XRP is gradually entering one of the most significant structural phases in its history. Although price action has primarily been bearish, and sentiment within the broader crypto market remains cautious, on-chain data reveals a different narrative.

According to data from Glassnode, XRP balances on centralized exchanges have decreased to approximately 1.5 billion XRP, marking their lowest level in over a year. This trend coincides with accumulation from newly launched XRP ETFs, potentially setting the stage for changes in the altcoin’s price dynamics leading into 2026.

Related Reading

XRP Exchange Balances Decline To Multi-Year Lows

Data from Glassnode’s XRP balance on exchanges metric indicates a clear and ongoing downtrend in balances held on crypto exchanges throughout 2025. Earlier this year, around 4 billion XRP were held on centralized platforms.

Since then, these balances have consistently decreased, with a noticeable drop happening in the fourth quarter. Presently, exchange-held XRP has dwindled to approximately 1.5 billion, one of the lowest figures seen in recent years.

This reduction has taken place despite the current downturn in XRP’s price action, indicating that some holders are choosing to transfer tokens into long-term storage, even as others liquidate their positions. This trend is crucial for fostering bullish momentum, as declining exchange balances diminish near-term sell pressure, making cryptocurrencies more responsive to rising demand.

Central to this supply decrease are US-based Spot XRP ETFs, which have emerged as a significant source of demand. Market estimates suggest that approximately 750 million XRP have been absorbed by the six Spot ETF products since the first one launched in November.

As ETFs continue to withdraw XRP from exchanges, the pool of liquid supply available to the spot market keeps diminishing. This shift may not prompt an immediate price reaction, but it alters the balance between supply and demand, and we could begin to observe the effects in the crypto in 2026.

Related Reading

Weekly Chart Indicates Exhaustion As XRP Holds Support

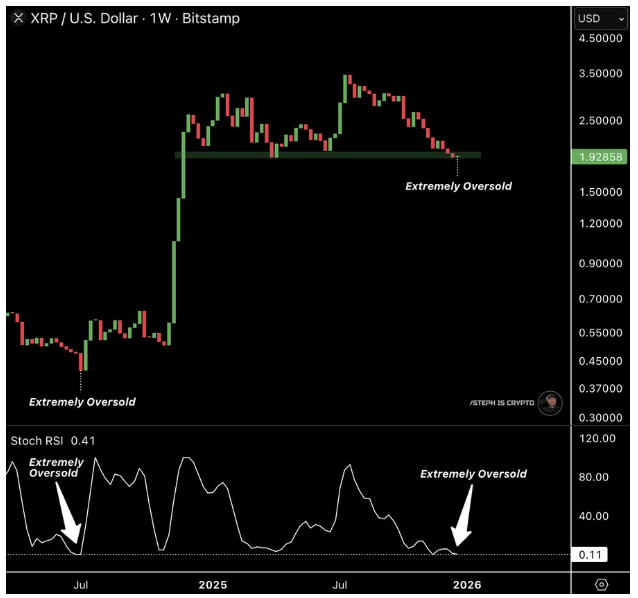

While on-chain data highlights a tightening supply, technical conditions are also starting to reflect a similar trend. Crypto analyst Steph Is Crypto recently noted that XRP is currently positioned on a critical horizontal support zone on the weekly timeframe.

The chart illustrates that XRP’s price action is now compressing into the $1.90 to $2.00 range following a prolonged decline from mid-2025 highs of around $3.50, bringing XRP back to a level that previously served as a launching point earlier in the cycle.

Additionally, the weekly Stochastic RSI is currently in extreme oversold territory, indicating that selling pressure has largely run its course.

Steph’s analysis indicated that turning points usually occur when downside momentum is exhausted and there is little energy left for sellers to continue driving prices lower. In light of this, traders might anticipate XRP shifting into bullish momentum in early 2026.

Featured image from Gemini, chart from TradingView