Key Highlights:

JPYC receives regulatory go-ahead to issue Japan’s first yen-pegged stablecoin.

Japan’s stablecoin reform aims at streamlined international money transfers.

Cryptocurrency tax and ETF proposals signal dynamic legal changes.

Japan Approves First Yen-Pegged Stablecoin for National Rollout

Japan’s Financial Services Agency is preparing to approve the country’s inaugural stablecoin, directly linked to the yen. The issuer, Tokyo-based fintech JPYC, will soon be registered officially as a licensed money transfer provider. This ground-breaking move not only aims to strengthen Japan’s fintech sector but could also revolutionize how cross-border transactions are settled, making them faster and more cost-efficient for businesses and individuals.

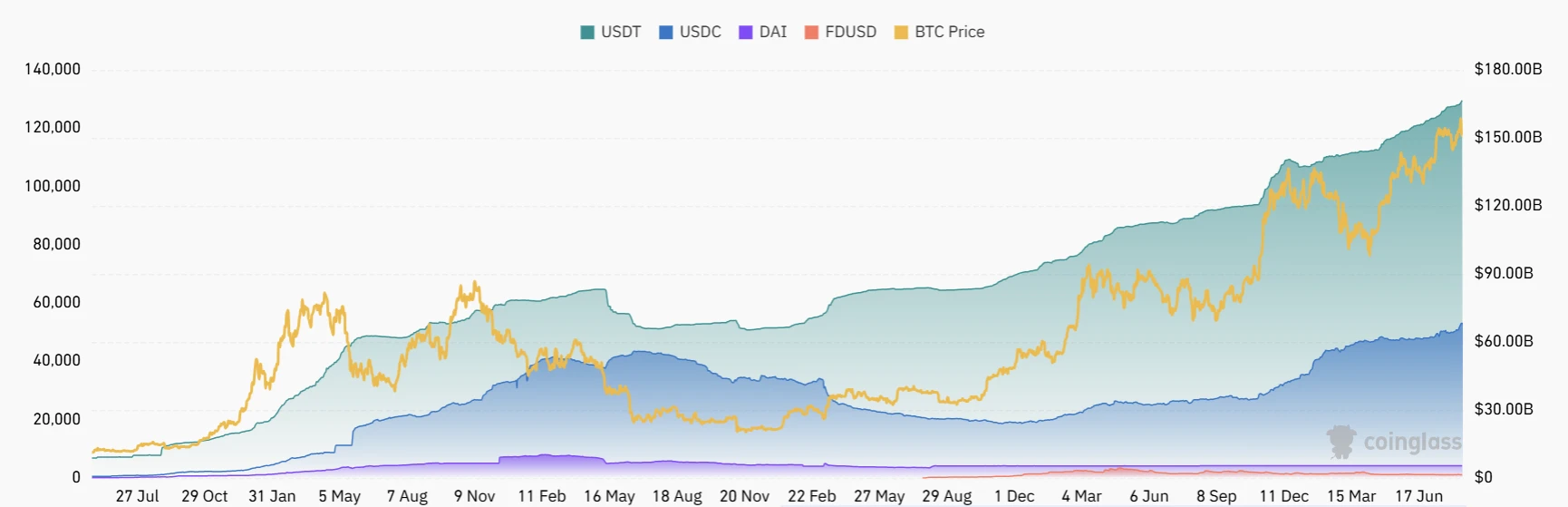

According to local reports, the global stablecoin market is expected to surpass $250 billion by 2025, with most coins currently pegged to the US dollar. Japan now positions itself on the cutting edge by enabling new forms of digital payments, diversifying its participation in the international crypto ecosystem.

Regulatory Reforms and Regional Stablecoin Growth

Separately, South Korean tech giant Kakao is developing a won-pegged stablecoin via the Kaia blockchain, highlighting a regional trend toward national digital assets. Meanwhile, Japan’s financial regulator has proposed reforms to classify cryptocurrencies as financial products. Such changes could pave the way for crypto ETFs and a simplified 20% flat income tax for crypto earnings, making Japan a more enticing market for investors and innovators alike.

These developments demonstrate Japan’s commitment to fostering digital innovation while maintaining regulatory oversight, positioning the country as a central hub in the rapidly expanding global stablecoin industry. Japan’s proactive stance not only sets a precedent for other countries but may accelerate international adoption of regulated, fiat-backed stablecoins.