Hedera Hashgraph’s native token, HBAR, has displayed muted price performance since the beginning of August, mostly trading within a narrow range.

However, with improving market momentum, HBAR has broken above the upper line of the channel, and on-chain data confirms the likelihood of staying above the price barrier in the short term.

HBAR Eyes Breakout Amid Capital and Activity Surge

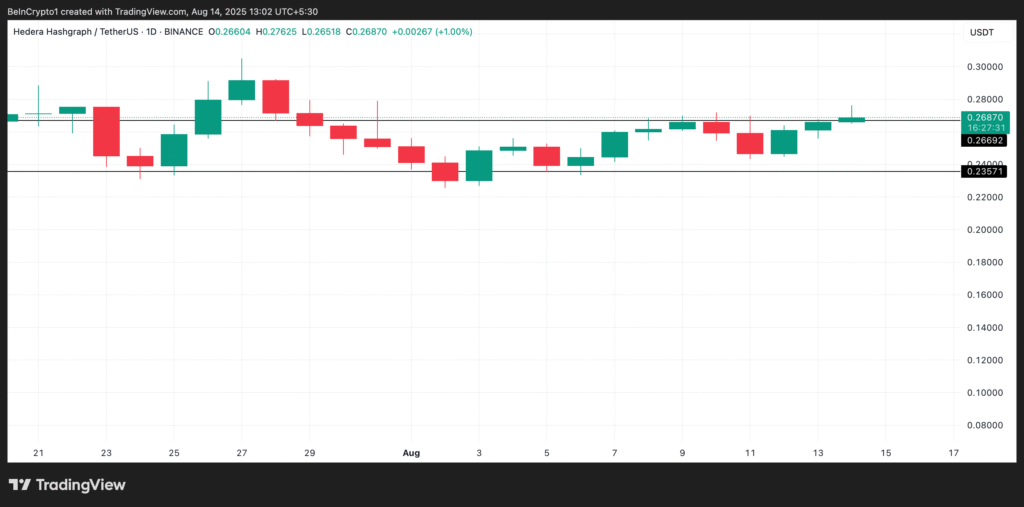

Readings from the HBAR/USD daily chart show that the altcoin has traded within a horizontal channel since the beginning of August.

This pattern emerges when an asset’s price oscillates between a defined resistance and support level, indicating consolidation. Since August 1, HBAR has found resistance at $0.2669, while support has held at $0.2357.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Over the past 24 hours, HBAR has risen by 3% and currently sits above this resistance. On-chain indicators suggest that as bullish pressure builds, this level may solidify as a new support floor, potentially paving the way for further gains.

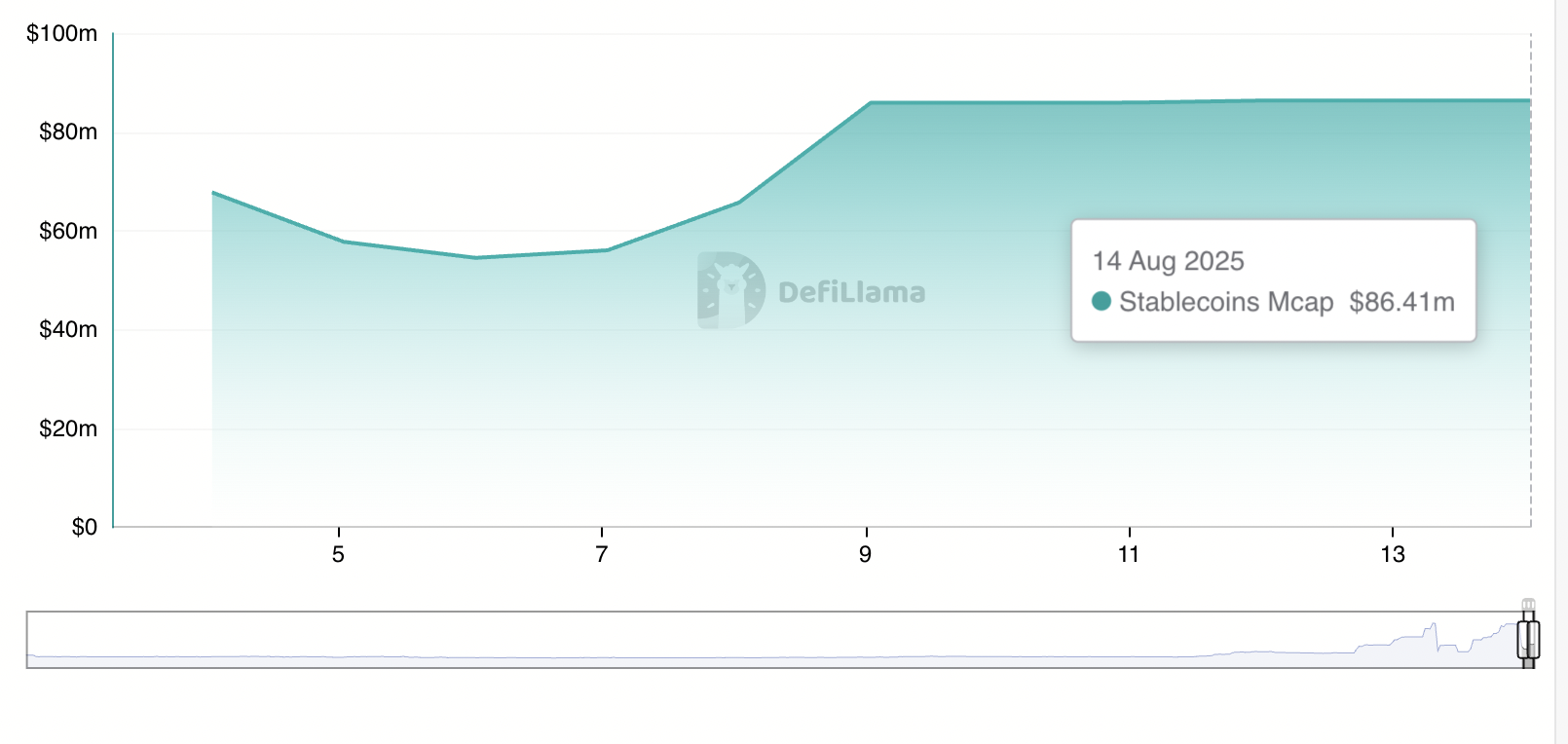

First, according to DefiLlama, Hedera’s stablecoins market capitalization has surged by over 54% in the past seven days, reaching $86.41 million.

A rising stablecoin market cap signals strong capital inflows into the network, suggesting increased investor confidence and liquidity. This can put upward pressure on HBAR as demand for the token grows alongside ecosystem activity.

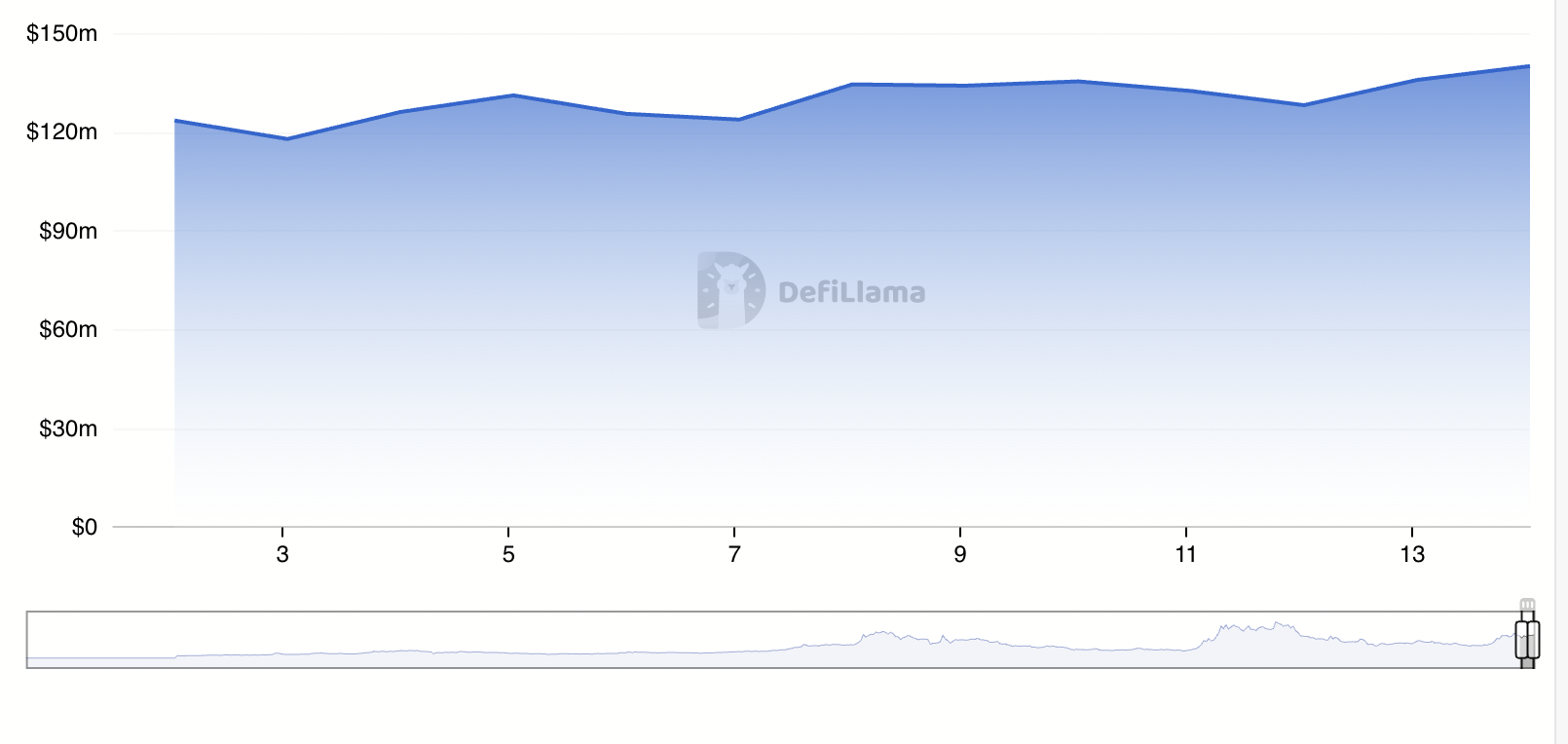

In addition, Hedera Hashgraph has seen a rise in its DeFi total value locked. Per DefiLlama, this currently stands at $140.06 million, up 20% since August 3.

TVL measures the amount of crypto assets staked or locked within a network’s protocols and is seen as a proxy for network activity and usage. Hence, the growing TVL indicates that more users are engaging with Hedera-based applications, which can boost short-term demand for HBAR and strengthen its price performance.

Could $0.2664 Become a New Support Floor?

The recent surge in stablecoin market capitalization and rising network TVL suggests that the resistance at $0.2669 may solidify as a new support floor.

Should buying pressure continue to build, HBAR could extend its gains toward $0.3050 in the near term if this happens.

However, a drop below $0.2669 could trigger a pullback toward $0.2357. HBAR may face a deeper decline if this level fails to hold, potentially testing $0.1963

The post HBAR Rally Gathers Steam as Stablecoin Inflows Surge and TVL Jumps 20% appeared first on BeInCrypto.