President Donald Trump’s initiative to exclude Democrats from U.S. regulatory roles has resulted in a unique circumstance at the two agencies most influential in federal crypto regulation: A small group of Republican crypto supporters now holds complete authority over both.

Last week, the U.S. Securities and Exchange Commission bid farewell to its only Democratic commissioner, Caroline Crenshaw, eliminating standard opposition to its current policy initiatives. Crenshaw frequently warned the agency about its transition towards embracing digital assets, opposing bitcoin exchange-traded funds (ETFs) as a risk to investors. She maintained a consumer-protection approach that consistently applied to those investing in crypto.

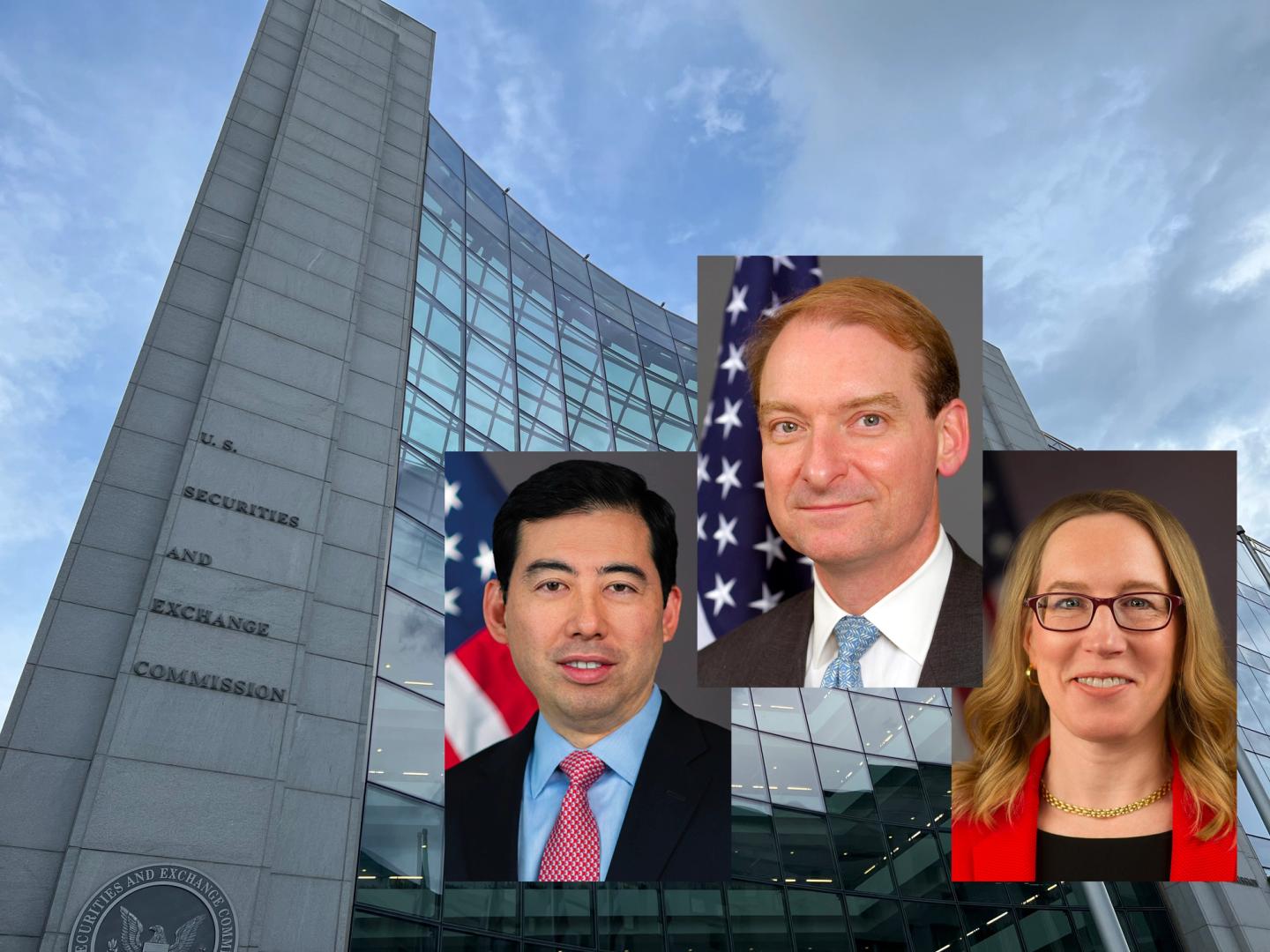

“It’s safe to say they’re speculating, reacting to hysteria from promoters, feeding a desire to gamble, engaging in wash trading to inflate prices, or as a Nobel laureate suggested — wagering on the popularity of the politicians who endorse, or personally benefit from, crypto success,” Crenshaw stated in a recent speech. Regardless of whether such public opposition within the agency influenced the SEC’s regulatory path, it has ceased to exist, as the agency is now led by Trump nominee Chairman Paul Atkins and two commissioners who support crypto, Hester Peirce and Mark Uyeda.

At its counterpart, the Commodity Futures Trading Commission, the new year commenced with a new top official; Trump nominee Mike Selig was confirmed late last month to take over as chairman on December 22. Acting Chairman Caroline Pham seized the chance to transition to a position in the industry at MoonPay, leaving Selig as the sole member of the five-commissioner body.

While this may be advantageous for crypto-friendly policies as Selig moves into his yet-to-be-defined agenda without the need for fellow commissioners’ opinions or debates, the lack of a bipartisan group at the CFTC and SEC has created complications for the crypto legislation pending in the U.S. Senate.

One key issue under discussion regarding the bill aimed at establishing a U.S. crypto regulatory framework is the Democrats’ insistence on filling their party’s vacancies at the two agencies. It remains uncertain how much Republicans are willing to concede. Trump has notably not provided clear insights on this matter.

When recently questioned about his willingness to make Democratic nominations, he responded with a question: “Do you think they would be appointing Republicans if it were up to them?”

Historically, presidents from both parties have typically made nominations from both sides, often in package deals negotiated within Congress resulting in multiple simultaneous confirmations.

“There are some areas we consider, and some areas where we share power, and I’m open to that,” Trump concluded, leaving the situation ambiguous.

Both agency leaders have been cautious not to publicly clash with Trump’s preference against allowing new Democrats into regulatory positions, with new CFTC head Selig stating during his confirmation that he would welcome bipartisan contributions at the agency but emphasized that it’s beyond his control.

Atkins acknowledged at Crenshaw’s departure that she had “listened carefully, engaged substantively, and approached every day with the objective of protecting investors and enhancing our markets.”

Currently, both the SEC and CFTC are rapidly advancing in crypto policy. In the final weeks of Pham’s interim leadership, she initiated several policies, enabling the trading of leveraged spot crypto at CFTC-registered platform Bitnomial and forming a panel of CEO advisors. Atkins has identified digital assets as the primary policy focus at his agency, having discontinued crypto enforcement actions and released various policy statements to clarify its pro-industry stance on issues such as mining, memecoins, staking, and custody.

Both Republican-led agencies have made it explicit that they plan to pursue crypto regulations with or without guidance from the legislation that Congress is currently debating.

If Congress successfully enacts the crypto market structure bill and the new law directs the agencies on a range of new regulations and responsibilities, the drafting of permanent rules would presently rest solely with Republican commissioners.

Read More: Most Influential: Paul Atkins