.

Conclusion

XRP is consolidating within a tight $2.90–$3.40 range, but the weekly chart flashes a bearish divergence, higher highs in price against lower highs in RSI, signaling fading momentum. A similar setup in late 2020 preceded a major pullback.

Immediate resistance sits at $3.35–$3.40, while $2.90–$3.00 remains critical support since a breakdown could accelerate losses toward $2.75–$2.62. Although a breakout above resistance could shift sentiment bullish, the current structure leans bearish, urging traders to proceed with caution.