By 2025, gold has established itself as the leading asset, achieving returns exceeding 50%, marking one of its most impressive performances in over ten years. The precious metal became the clear frontrunner in what analysts referred to as the “debasement trade,” a term that resonated with growing investor concerns around global debt levels, rampant borrowing, and a weakening U.S. dollar, which recorded its worst performance in years. By October, gold’s surge hit record levels, nearly reaching $4,400 an ounce, and has since settled around the $4,000-per-ounce mark.

This feature is part of CoinDesk’s Most Influential 2025 list.

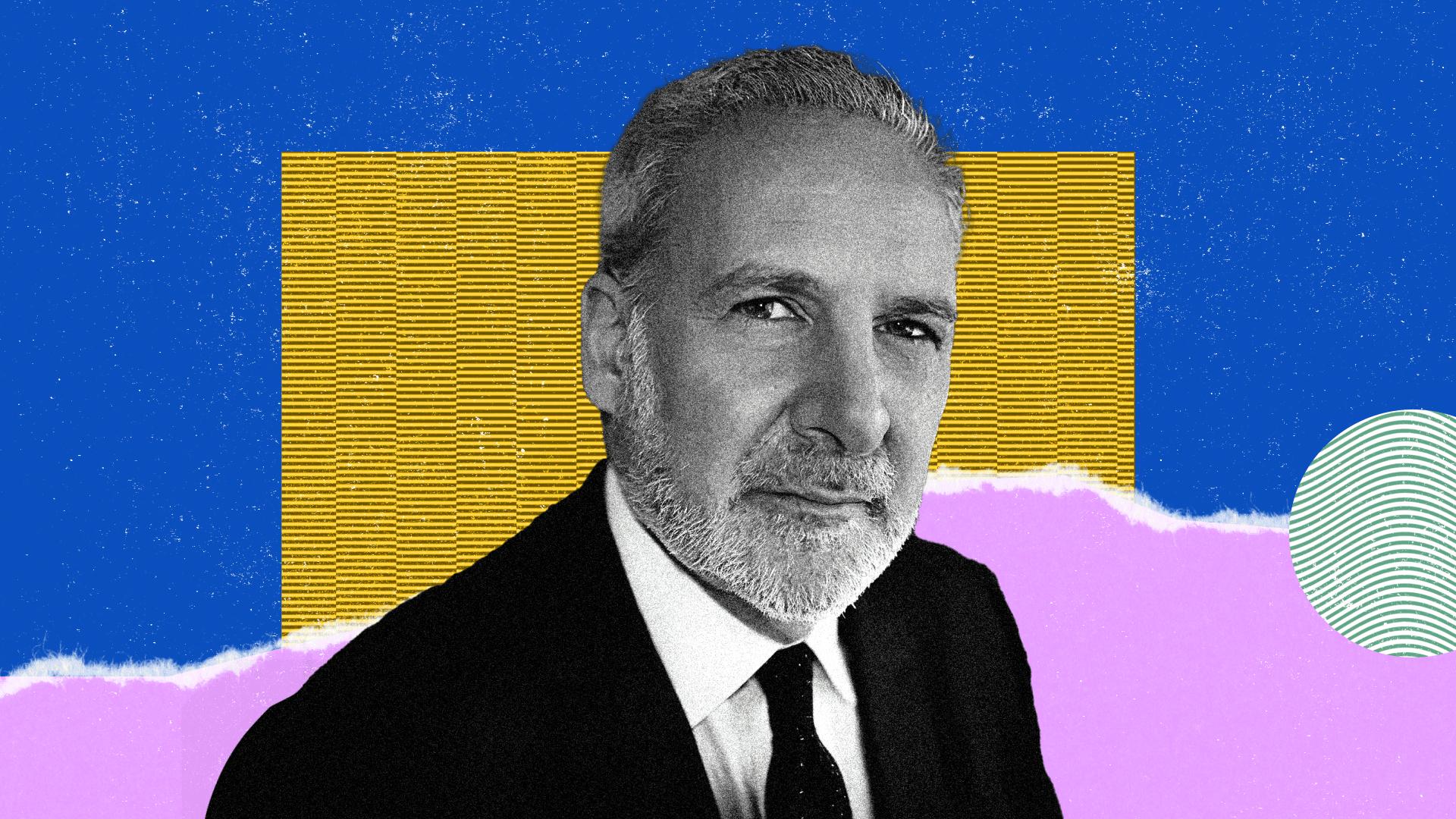

This context has affirmed long-held warnings about monetary debasement, a sentiment frequently echoed by the Bitcoin community. However, it was ironically gold—not Bitcoin—that attracted investor focus and funds this year. Gold has thus far outperformed Bitcoin by a factor of eight in returns for 2025. Peter Schiff, a prominent advocate for gold and a noted critic of Bitcoin, has found validation in the market’s outcome, reinforcing his position after years of skepticism regarding digital assets.

While Schiff continues to advocate for gold as the supreme store of value, the overall market narrative has progressed, balancing traditional safe havens against digital alternatives.