Sharplink co-CEO Joseph Chalom suggests that Ethereum may experience a significant increase in total value locked (TVL) next year if certain on-chain trends gain momentum.

Chalom has set an ambitious target: a 10X increase in TVL by 2026. This projection is linked to the growing use of stablecoins, the larger tokenization of real-world assets, and heightened interest from major financial institutions.

Related Reading

Stablecoin Activity On Ethereum

Current estimates place the total stablecoin market at around $308 billion, with projections suggesting it could reach $500 billion by the end of next year, marking an approximate 62% increase.

Approximately 54% of all stablecoin activity occurs on Ethereum, which is significant; increased stablecoin flows into Ethereum typically enhance the protocol’s TVL, as much of this capital resides in smart contracts for swaps, lending, and liquidity pools.

Sharplink Gaming currently holds 797,704 Ether, valued at roughly $2.30 billion at the time of this update, indicating that some public treasuries are already making substantial investments in the network.

Tokenized Assets Gain Traction

Chalom anticipates a rapid expansion in the tokenized real-world asset sector, predicting a $300 billion market for RWAs by 2026 and a tenfold increase in assets under management (AUM) next year as funds, stocks, and bonds are tokenized on-chain.

In 2026, I believe Ethereum’s Total Value Locked (TVL) will increase 10X. Why and how? 🧵

Views ≠ investment advice.

— Joseph Chalom (@joechalom) December 26, 2025

He highlights the growing interest from mainstream institutions like JPMorgan, Franklin Templeton, and BlackRock. Reports indicate that sovereign wealth funds might enhance their Ethereum holdings by five to ten times, potentially injecting substantial, patient capital into tokenization initiatives and protocol deposits.

Ethereum Price Action

On December 25, 2025, Ethereum was priced at approximately $2,921, giving the network a market capitalization of around $352 billion, with a 24-hour trading volume of about $11.47 billion.

Throughout 2025, ETH experienced a complete market cycle, starting the year near $3,298, reaching approximately $4,390 in August, and dropping back to the $2,921 range by year-end after failing to surpass its all-time high of $4,942.

The price fluctuated significantly, with annual volatility nearing 140%. Technical indicators show mixed momentum—while the weekly RSI sits at 41.7, indicating a neutral-to-bearish trend, the daily MACD histogram is at -0.15, maintaining a negative outlook. Price action remains confined within a narrow range between $2,774 and $3,038.

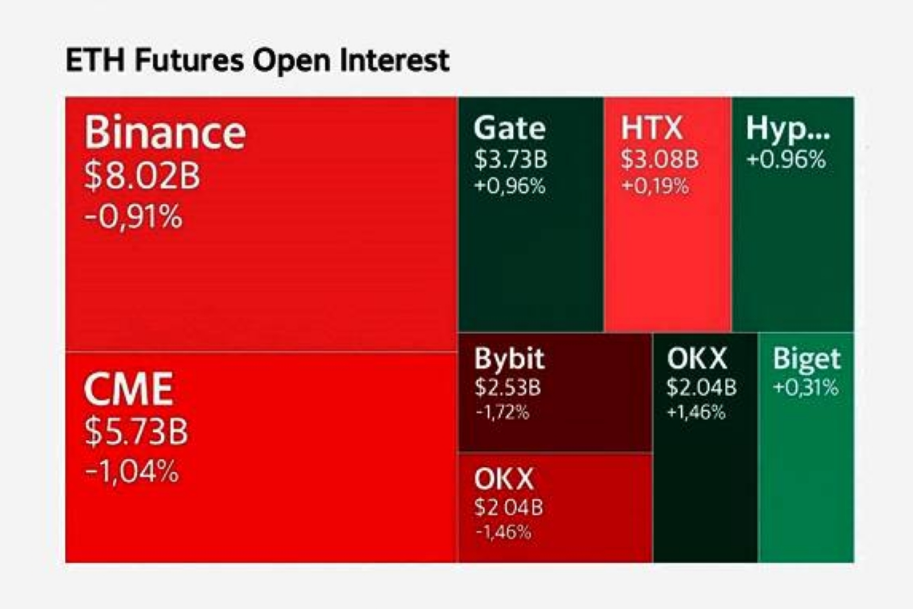

Futures data further supports a cautious sentiment. Total open interest is approximately $37 billion, showing a 0.62% decline over the past 24 hours, indicating reduced trader engagement. Liquidation data reveals that over $100 million in long positions could be triggered to liquidate between $2,880 and $2,910, a critical pressure point.

Related Reading

Market Signals And Risks

Opinions differ on whether token flows will result in immediate price increases. Crypto analyst Benjamin Cowen believes Ethereum is unlikely to achieve new highs next year given the current Bitcoin market conditions.

This skepticism aligns with technical analysis suggesting range-bound trading and a slight decline in open interest. The liquidation cluster around $2,880–$2,910 indicates a zone where leveraged positions may be liquidated, which could lead to quick price movements driven more by market stress than by fundamentals.

Featured image from Gemini, chart from TradingView