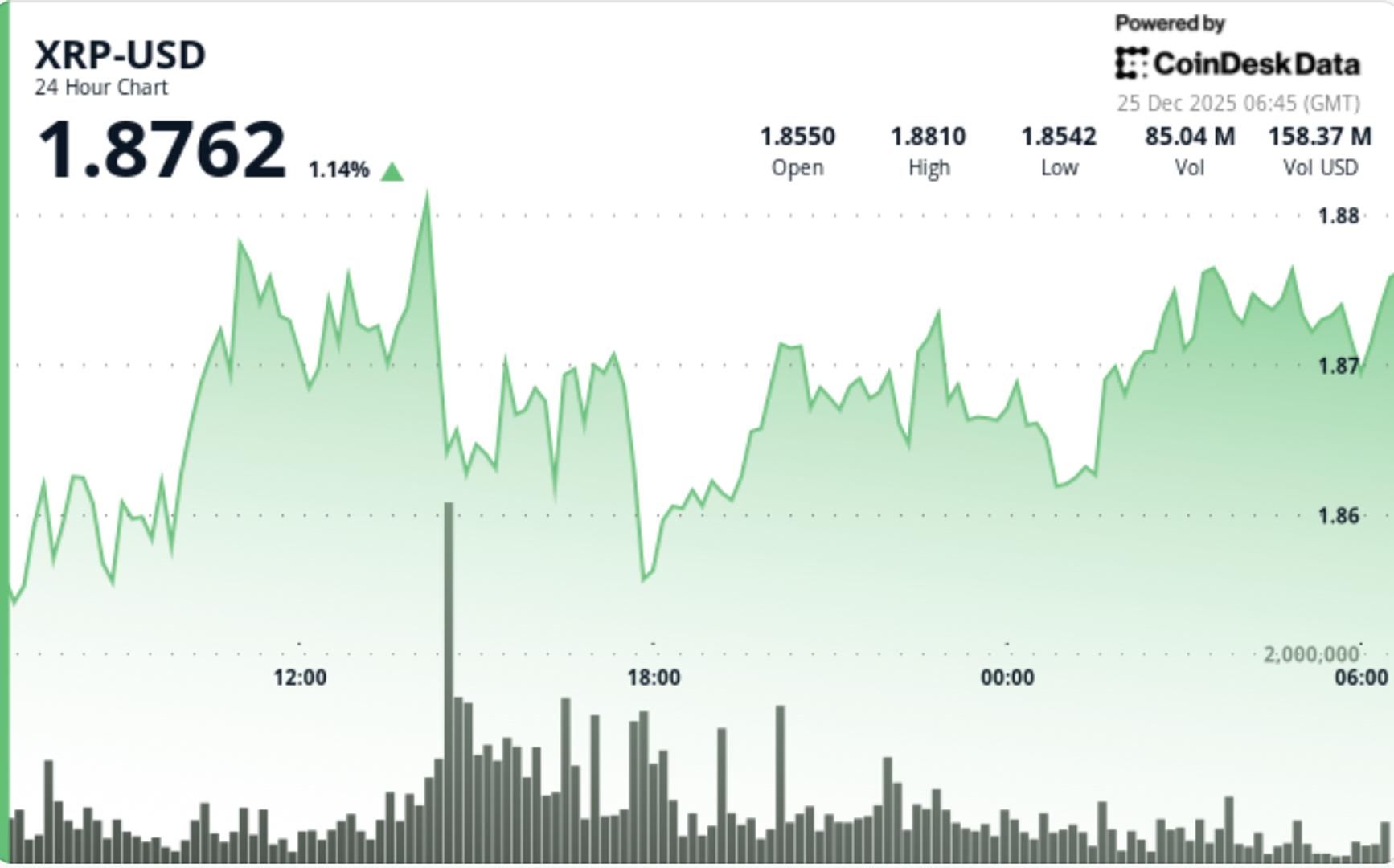

XRP declined to $1.86 as traders persisted in selling during rallies, despite steady spot ETF demand and total ETF-held assets rising to $1.25 billion, indicating the market is still adjusting to supply at significant technical levels.

News background

The desire for XRP exposure among institutional investors has consistently increased through exchange-traded funds, with an addition of $8.19 million in recent sessions. This raised total ETF-held net assets to $1.25 billion, reinforcing the notion that professional investors are accumulating positions via regulated vehicles rather than pursuing spot momentum.

This flow trend aligns with a broader pattern in institutional crypto allocation: portfolio managers are leaning toward structured products that alleviate custody and compliance issues, particularly as liquidity strengthens and regulatory clarity improves. XRP’s availability across platforms and the steady ETF appetite has maintained longer-term demand, even as short-term price movements remain volatile.

In the broader market, bitcoin’s attempted rebound during U.S. hours did not sustain itself, leaving major cryptocurrencies trapped in a risk-off, range-bound market where flows matter, but technical levels still govern daily trading.

Technical analysis

XRP fell from $1.88 to $1.86, remaining within a $1.85–$1.91 range as sellers consistently defended the $1.9060–$1.9100 resistance level. Trading volume increased significantly during the session’s peak activity period, with 75.3 million exchanged—approximately 76% above average—during the rejection, highlighting that this isn’t a low-liquidity situation. It’s a market encountering real offers overhead.

The price briefly broke out of its $1.854–$1.858 consolidation area and reached $1.862 during a surge of activity that spiked roughly 8–9 times the average intraday flow. However, this move lacked durability, and XRP reverted to $1.86 as supply resurfaced.

The ongoing defense of the $1.90+ level indicates sellers are utilizing this zone to distribute into strength. Simultaneously, consistent bids around $1.86–$1.87 have emerged frequently enough to prevent market unraveling — establishing a tightening coil that suggests the next break may be significant.

Price action summary

- XRP declined from $1.8783 to $1.8604, remaining confined in a $1.85–$1.91 range

- The most substantial selling response occurred near $1.9061 resistance with above-average volume

- Bulls maintained the $1.86 level during multiple retests, limiting downside momentum

- A brief surge above the prior consolidation pocket did not evolve into a sustained increase

What traders should know

The levels are clear:

- If $1.87 remains intact and XRP can reclaim between $1.875–$1.88, the next challenge will be the significant supply cluster at $1.90–$1.91. A close above this would likely trigger short-covering and drive the price toward $1.95–$2.00.

- If $1.86 fails, the market may decline to the next demand area around $1.77–$1.80, where past buyers have historically defended, and where sentiments of “fear” generally peak.

For now, the market reflects a state of consolidation with distribution above — but with ETF flows acting as a stabilizing force that could make downside movements more gradual rather than sharp unless bitcoin experiences a significant decline again.