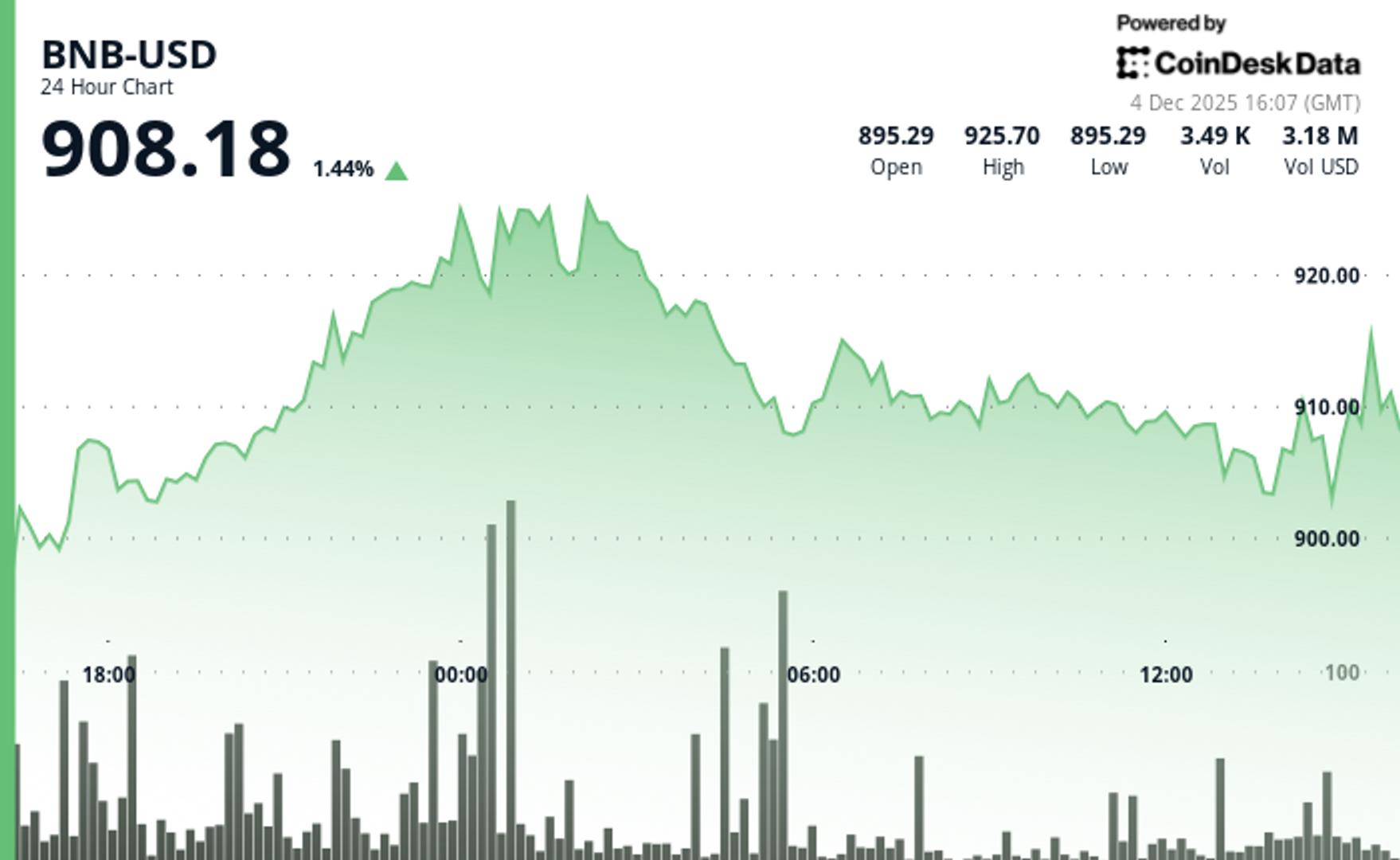

BNB increased to $908 in the last 24 hours, marking a 1.44% rise, as a surge in trading activity indicates that significant investors might be accumulating the token during this consolidation phase.

Trading volume surged 68% above the usual levels, reaching a peak of 86,436 tokens traded in just one hour, as BNB tested a crucial resistance range between $920 and $928, based on technical analysis data from CoinDesk Research.

The token slightly retraced to $903 but remained above its recent lows around $896, establishing a sideways trading pattern that often shows buyers are preparing for a larger price movement.

This uptrend coincides with a broader market recovery in cryptocurrencies, with major assets like Bitcoin and Ether recording gains between 0.5% and 3.5%, following favorable signals from traditional finance. This includes expectations of a more accommodative monetary policy, as markets now anticipate that the Federal Reserve will likely cut interest rates this month.

BNB’s activity aligns with ongoing developments within the BNB Chain, such as heightened on-chain volume and the introduction of new tools like predict.fun, a prediction market application linked to the Binance ecosystem.

Despite recent price fluctuations, these projects aim to enhance the chain’s utility, drawing both speculative and long-term interest.

Traders are now closely monitoring the $920-$928 range. A breakout above this zone could propel BNB toward $940 or even $1,000, while a fall below $903 might test support near $896.

Disclaimer: Parts of this article were generated with assistance from AI tools and reviewed by our editorial team to ensure accuracy and compliance with our standards. For further details, refer to CoinDesk’s complete AI Policy.