This week, the Bitcoin price has been fluctuating as investors await the Bank of Japan’s interest rate announcement set for Dec. 19.

Summary

- The Bitcoin price has retraced this week as traders anticipate the BoJ interest rate decision.

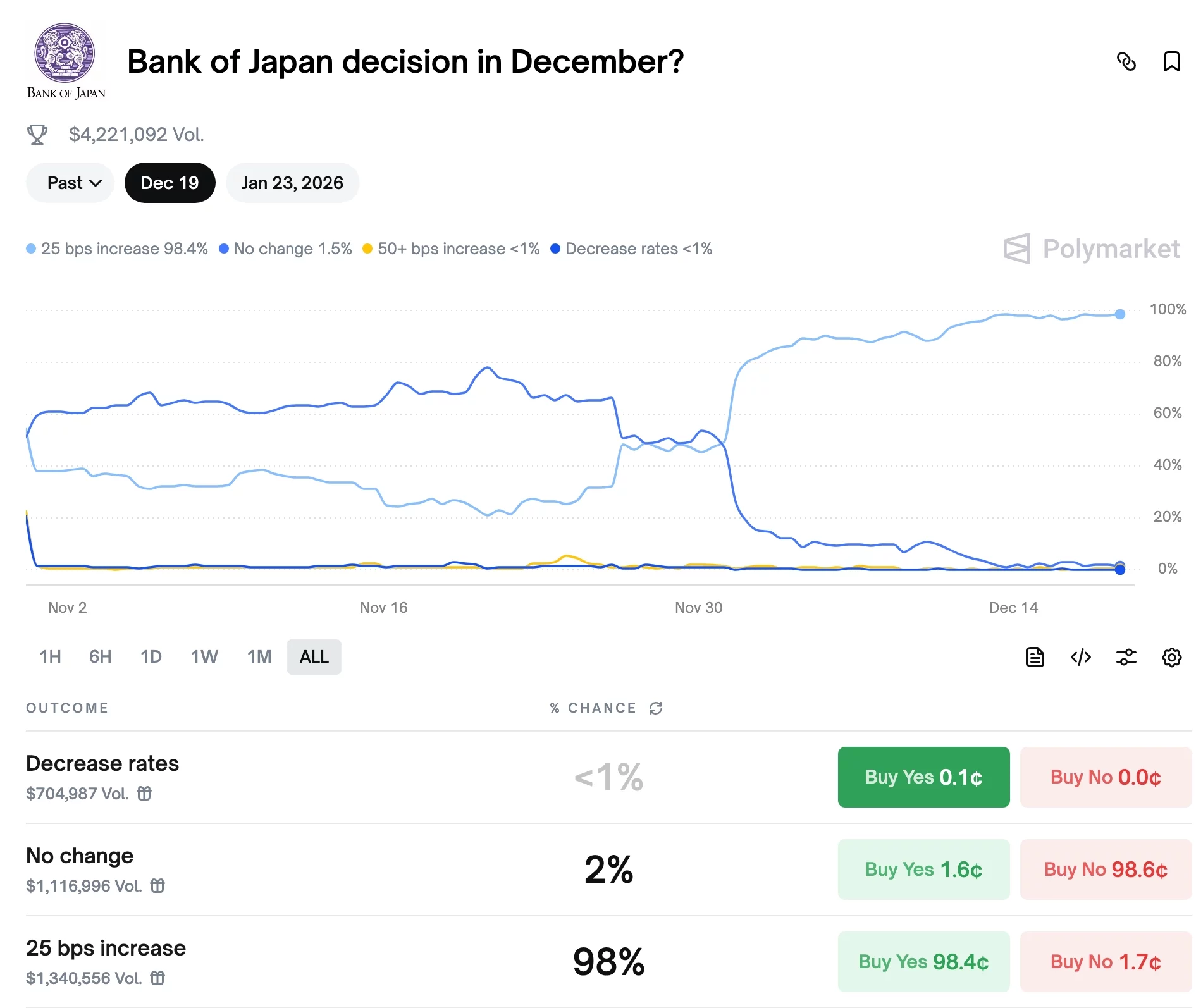

- Polymarket now shows a 99% chance of a rate cut.

- A bearish flag pattern has emerged on the Bitcoin daily chart.

At the time of writing, Bitcoin (BTC) was trading at $87,700, reflecting a drop of approximately 7.47% from its peak this month and 30% below its all-time high.

Increasing odds of a BoJ interest rate hike

Recently, Bitcoin, altcoins, and the stock market have shown a pullback as expectations for a BoJ rate hike rise. Polymarket assigns a 98% probability to this possibility.

A rate hike from the BoJ carries significant weight due to its status as one of the largest central banks in the world, holding over $4.48 trillion in assets and being the largest holder of US government bonds.

The risk posed by a BoJ rate hike amid Fed rate cuts could lead investors to unwind their carry trades. A carry trade involves borrowing from a low-interest-rate currency to invest in higher-yielding assets.

Japan has historically been a major player in carry trades, maintaining low interest rates over decades. As the yield spread between U.S. and Japanese bonds narrows, investors might begin to offload the riskier assets they’ve acquired.

However, a BoJ rate hike might not negatively impact Bitcoin. With a 99% probability already factored in, market participants may start buying the news, allowing the coin to recover as it adapts to the changing landscape.

Technical analysis of Bitcoin price

The daily chart indicates that the immediate trend for Bitcoin appears to be bearish. It is gradually forming a bearish flag pattern, having completed the inverted flagpole and now entering the flag section.

Bitcoin continues to remain under the Supertrend indicator and the 100-day Exponential Moving Average, while approaching the 78.6% Fibonacci Retracement level.

This situation raises the possibility that Bitcoin could decline further and test its year-to-date low of $74,423, roughly 15% lower than the current pricing.

Although the prevailing outlook for Bitcoin leans bearish, a potential rebound might occur, testing the upper edge of the flag at $94,500 before resuming the downward trend.