Bitcoin transaction fees have dropped to their lowest levels in over a decade, indicating a significant change in network usage.

Data from Glassnode reveals that the 14-day simple moving average of daily fees currently stands at 3.5 BTC, a figure not observed since 2011, during the early adoption period of the protocol.

Why is Bitcoin’s Network Fee Declining?

The decline is driven by weaker demand for blockspace, showcasing a broader shift in Bitcoin’s purpose. Investors are increasingly viewing the asset as a store of value rather than a means of payment.

On-chain data supports this transition. Public companies like Strategy have significantly increased their Bitcoin holdings recently, viewing it as digital capital rather than for daily transactions.

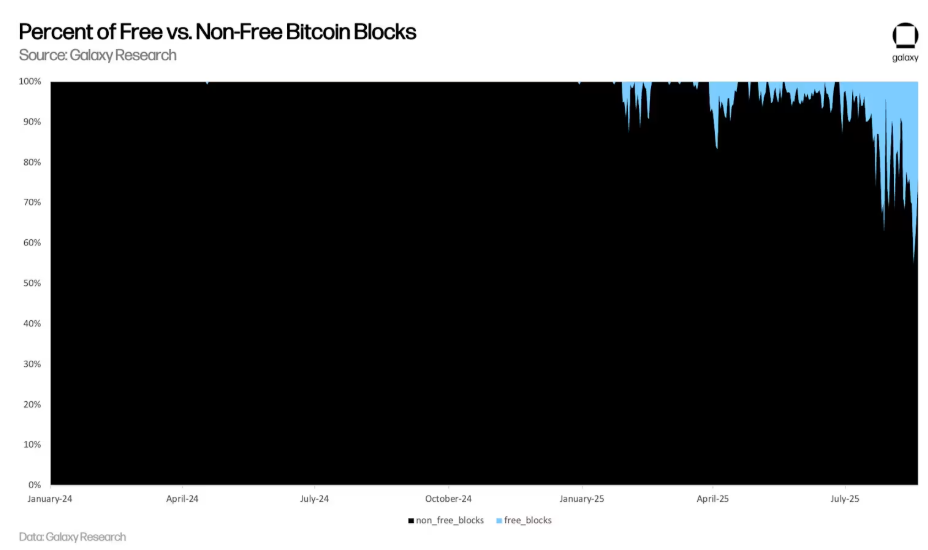

For context, Galaxy Digital has pointed out a lack of activity in Bitcoin’s mempool, with the percentage of not-full blocks rising to nearly 50% at times in recent months.

“These blocks fail to reach the maximum weight limit (4,000,000 weight units) despite room for more transactions. In essence, the mempool, Bitcoin’s pending transaction space, is often empty or contains transactions that don’t require high fees for quick processing,” Galaxy stated.

The firm added that after the 2024 halving decreased block rewards to 3.125 BTC, miners anticipated that transaction fees would compensate for lost revenue. However, the opposite occurred.

According to the firm, a subdued fee market complicates profitability for smaller operators, raising concerns about the long-term viability of Bitcoin’s security model.

In addition to these technical changes, the prevailing market structure also impacts the reduction in Bitcoin network fees.

Galaxy notes that the rise of custodial products like exchange-traded funds and institutional derivatives has lessened the need for on-chain transactions by investors.

Furthermore, retail traders seeking high-volume activity, particularly in meme coin markets, are turning to faster and cheaper blockchains such as Solana, which provide smoother execution than Bitcoin’s Runes ecosystem.

“If BTC volume continues to shift towards ETFs, custodians, and swift alt-L1s, the core network risks functioning as a settlement layer without adequate settlement activity,” Galaxy cautioned.

This change coincides with a noteworthy surge in global institutional and governmental adoption of the blockchain network.

Consequently, Bitcoin’s price has soared to a new all-time high exceeding $124,000, with heightened expectations that its value could surpass $1 million.

The post Bitcoin Fees Hit Satoshi-Era Levels as Blockspace Demand Evaporates appeared first on BeInCrypto.