Last month’s $500 million share sale by Ripple attracted major players in global finance, but only after investors insisted on a range of downside protections resembling those found in structured credit rather than a standard venture capital round, as reported by Bloomberg.

Participants in the funding round, which valued Ripple at $40 billion—the highest for any privately held crypto company—include Citadel Securities, Fortress Investment Group, Marshall Wace, Brevan Howard-affiliated vehicles, Galaxy Digital, and Pantera Capital.

Bloomberg’s Ryan Weeks notes that several funds perceived this as a concentrated bet on a single volatile asset.

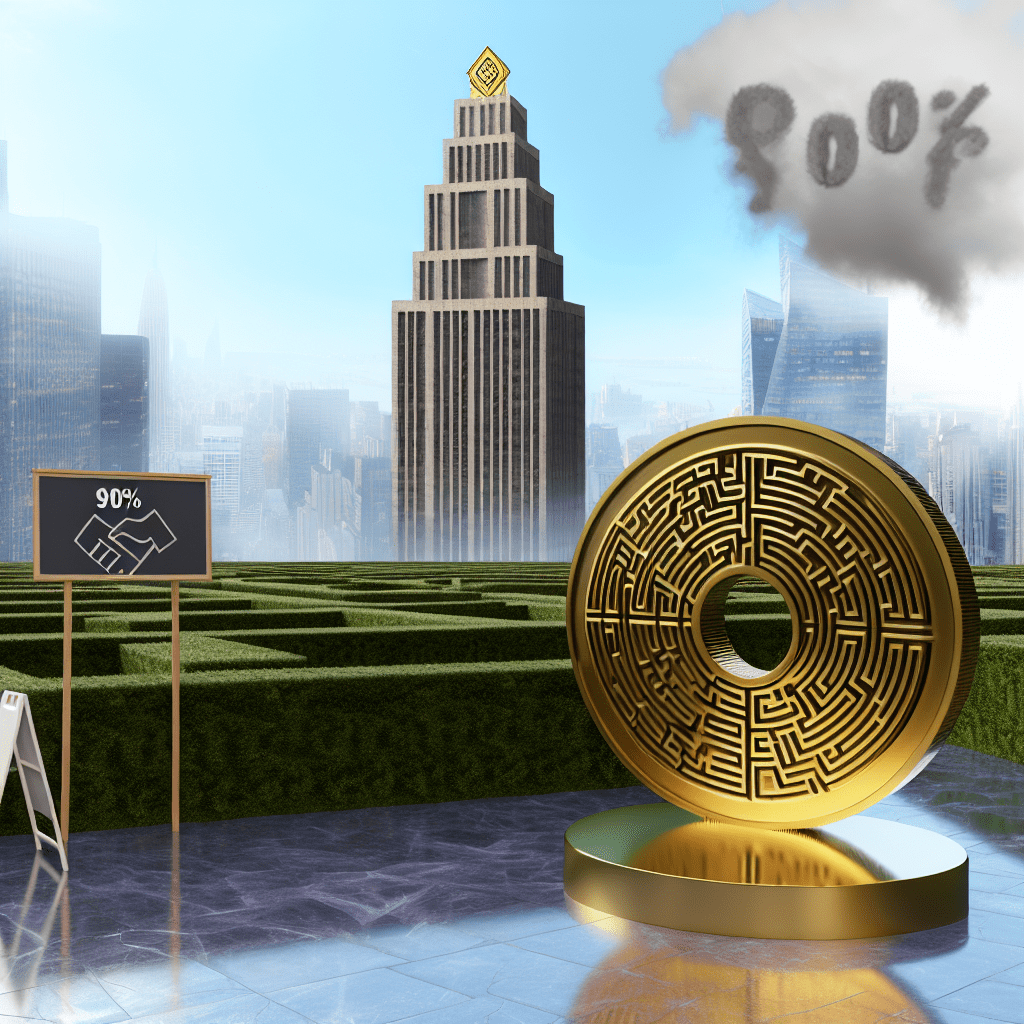

Investors established that more than 90% of Ripple’s net asset value was linked to XRP, the token that is legally separate from the company. In July, Ripple held $124 billion worth of XRP in its treasury at market prices.

While institutions seem to accept this exposure, they are only willing to do so with adequate safeguards in place. This significant and risky exposure led funds to negotiate strong protections: 1. The right to sell shares back to Ripple after three or four years at a guaranteed 10% annualized return, 2. A 25% annualized return if Ripple initiates a buyback, and 3. A liquidation preference that gives them priority over legacy shareholders in the event of a sale or insolvency.

These terms create a synthetic floor for investors’ capital, establishing a structure rarely seen in late-stage tech financing yet increasingly adopted as traditional finance adjusts its risk-management strategies to address crypto’s volatility.

XRP has since dropped about 40% from its peak in mid-July, affected by the broader downturn in the crypto market in October and November.

Meanwhile, U.S. spot XRP ETFs are nearing $1 billion in inflows, following a 15-day period of net investments. The ETFs have likely gained from the resolution of Ripple’s lawsuit with the SEC, which clarified XRP’s regulatory standing.

Mails sent to Ripple’s press inquiry page and media representatives have not yet received a response during U.S. morning hours on Monday.