XRP is moving in tandem with the broader crypto trend and has managed to hold above the $3 price level. According to a recent technical analysis by popular crypto chartist Egrag Crypto, XRP’s price action is about to enter a critical stage that will push it well above double digits. Its monthly Relative Strength Index (RSI) is currently playing out what he calls the “Cycle of Three,” which projects an incoming explosive phase.

Major Pump, Correction, And Blow-Off Top

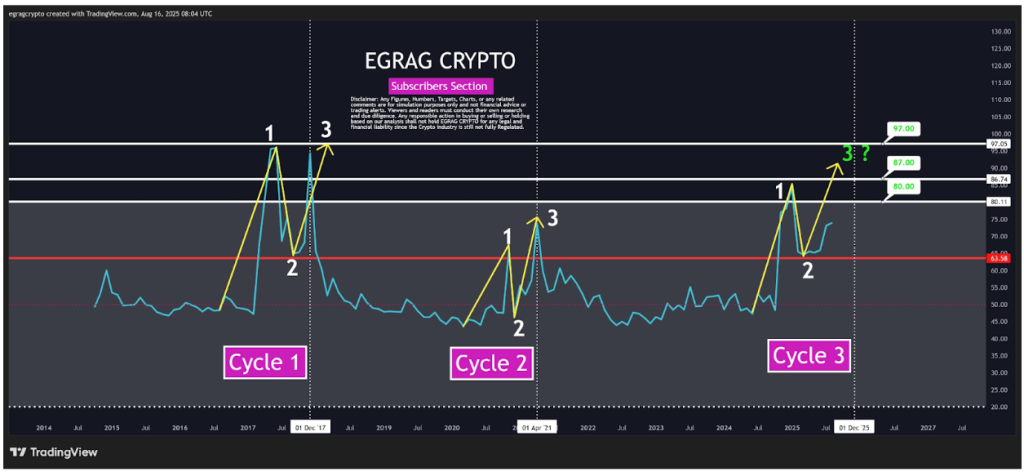

Egrag’s framework is built around a repeating pattern that’s always taking place on XRP’s monthly RSI indicator. According to his analysis, the first stage of the cycle historically delivers a major RSI pump, followed by the second stage, where corrections set in, and then a third stage that has consistently played out as a blow-off top.

Related Reading

Both Cycle 1 and Cycle 2, which took place during the XRP rallies of 2017 and 2021, respectively, exhibited the same sequence, although with varying levels of intensity. The 2017 rally was much greater than the 2021 rally, which was suppressed by the Ripple lawsuit at the time. As such, the 2021 RSI pattern was much less pronounced, but it followed the same sequence nonetheless.

The current setup, which is marked as Cycle 3 in the chart below, has already seen the pump and correction phases completed. What remains, according to the analyst, is the third stage. This is the push to an RSI blow-off top that could send the price of XRP into new territories.

Egrag Crypto predicted three possible targets of 80, 87, and an ambitious 97 for XRP’s monthly RSI peak in the current cycle. These numbers are derived from the RSI trajectory observed in the last two cycles and projected onto today’s XRP RSI conditions.

What Does This Mean For XRP’s Price?

If XRP’s monthly RSI reaches levels such as 80, 87, or even 97, it would be one of the strongest overbought signals in the asset’s history. The last time XRP’s monthly RSI crossed above 90 was during the 2017 bull run, which saw XRP’s price explode from less than $0.1 to its then all-time high of $3.40.

Related Reading

In technical terms, an RSI above 70 means that an asset is trading at overheated levels, but in bull markets, these conditions can persist for extended periods during price rallies. For XRP, such elevated RSI readings would likely coincide with new all-time highs that mirror those seen in the 2017 bull run. Realistically, this could see the XRP price break above its newly established all-time high of $3.65 and into $4, $5, and beyond into double digits.

XRP RSI reaching above 90 could also serve as a warning that the price may already be at a new multi-year top. At the time of writing, the monthly XRP RSI was at a 73 reading. XRP was trading at $3.12.

Featured image from Pexels, chart from TradingView