Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

The crypto landscape has always been noisy: from the ICO craze to DeFi highs, NFT trends, and the collapses of FTX and Terra. For over ten years, the industry has leaned on noise — more pronounced narratives, grander promises, speedier cycles — to define itself globally.

Summary

- People are already convinced of speed, ownership, and empowerment, yet widespread adoption falters as crypto highlights complexity (keys, gas, chains, risk) rather than simplifying it. The main barrier is friction, not skepticism.

- Successful technologies integrate into everyday life by concealing their infrastructure. Crypto flourishes when it operates seamlessly in the background, rather than forcing users to grasp the underlying mechanisms.

- User experience (UX) is the true scaling issue; it’s the ambiguity, not regulation, that deters users. Web3 doesn’t need more believers or louder ideologies; it requires user-friendly, forgiving products that feel secure, stable, and human.

Whitepapers forecasted revolutions. Conferences assured inevitability. Social feeds tantalized with promises of riches. Yet, despite substantial investments, regulatory milestones, and institutional engagement, mass adoption remains elusive. This setback isn’t ideological; it’s experiential.

Crypto hasn’t faltered due to a rejection of its values. It stagnated because it forces everyday users to focus on areas they shouldn’t need to mentally navigate, such as private keys, gas fees, bridges, wallet security, chain selection, and compliance uncertainty. None of these concepts captivate. They shouldn’t be prerequisites for engaging in a global financial system. The uncomfortable reality is this: crypto will thrive by becoming less visible, embedding itself as a fundamental component.

Adoption fails not due to disbelief — it fails due to difficulty

If belief alone sufficed, crypto would already be mainstream and potentially the singular financial instrument. People trust faster payments. They trust ownership. They trust global access. They trust programmable currency — even if they don’t label it that. They trust empowerment. They trust decentralization. What they don’t trust is friction.

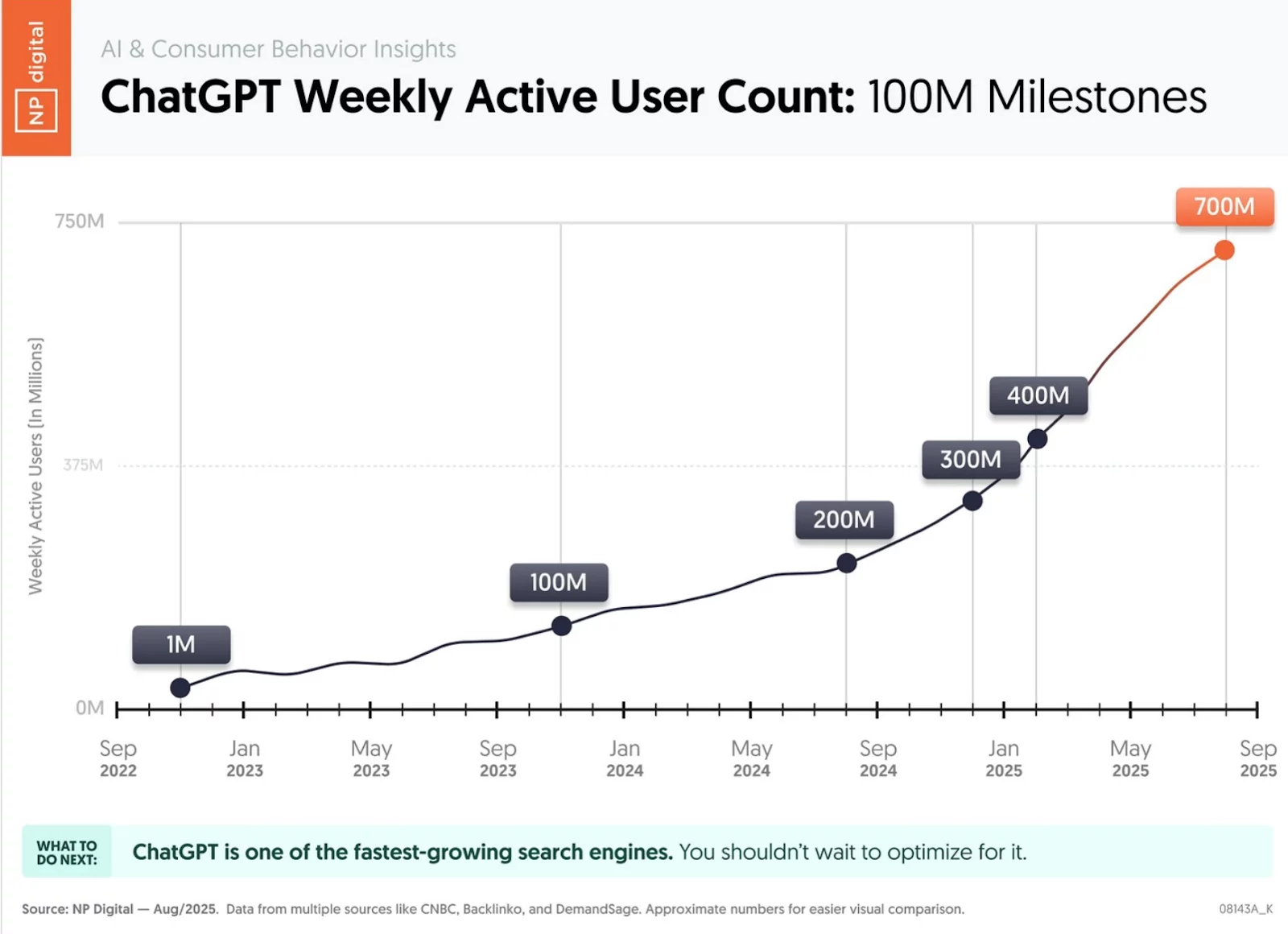

Every successful consumer technology has followed a similar trajectory: complexity shifts inward, while experience expands outward. Email conceals SMTP. Smartphones hide their operating systems. Streaming obscures infrastructure. Users shouldn’t have to comprehend how systems function — only that they do. A recent instance is the uptake of AI tools like ChatGPT.

Crypto reversed that principle. It showcased the machinery, and it hasn’t been able to undo this process. Rather than onboarding users, it burdened them with responsibilities. Instead of concealing risk, it shifted it onto users. Instead of cultivating trust through familiarity, it demanded faith via education. The standard response to confusion became “Read the docs” — as if mass markets ever adopted anything through documentation alone. This explains the lack of adoption. People aren’t hostile; the cost of getting involved exceeds the perceived rewards.

Silence as an asset, not a failure

The next stage of crypto evolution won’t mirror the previous one. It won’t be loud, ideological, or tribal. It will be understated — almost dull — and that’s the objective. Successful technologies don’t announce themselves; they integrate into our routines.

Instant payments that occur without noticeable references to blockchain. Identity systems that authenticate without requiring users to manage keys. Financial products that feel familiar while operating on entirely new mechanics. The less apparent the crypto infrastructure, the more powerful it becomes. This isn’t abandoning ethos; it’s the true realization of all decentralization’s promises.

Decentralization was never supposed to be a daily hassle for users. It was intended to be an invisible assurance — similar to encryption in messaging apps. Most individuals don’t contemplate cryptography when they message; they merely expect privacy. Crypto should strive for the same expectation.

UX is the genuine scalability dilemma

The industry frequently portrays scalability as a technical issue: throughput, latency, and costs. Yet, the most critical limitation on growth isn’t TPS; it’s usability. Wallets continue to come off as experimental. Onboarding feels unnecessarily complex. A single misclick can lead to irreversible loss. For novices, crypto isn’t empowering; it’s precarious. And that precariousness undermines trust.

Connect this to the psychological shifts humanity is experiencing: our attention span has declined to 8.5 seconds. We have become intolerant of complexity and subtlety. We favor simplicity (not we, but the neoliberal logic of mass consumption, of course). It’s predictable that widespread adoption calls for forgiving systems. Defaults that safeguard users. Recovery processes that don’t hinge on perfect conduct. Experiences that assume mistakes will occur, because they invariably do.

The destiny of web3 is linked to products that make participation feel secure, familiar, and reversible, even if the underlying system isn’t. Users shouldn’t need to comprehend self-custody to reap its benefits. They shouldn’t have to select chains to utilize applications. They shouldn’t need to worry about gas at all. When UX improves, retention increases. When retention increases, adoption accelerates.

Regulation isn’t the foe of adoption — ambiguity is

Another misconception hampering crypto is the belief that regulation hinders expansion. In truth, it’s uncertainty that does. Clear guidelines don’t deter users; they comfort them.

Most individuals aren’t awaiting permission to speculate; they’re seeking assurance that the platform they’re utilizing won’t vanish, malfunction, or retroactively become unlawful. Regulatory transparency doesn’t undermine decentralization; it offers the social trust layer that mass markets need.

We’re already witnessing this transition. As frameworks evolve and institutions engage, the narrative is shifting from “permissionless rebellion” to “trustworthy infrastructure.” That’s not a loss of essence; it signifies maturation. For crypto to connect with everyday users, it has to feel legitimate before it feels revolutionary. People embrace systems that exude stability, not system that come across as experimental.

Web3 doesn’t require more believers — it requires functional products

The industry often confuses cultural resonance with adoption. However, shared beliefs don’t cultivate habits. Products do. Individuals don’t use email because they have faith in open protocols. They utilize it because it works. They don’t turn to cloud storage due to their fondness for abstraction layers. They rely on it because their files are accessible when they need them.

Web3 will follow this same trajectory, or it will fail entirely. The principles of crypto — ownership, openness, and empowerment — are genuinely enticing. Yet, principles alone don’t onboard users. Experience does. If engaging in web3 continues to feel like joining a movement rather than using a product, widespread adoption will remain unattainable.

The ultimate success of crypto won’t be gauged by headlines, price benchmarks, or ideological supremacy. It will be assessed by invisibility. When users are unaware they’re utilizing crypto — but would miss it if it vanished — that constitutes success. When wallets operate like apps, not merely tools. When compliance embodies security, not friction. When decentralization functions quietly in the background, safeguarding users without demanding attention.

This forthcoming reality isn’t anti-crypto. It’s post-crypto. And it’s closer than it seems. The industry doesn’t require louder proclamations to win people’s loyalty. It must listen more intently — and then create systems so seamless that belief becomes inconsequential.

Silence, not spectacle, is the path for crypto to truly resonate with humanity.