Flow’s DeFi ecosystem is rapidly expanding, with DeFi TVL increasing by 46% in the last quarter to reach $68 million.

Summary

- Flow’s DeFi TVL surged by 46% to $68 million last quarter, marking its best performance to date

- The blockchain is realigning its focus towards stablecoins, liquid staking, and DeFi.

- PayPal’s PYUSD supply on Flow increased by 212% QoQ, reaching $26.2 million

Previously regarded as a mere NFT chain that had lost its relevance, Flow (FLOW) is gradually making a resurgence. On Thursday, August 21, Messari published a report detailing the status of the Flow ecosystem in Q2 2025. The report highlights a 46% increase in TVL to $68 million, representing the most successful quarter to date.

This growth is primarily driven by stablecoins, liquid staking, and DeFi, rather than collectibles. Significantly, Flow has experienced heightened interest in stablecoins, with PayPal’s PYUSD supply swelling by 211.9% QoQ to $26.2 million, establishing PYUSD as the dominant stablecoin on the network.

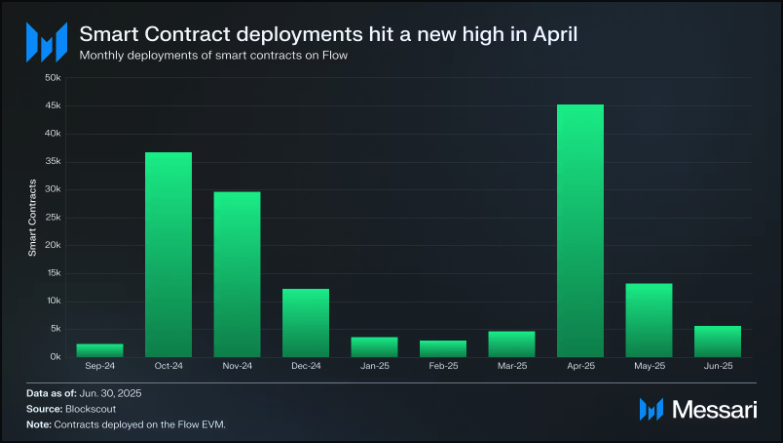

Moreover, developer activity has surged, featuring a remarkable 473% QoQ rise in smart contract deployments. April marked the peak for contract deployments, totaling 45,239. Additionally, user engagement soared, with average daily transactions on Flow increasing by 602% to 40.1k, fueled by the LayerZero integration.

Flow shifts from its initial NFT strategy

The increasing activity indicates that Flow has effectively transitioned from its original NFT-centric approach. Launched by Dapper Labs in 2020, the developers of Ethereum’s (ETH) CryptoKitties NFTs, Flow has undergone significant evolution. Initially designed to address the congestion caused by CryptoKitties on Ethereum, Flow aimed to be a layer-1 chain capable of supporting mass-market dApps.

It initially capitalized on the NFT boom, securing relationships with major players like Disney, the NFL, and the NBA. However, as interest in digital collectibles waned, Flow adapted its strategy, placing greater emphasis on DeFi.