The Bitcoin and broader cryptocurrency market have recently begun to show signs of activity, but the underlying liquidity conditions remain notably weak, as per insights from onchain analytics company Glassnode. This mirrors concerns highlighted in a CoinDesk analysis from November regarding the frail liquidity of the crypto market following the crash in October.

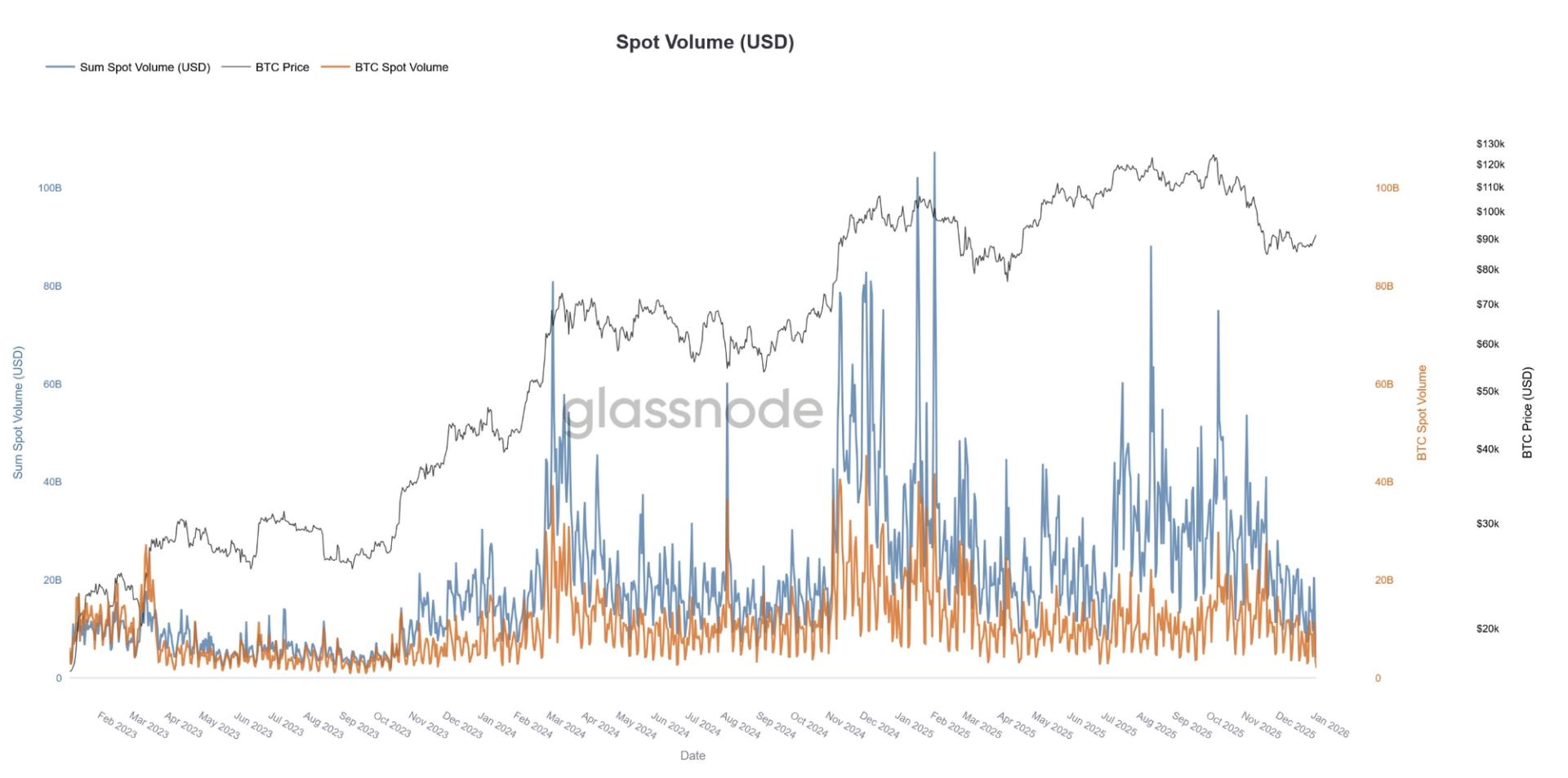

According to the latest findings by Glassnode, both the spot trading volume of Bitcoin and the overall altcoin spot volume have dropped to their lowest levels since November 2023, despite recent price increases. This divergence typically indicates reduced market participation and weak demand beneath the apparent price strength.

Spot volume gauges the actual buying and selling activity occurring on exchanges, serving as a measure of genuine trading interest.

Typically, healthy price increases are accompanied by rising volumes as new capital and traders enter the market. However, in this case, spot volumes have not only failed to rise in conjunction with prices but have also plummeted to yearly lows, highlighting a lack of widespread participation in the market movements.

Loading…

This evaluation reinforces concerns raised in a CoinDesk research article from November, which noted that liquidity across centralized exchanges—covering Bitcoin and Ether market depth—had not fully recovered post the October liquidation surge.

The research indicated that after the crash, the order-book depth remained structurally lower than prior to the sell-off, hinting at a new, thinner liquidity baseline that renders markets more susceptible to exaggerated price fluctuations.

The October incident, which erased $19 billion in leveraged positions in mere hours, did more than simply deflate overleveraged bets; it transformed the market’s structural foundation, resulting in a sustained retreat in available liquidity as market-making entities and liquidity providers withdrew, thereby making markets shallower and less able to handle significant trades without substantial price shifts.

Currently, Bitcoin is priced at $93,500, having risen by 7.5% since January 1. However, this increase on minimal volume is raising several warning flags for traders.