ARK Invest’s report for the third quarter reveals that Solana has produced the highest blockchain revenue compared to other networks, totaling $223 million.

Summary

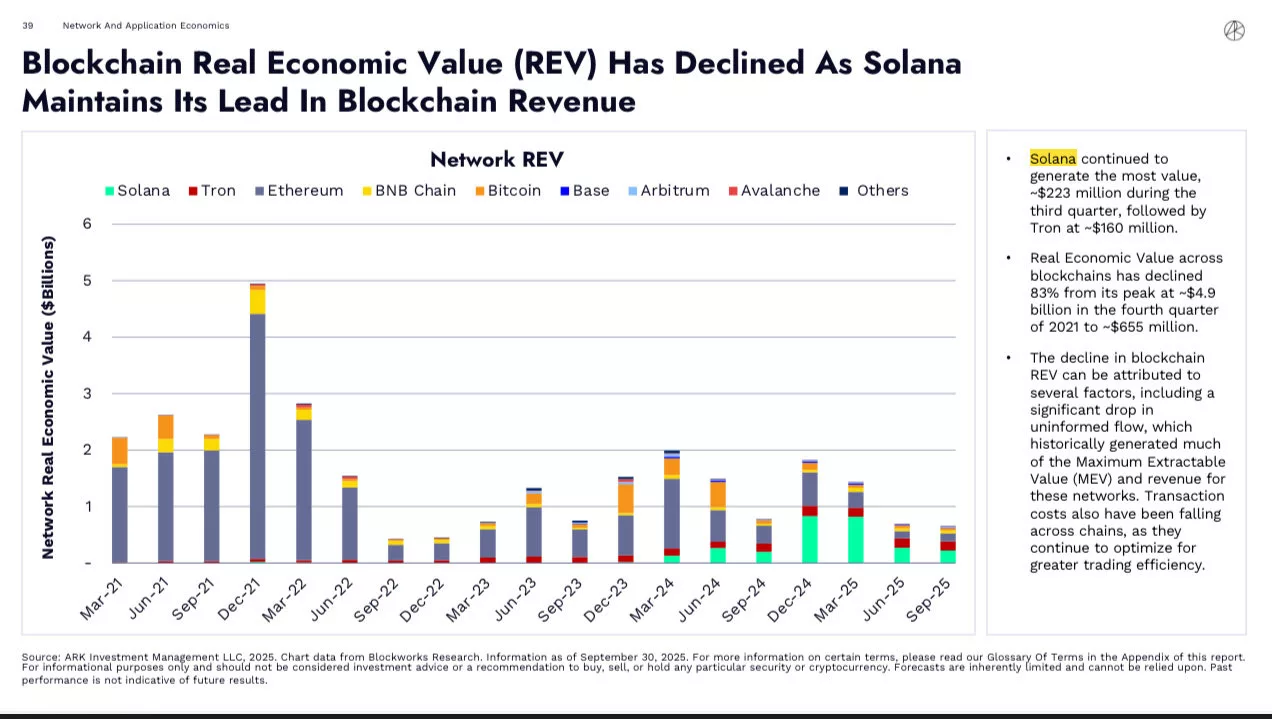

- In Q3 2025, Solana outperformed all blockchains, generating $223 million in real economic value, followed by Tron with $160 million, despite total blockchain revenue dropping 83% from its peak in 2021.

- ARK Invest highlighted that the reduction in overall revenue was due to lower uninformed capital flows and decreasing transaction costs.

The third-quarter DeFi report from ARK Invest indicates that Solana consistently generates significant economic value, around $223 million, leading all listed networks in value creation. The report emphasizes the growth of the Solana ecosystem and its superior revenue generation compared to its counterparts.

The quarterly report examined crucial metrics in decentralized finance, including on-chain activity, stablecoins, and decentralized exchanges. Overall, Solana (SOL) generated approximately $223 million in value, outpacing all other networks.

Following closely is the Tron (TRX) network, which generated about $160 million in value.

According to the report, total real economic value across networks has decreased by 83% from its highest peak of $4.9 billion in Q4 2021, with the current overall value at $655 million in Q3 2025.

ARK Invest noted several factors contributing to the decline in revenue among blockchains. The first is a significant drop in uninformed capital flows, historically known for generating the majority of Maximum Extraction Value and revenue for these networks.

Additionally, the decrease in transaction costs across various chains has also contributed to the decline in revenue, as they lower costs to attract more users by enhancing trading efficiency.

As per data from DeFi Llama, Solana’s revenue in the past 24 hours reached $1.1 million. The total value locked in the chain has amounted to $11.36 billion, increasing by 0.74% in the last day. Gauntlet has contributed the largest share of fees at $12.71 million, while Jupiter holds the largest total value locked.

ARK Invest’s Solana investments

Historically, ARK Invest has heavily invested in Solana-related projects. On Sept. 19, ARK Invest purchased approximately $162 million worth of shares in Solmate or BREA, participating in the company’s $300 million funding round. The firm now holds about 6.5 million shares of BREA.

In July 2025, ARK Invest shifted its validator operations for the Digital Asset Revolutions Fund to SOL Strategies, a Toronto-based company that specializes in Solana.

Earlier, in April 2025, ARK Invest made its inaugural direct investment in Solana through the SOLQ ETF, a Canadian SOL staking ETF. This purchase made ARKW and ARKF the first U.S.-listed ETFs to include Solana in their portfolios.