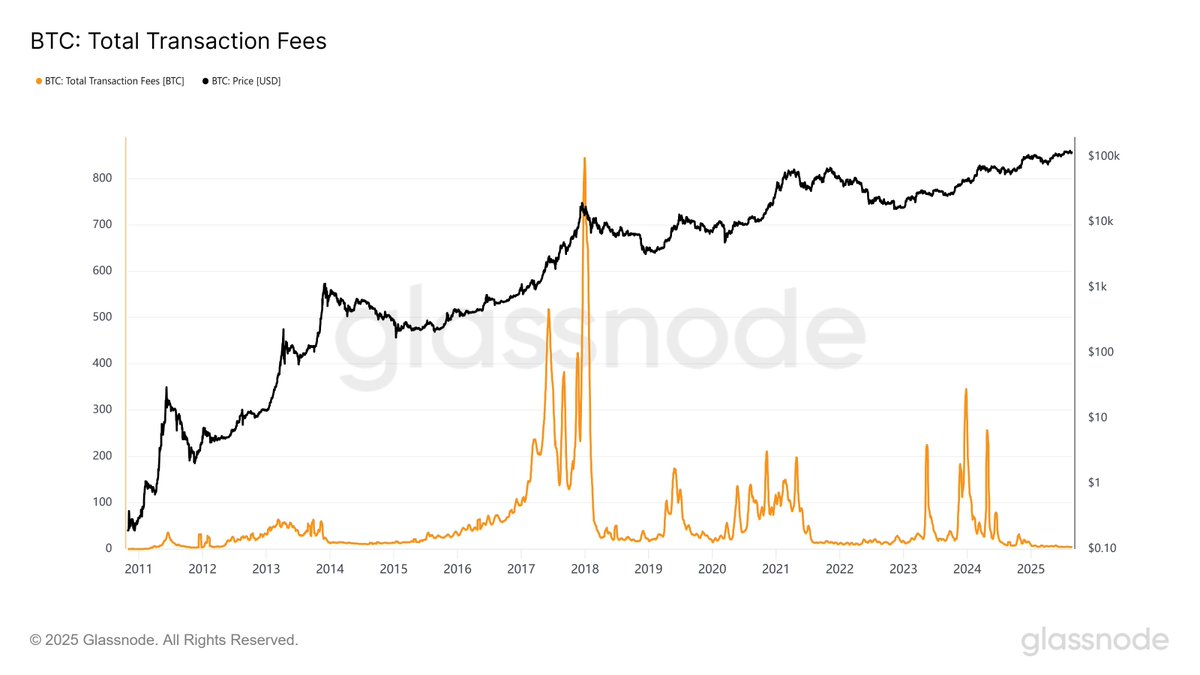

Bitcoin transaction fees have dropped to their lowest point in over ten years, as anticipation around Federal Reserve rate cuts intensifies, prompting discussions about the sustainability of the market.

Summary

- Bitcoin fees decline to their lowest level since 2011 with a daily average of 3.5 BTC

- Hype surrounding Fed rate cuts reaches an 11-month peak, reminiscent of previous market peaks

- BTC balances on exchanges up by 70K since June, indicating potential selling pressure

Data from Glassnode reveals that daily transaction fees on the Bitcoin (BTC) network (14-day SMA) have recently fallen to 3.5 BTC, marking the lowest level recorded since late 2011.

The recent strength in the market can be attributed to Fed Chair Jerome Powell’s remarks at Jackson Hole, where he suggested potential rate cuts by mentioning that the “shifting balance of risks may warrant policy adjustments.”

Social sentiment hits precarious levels for bulls

Discussions surrounding terms such as “Fed,” “rate,” and “cut” on social media are on the rise. Data from Santiment indicates this surge is the highest seen in the past 11 months.

This significant increase in conversation around a singular bullish topic typically signals heightened euphoria.

When social sentiment regarding a specific catalyst reaches extreme heights, it often aligns with local price peaks.

Glassnode’s analysis highlights a troubling situation for Bitcoin investors. A dense cluster of supply, formed between $113,000 and $120,000 since early July, consists of investors who have held for less than three months.

The SOPR by Age metric for these short-term holders currently ranges from 0.96 to 1.01, suggesting a slight decline in profitability perception.

Exchange inflows depict a concerning outlook for Bitcoin

A troubling trend has emerged with Bitcoin’s supply on exchanges increasing. Since early June, the quantity of BTC held on exchanges has risen by nearly 70,000 coins.

This contrasts with the long-term trend of moving coins into cold storage, indicating that more holders are preparing to sell.

Historically, rising balances on exchanges have signaled upcoming selling pressure as investors transfer coins to these platforms for liquidation.

Bitcoin’s on-chain health metrics present a neutral-to-cautious outlook, with daily active addresses and transaction volume easing from recent peaks.

The long-term MVRV ratio currently stands at 18.5%, placing it in a slightly risky zone for new investments.