Shiba Inu’s price performance has remained largely muted this week, trending sideways even as the broader cryptocurrency market experiences an uptick.

This rally has spilled over into the meme coin ecosystem, with several small-to-mid-cap meme tokens noting sizable gains this week. Surprisingly, despite the overall market enthusiasm, SHIB has struggled to capitalize on the momentum. This is why.

Shiba Inu Loses Steam as Key Investors Reduce Holdings

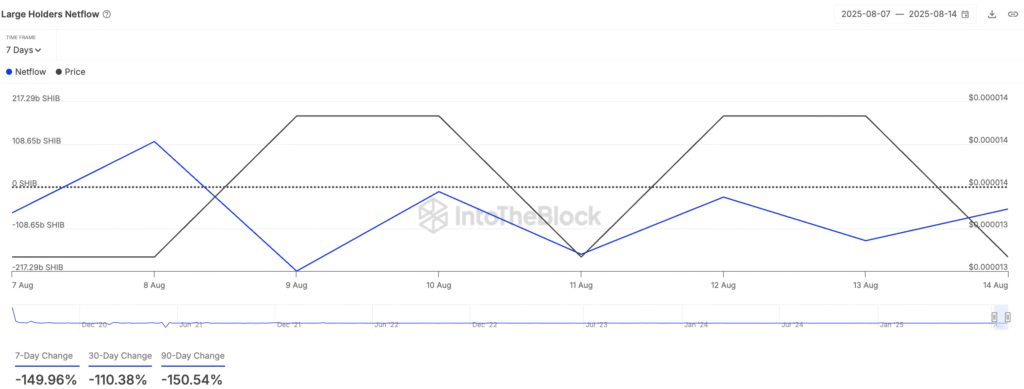

According to IntoTheBlock, SHIB has noted a 150% dip in its large holders’ netflow over the past week, signalling a pullback from key investors.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Large holders are whale addresses holding more than 1% of an asset’s circulating supply. Their netflow tracks the difference between the coins they buy and the amount they sell over a specific period.

When an asset’s large holders’ netflow increases, more of its tokens or coins are flowing into whale wallets than are flowing out. This trend indicates that these holders are accumulating the asset, signaling confidence in its future value.

On the other hand, when it falls, whales are selling more of the asset, leading to a net outflow from their wallets. This signals reduced confidence in SHIB’s near-term performance and puts downward pressure on the asset’s price.

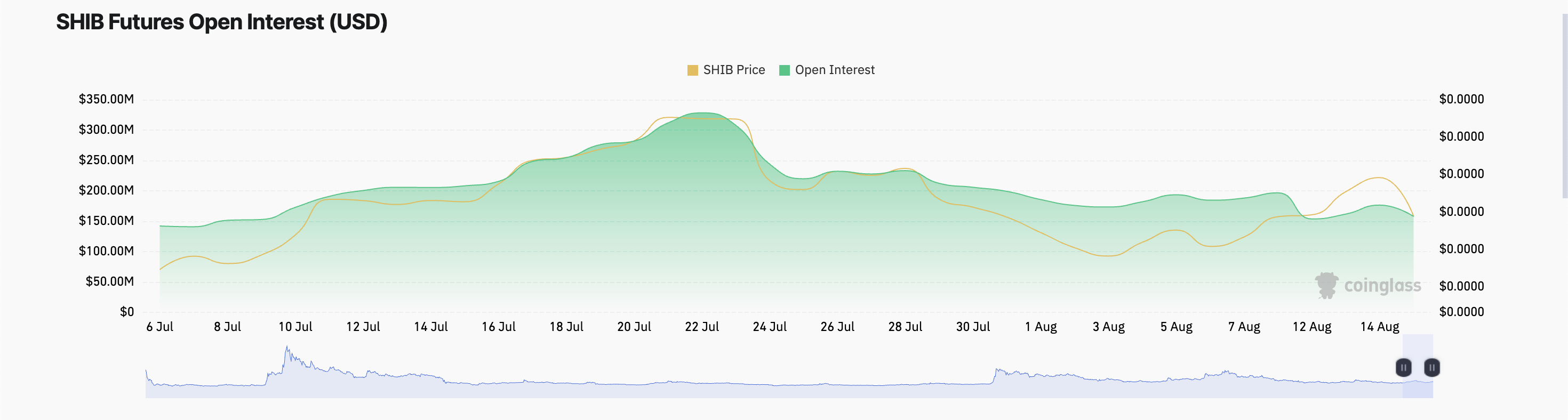

Further, the lackluster price performance has triggered inactivity from SHIB’s futures traders, pushing its open interest to a 30-day low. Per Coinglass, SHIB’s futures open interest is $158 million, falling 15% in the past seven days.

Open interest measures the total number of outstanding futures or options contracts for an asset that have not yet been settled. When open interest falls, traders are closing positions without opening new ones, signaling reduced market participation.

Falling open interest during a period of muted price performance for SHIB indicates fading market interest and a weakening conviction in the meme coin’s near-term trajectory.

Will Buyers Step In Before Decline to $0.00001295?

Readings from the SHIB/USD daily chart show the meme coin resting below its Super Trend Indicator, which currently forms dynamic support at $0.00001446.

This indicator tracks the direction and strength of an asset’s price trend. It is displayed as a line on the price chart, changing color to signify the trend: green for an uptrend and red for a downtrend.

When an asset’s price trades below its Super Trend indicator, selling pressure dominates the market. If this continues, SHIB could break below its narrow pattern and fall under $0.00001295.

On the other hand, if new demand resurfaces, it could drive a rebound toward $0.00001385.

The post SHIB Sits Out Meme Coin Party as Whales Trim Holdings appeared first on BeInCrypto.