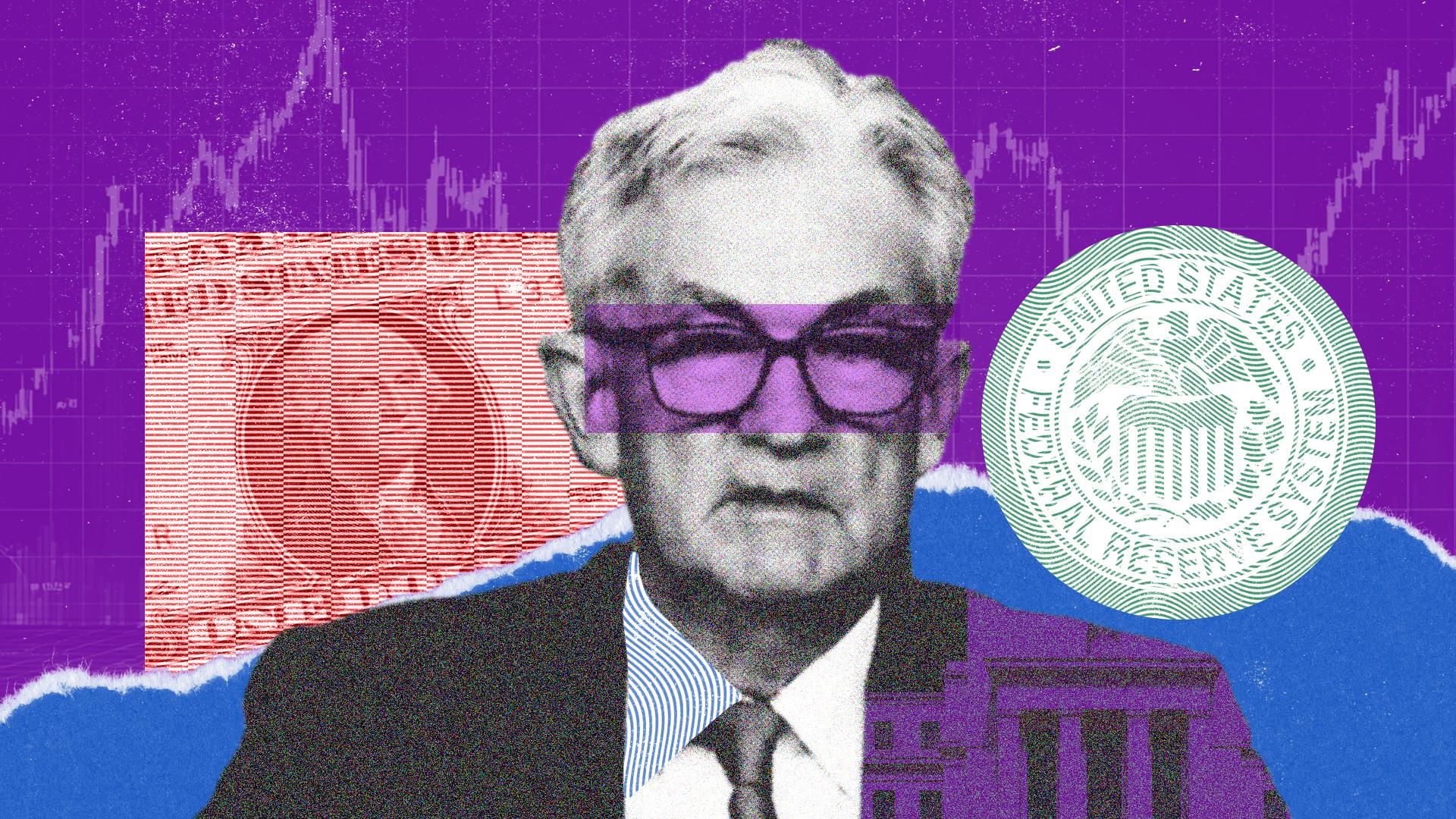

When Jerome Powell’s term as chairman of the Board of Governors of the Federal Reserve System concludes in May 2026, he will have held this position through segments of three presidential administrations: Trump I, Biden, and Trump II.

This feature is part of CoinDesk’s Most Influential 2025 list.

Powell is likely to be primarily noted for his confrontations with U.S. President Donald Trump, the very individual who appointed him as chair in early 2018 (he was later re-nominated for a four-year term by President Biden in 2022). However, his more enduring legacy may well be his response to the 2020 COVID-19 crisis. The extensive liquidity injection into the financial system may or may not have alleviated the public’s suffering during the lockdowns, but it undeniably sparked one of the most significant rallies in financial assets (including crypto) while also laying the groundwork for the first major inflation wave in the U.S. since the 1970s.

As we approach the end of 2025, this inflation—though significantly reduced from its alarming levels in 2022, when it hovered near double digits for much of the year—remains a critical challenge for monetary policy.

Indeed, the Fed’s final policy meeting of the year, scheduled for December 9-10, is expected to stand out as one of the most contentious in the central bank’s history. Typically, indications of economic slowdown, as reflected in recent weak employment and manufacturing reports, would prompt the Fed to swiftly and unanimously ease monetary policy by lowering the benchmark fed funds rate.

Yet, inflation continues to stubbornly exceed the Fed’s 2% target. In the weeks leading up to the meeting, several Fed policymakers openly expressed their differing views not just on any potential easing in December, but even regarding the rate cut in October.

Debate is acceptable, but the Federal Reserve has long maintained a collegial atmosphere, with dissenting opinions so rare that even a single member voting differently on a policy decision often makes news. Powell’s recent decision to reduce rates by another 25 basis points last week met with three dissenting votes—two from members who preferred to keep policy unchanged and one who advocated for a 50 basis point cut.

Crypto and the Fed — rallies and reversals

The connection between Fed policy and cryptocurrency markets is well-known: generally, the prices of speculative assets like crypto thrive when monetary policy is loosened and tend to suffer when it tightens.

This was definitely noticeable in 2020, as Powell’s aggressive action in response to the COVID-19 pandemic propelled bitcoin from approximately $3,000 to $65,000 in just over a year.

The same dynamics were evident in 2022, when bitcoin plummeted to $15,000 towards the year’s end as Powell’s Fed began to recognize the seriousness of inflation, repeatedly raising its benchmark interest rate from 0.00% in January to 4% by December (eventually peaking at 5.25% in mid-2023).

This year, bitcoin surged to a record high over $125,000 following two rate cuts from the Fed. However, its recent downturn began right after the Fed’s meeting on October 28-29, during which Chair Powell indicated that market expectations for further easing were overly optimistic.

The market’s reaction was immediate, with bitcoin dropping from over $113,000 to $107,000 the following day, and to $80,000 three weeks later. A slight recovery has occurred since then, especially following the December rate cut. Nevertheless, market expectations for additional easing in January have significantly diminished.

Looking ahead

Powell’s tenure as Fed chair will end in May 2026, and President Trump has explicitly stated that he does not plan to re-nominate him. Recent reports from the White House suggest that Trump may announce Powell’s successor before the New Year.

This decision would effectively establish a shadow Fed chair for Powell to navigate in the final months of his term.

While Powell’s term as Fed chair will conclude next spring, he could, if he chooses, remain a member of the Board of Governors, as his fourteen-year term on that board will not finish until 2028.