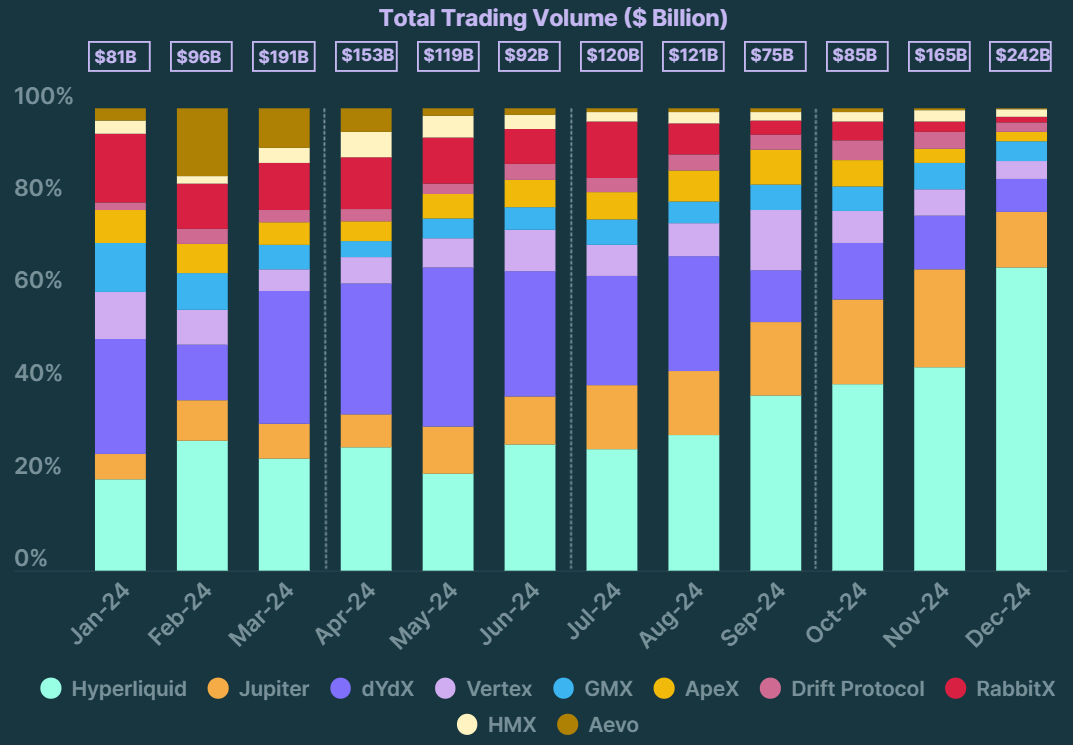

Hyperliquid commands approximately 80% of the decentralized perpetual futures market, underscoring its swift dominance over peers. Nonetheless, this concentration poses questions about sustainability and the risks involved if trading volumes decrease.

Summary

- Hyperliquid has rapidly emerged as the leading decentralized perpetual futures platform, executing up to $30 billion in daily trades.

- Its streamlined, self-funded team developed a quick, execution-focused blockchain with fee-sharing incentives that appeal to traders and developers alike.

- Despite its fast expansion, risks such as validator concentration, transparency deficits, and dependence on high trading volumes cast uncertainty on its future.

In just over a year, Hyperliquid has established itself as a preeminent player in decentralized perpetual futures, with Redstone projecting that it holds around 80% of the market, achieving trading volumes comparable to major centralized exchanges, and raising fresh concerns about the sustainability of such concentrated activity.

At its highest, the platform facilitated up to $30 billion in daily trades—a milestone only a handful of decentralized exchanges have reached—despite operating with a nimble team of just 11 individuals.

Co-founded by Jeff Yan, a former quant at Hudson River Trading and a Harvard alum, the platform chose to bypass venture capital from the outset, a strategy that, combined with its timing, allowed Hyperliquid to seize opportunities faster than its competitors.

At the beginning of 2024, decentralized exchange dYdX accounted for around 30% of trading volume across decentralized platforms. By the year’s close, its share plummeted to about 7%, while Hyperliquid maintained a share above 65%, according to CoinGecko’s data.

Much of Hyperliquid’s expansion appears linked to its execution capabilities. Features like one-click trading, zero gas fees, and sub-second order finalization create an experience akin to centralized exchanges, attracting both retail and professional traders.

“Created by a compact, self-funded team that declined VC funding, they illustrate that technical precision and a community-first approach can outshine well-capitalized competitors.”

RedStone

The platform operates on its dedicated blockchain with HyperBFT, a consensus mechanism designed to handle hundreds of thousands of orders per second, achieving settlement finality within a second. By prioritizing speed and reliability prior to enhancing infrastructure, Hyperliquid has seemingly gained trust among traders quicker than many of its peers.

Incentives and Revenue

The platform shares trading fees with its community. Individuals listing new spot markets can retain up to half of the fees those trades produce. Developers creating user interfaces receive a portion that can even surpass the protocol’s own share. Additionally, those launching perpetual markets split their fees with the investors backing them.

This arrangement has motivated external developers to engage with the platform without the need for grants or subsidies. They have already developed tools to address gaps, such as enabling traders to manage one balance across various positions or borrow against their assets. This has resulted in a burgeoning ecosystem that competing decentralized exchanges have struggled to replicate.

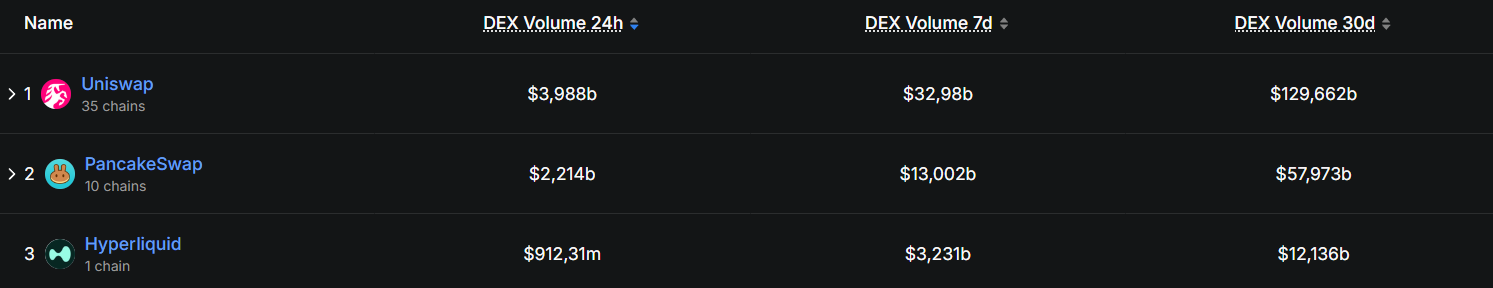

According to DefiLlama data Hyperliquid ranks third among decentralized exchanges in terms of weekly trading volume, generating over $12 billion, surpassed only by PancakeSwap and Uniswap. This surge has enabled Hyperliquid to yield more than $1 billion in annualized revenue, resulting in an estimated $102.4 million per employee.

As reported earlier by crypto.news, this figure exceeds Tether at $93 million, OnlyFans at $37.6 million, Nvidia at $3.6 million, and Cursor at $3.3 million.

Risks ahead

A joint report from OAK Research and GL Capital highlights that despite Hyperliquid’s swift ascent, “several key milestones must still be achieved to validate [the valuation] thesis.”

“Centralization poses a concern, with only 16 validators, and the opacity in the codebase might discourage third-party developers. While full control over the infrastructure is a compelling model, it also makes the platform vulnerable, as shown by the HLP incident.”

OAK Research and GL Capital

The platform’s dependence on consistent trading volume amplifies risk. A prolonged bearish market could lead to diminished returns and challenge the token buyback mechanism that underpins much of the HYPE ecosystem.

From a valuation standpoint, analysts describe the opportunity as “asymmetric risk/reward,” estimating HYPE’s fair value between $32 and $49 under conservative scenarios, with its current trading price at about 86% of the upper limit of that range, pegged at $42.

Hyperliquid has showcased swift adoption, yet it confronts numerous structural and market risks. Validator concentration, transparency issues, reliance on heightened trading volumes, and growth contingent on execution imply that outcomes remain sensitive to both internal strategies and external market fluctuations.