The recent stagnation of Bitcoin within a narrow trading range might not be as closely tied to spot Bitcoin ETF flows as many headlines imply. Instead, it seems to be largely influenced by the derivatives market, which continues to take the lead, despite a recent decline in futures activity.

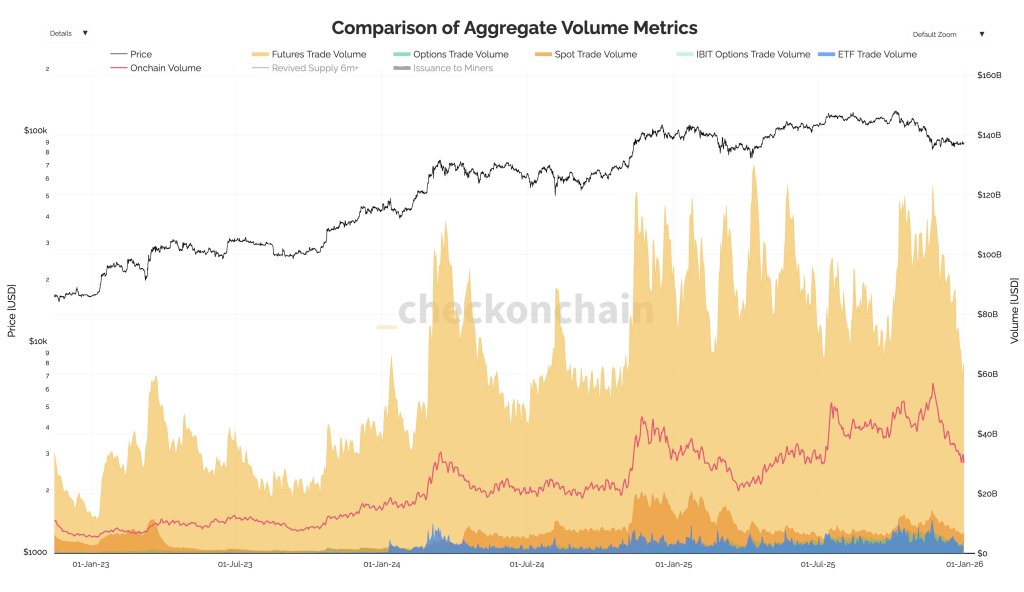

This is the central takeaway from CryptoQuant analyst Darkfost (@Darkfost_Coc), who pointed out that Bitcoin futures volumes have “plummeted since November 22,” halving from $123 billion to $63 billion in daily transactions.

Futures, Rather Than ETFs, Are Keeping Bitcoin Steady

The analyst noted that this slowdown “partly accounts for the low volatility seen in BTC lately.” However, the more crucial aspect is the scale of trading: with futures at $63 billion daily, they still dwarf spot Bitcoin ETFs, which only total $3.4 billion, and spot market volumes at $6 billion, as per his analysis.

Thus, even if ETF outflows are genuine and apparent, they might not be the primary force influencing market conditions. “Many analysts are still pointing towards ETFs, which have seen notable outflows recently,” Darkfost stated. “While these outflows add to selling pressure, futures trading clearly remains the leading factor in overall volumes.”

Related Reading

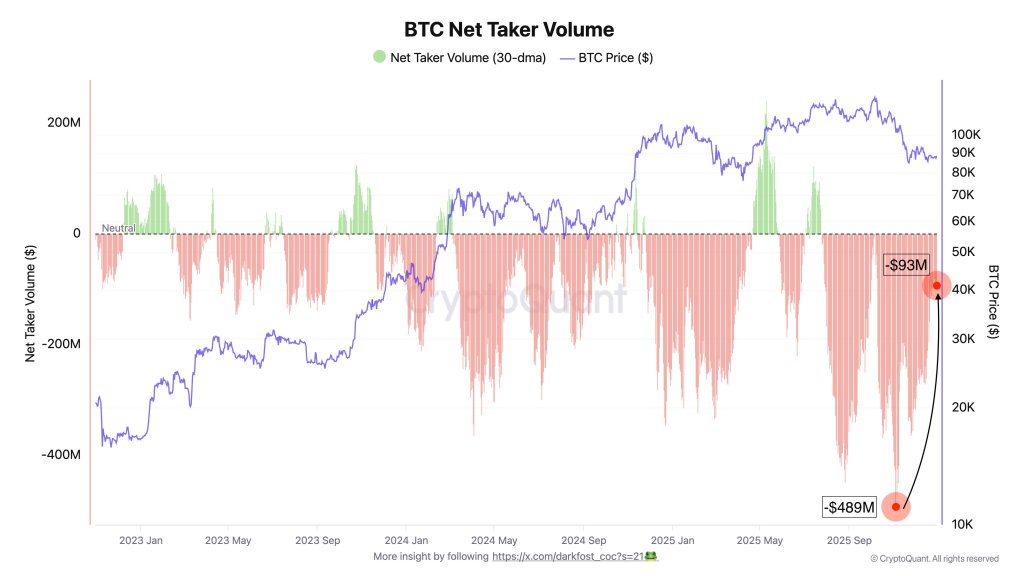

Darkfost highlighted net taker volume, a derivatives metric used to gauge aggressive buying or selling, as a clearer indication of the price struggles. He contextualized it based on past market behaviors: “Whenever net taker volume turns negative, Bitcoin typically enters a corrective phase. A shift to negative indicates a dominance of selling volume.”

Overall, he suggested that this negative trend has persisted for months. Since July, net taker volume has “generally been negative,” he asserted, marking one exception: “A significant slowdown happened in early October, allowing Bitcoin to reach a new all-time high, but selling pressure soon regained dominance. Presently, selling volumes continue to prevail, keeping Bitcoin confined within a range for the past month.”

However, there are signs of tentative improvement in the same dataset. Darkfost mentioned that futures-driven selling pressure has seen a decline since early November, with net taker volume adjusting from around -$489 million to -$93 million. He described this as “a positive signal,” yet not sufficient to alter the prevailing market conditions. “Liquidity remains subdued,” he noted, adding that ETF and spot volumes are “still inadequate to facilitate a breakout from the current consolidation phase.”

Demand Is Crucial

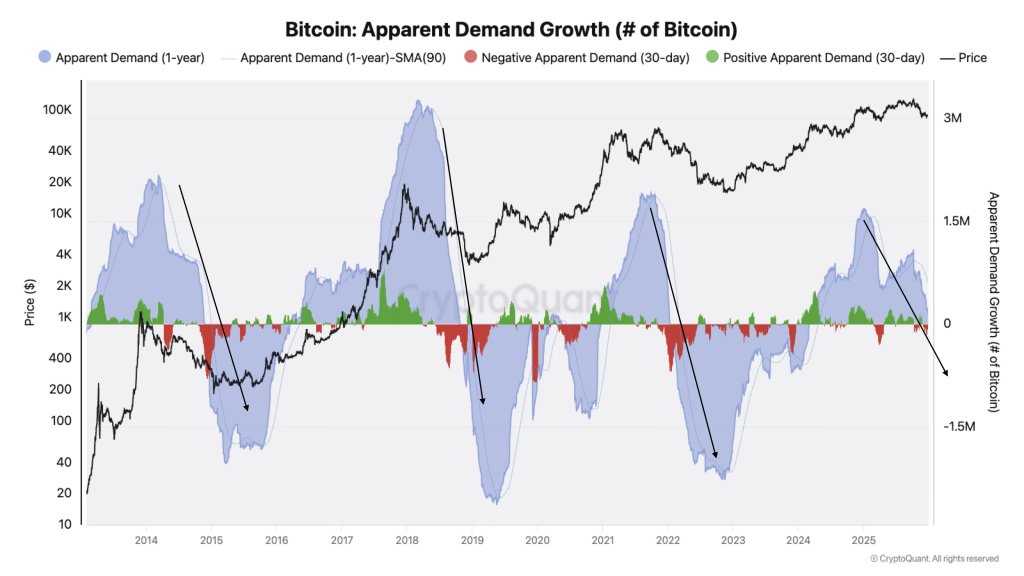

In another X post, CryptoQuant’s Head of Research, Julio Moreno, shared a broader perspective that shifts focus from cyclical price analysis to demand dynamics. “Many are concentrating on price movements to define a cycle, but what they should really be examining is demand,” Moreno remarked. “Bitcoin demand is decreasing monthly and showing significant slowing on an annual basis (nearing negative territory).”

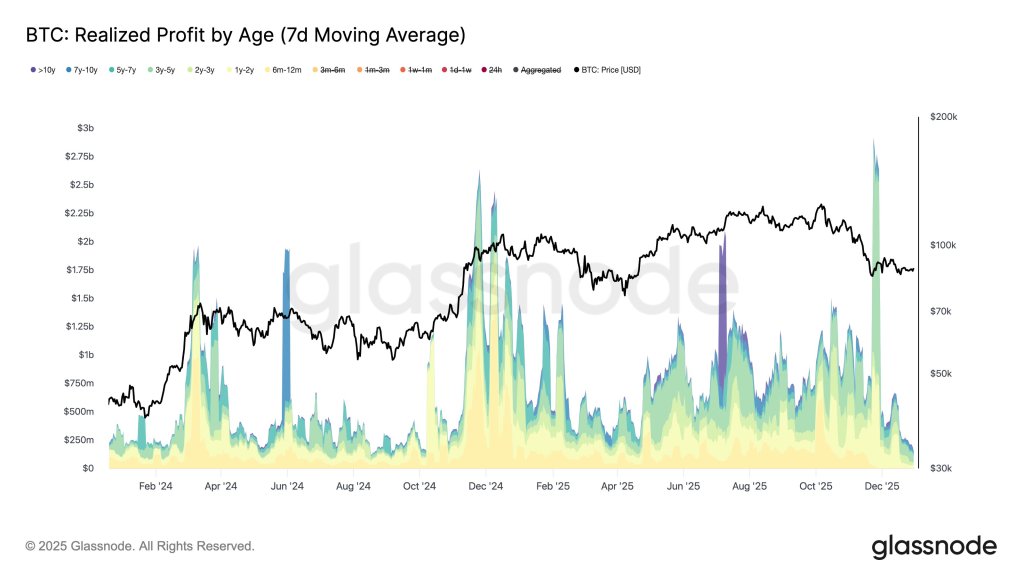

Aside from the impact of futures on Bitcoin’s stagnation, recent selling pressure from long-term holders (LTHs) has been identified as a key factor in Bitcoin’s underperformance compared to both the stock market and gold. As noted yesterday, numerous on-chain analysts indicated that long-term holder selling appears to have stabilized, with approximately 10,700 BTC transitioning into long-term held coins.

Related Reading

In a recent post, leading Glassnode analyst CryptoVizArt suggested that the recent shifts are more about the pace than the actual direction. “LTHs haven’t ceased their selling,” the analyst claimed, stating that LTHs “are still disposing of around ~7.3k BTC/day (7D SMA) while realizing profits of less than $200M/day. What has changed is not their behavior, but the rate. This is merely a cooldown following months of heavy distribution, not a transition to pure accumulation.”

While Darkfost acknowledged that LTHs may consistently sell, he highlighted a different perspective. “In reality, LTHs never truly stop selling, but analyzing supply changes offers a different narrative,” he indicated. “It seems their distribution has paused temporarily, meaning the BTC aging into long-term status equals the BTC sold by LTHs (with short-term holders buying).”

As of the latest data, BTC is priced at $87,972.

Featured image created with DALL.E, chart from TradingView.com