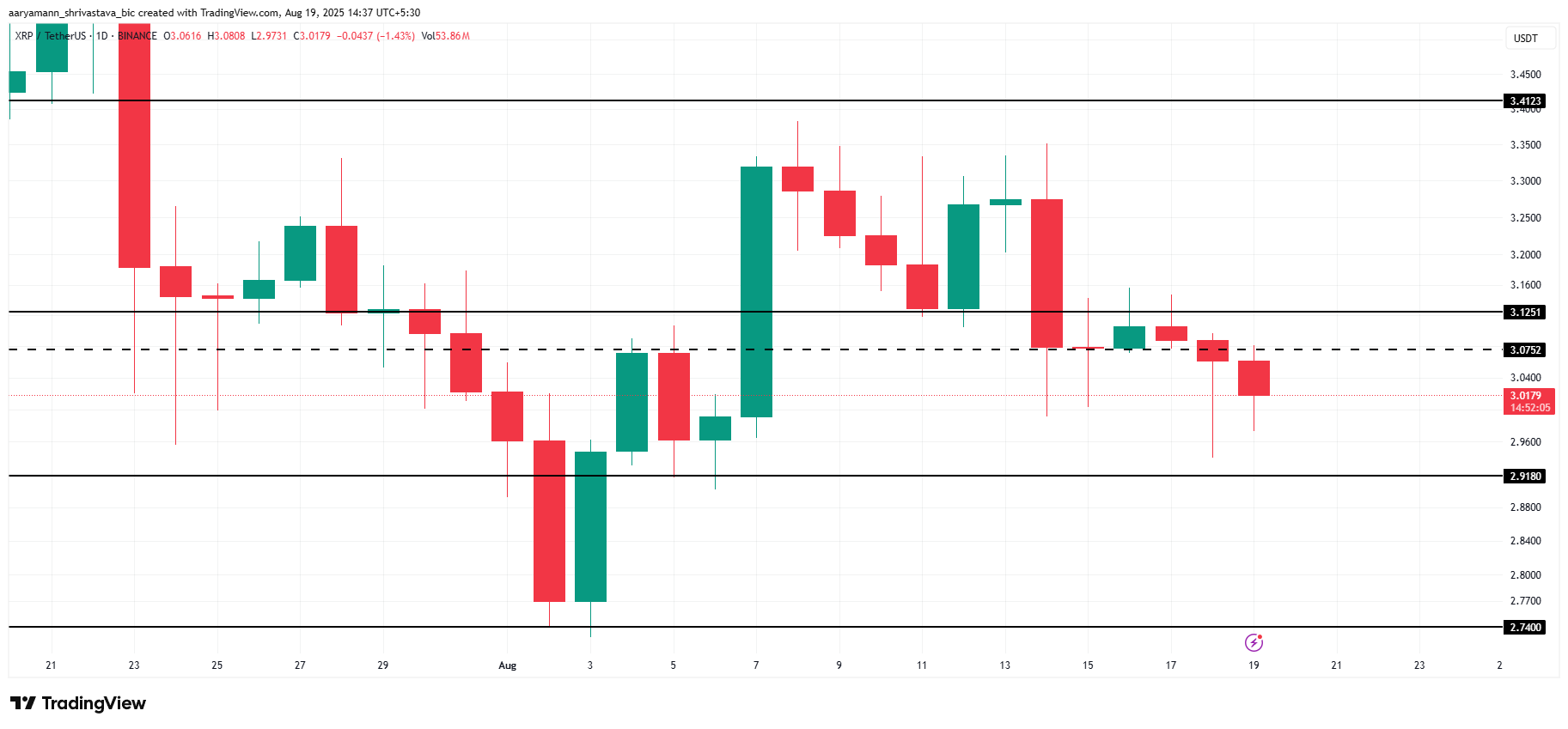

XRP has faced a recent decline despite a surge in buying activity, with its price moving lower. The token is currently priced at $3.01, having lost its local support of $3.07 in the last 24 hours.

This dip follows a pattern where key holders opted to sell their holdings, contributing to the bearish momentum.

Some XRP Holders Move To Buy

Investors are still actively accumulating XRP, as reflected in the declining exchange net position. The indicator currently sits at a 5-month low, signaling net outflows from exchanges. In the past week alone, over 312 million XRP, worth approximately $950 million, has been bought by holders, showing optimism toward the asset’s potential recovery.

The strong accumulation points to confidence among retail and institutional investors, signaling a belief in XRP’s future price action. While the price has recently declined, the accumulation trend shows that investors are positioning themselves for a long-term upward movement.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

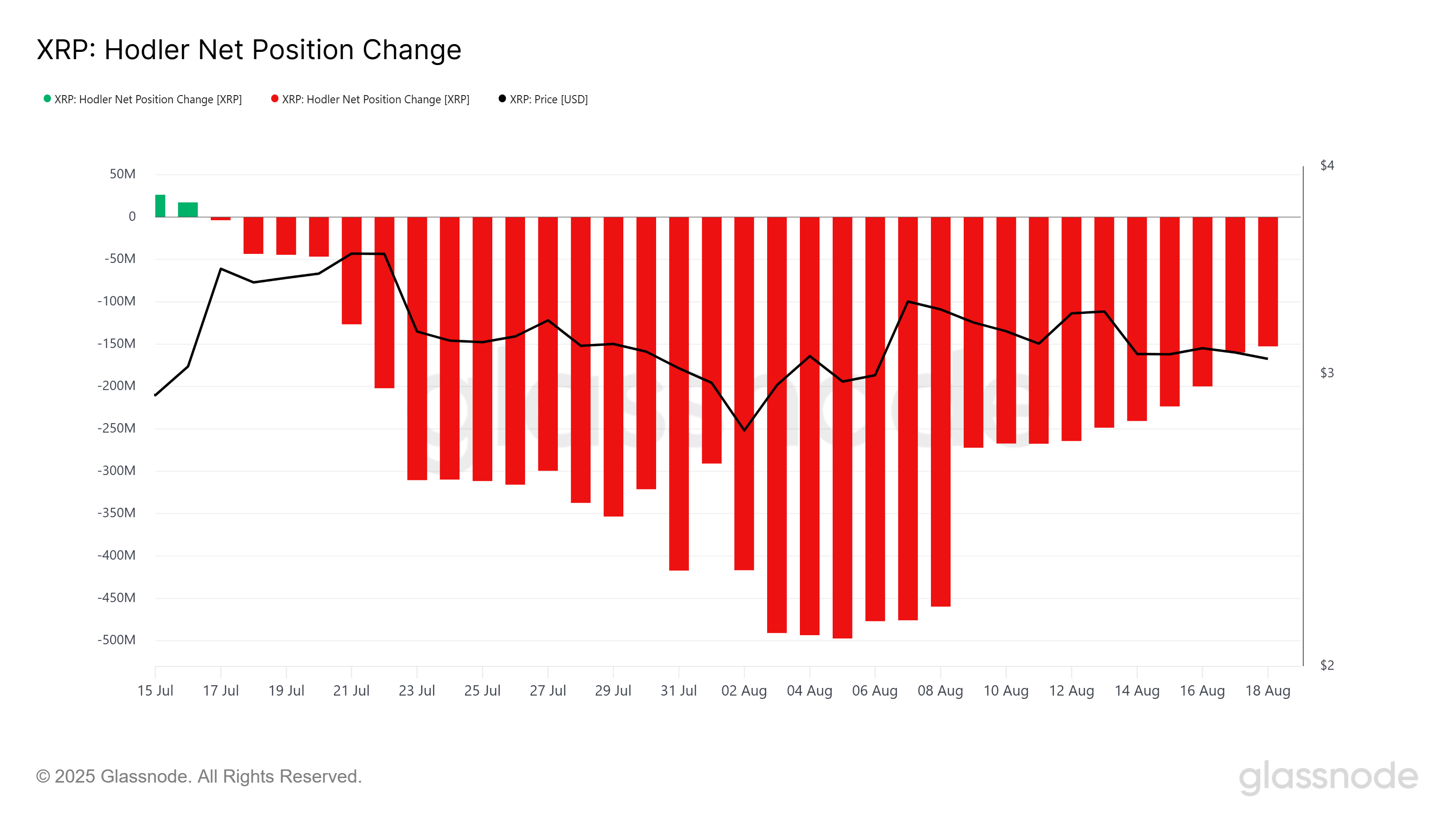

The overall macro momentum for XRP is slightly more cautious. The HODLer Net Position change indicator, which tracks long-term holders’ (LTHs) supply movement, shows a shift from selling to buying over the last few days. However, despite this change, LTHs have not yet repurchased the XRP they sold in the previous month.

Without a significant buying surge, the bearish sentiment among LTHs may continue to influence XRP’s price. These holders play a key role in determining price movement, and their hesitance to re-enter the market signals a level of caution. This lack of buying pressure could potentially keep XRP’s price under control in the near term.

XRP Price Needs To Reclaim Support

XRP’s current price is at $3.01 after losing the support at $3.07. The decline in price is largely due to a lack of bullish momentum, compounded by broader market negativity. Without a clear catalyst, XRP might face further consolidation as the market waits for stronger buying signals.

In the coming days, XRP may test the $2.91 support level, marking a potential 2-week low. A drop below this level is unlikely, suggesting that this range could act as a temporary consolidation zone. As long as the price holds within this range, the market may await a clearer direction.

However, if XRP reclaims the $3.12 support, the cryptocurrency could recover its recent losses. This would depend on continued accumulation by investors, as well as sustained optimism for a price rebound. Only with this renewed interest would XRP be able to push for higher levels.

The post What $950 Million XRP Being Moved Off Exchanges Means for Price appeared first on BeInCrypto.