XRP has continued its upward trajectory, successfully breaching the $2.197 resistance level, which indicates a revival of bullish momentum as institutional buying interest becomes evident at crucial levels.

- The overall cryptocurrency sentiment has improved, thanks to BlackRock reaffirming its commitment to real-world asset tokenization.

- Firelight, an emerging DeFi project, enables XRP holders to stake their tokens and earn rewards while offering on-chain protections against hacks.

- Developed by Sentora and supported by Flare Network, Firelight introduces a capital-efficient protection mechanism designed to bolster DeFi’s resilience.

- The protocol leverages Flare’s FAssets system, integrating XRP into DeFi and presenting a novel yield-earning prospect for XRP holders. Technical Analysis

- This accomplishment allows FSRA-licensed entities to utilize RLUSD for regulatory activities, enhancing its footprint in the Middle East.

- RLUSD’s endorsement in ADGM underscores its status as a stablecoin with definite reserve regulations, making it attractive to banks and payment entities in the region.

Technical Analysis

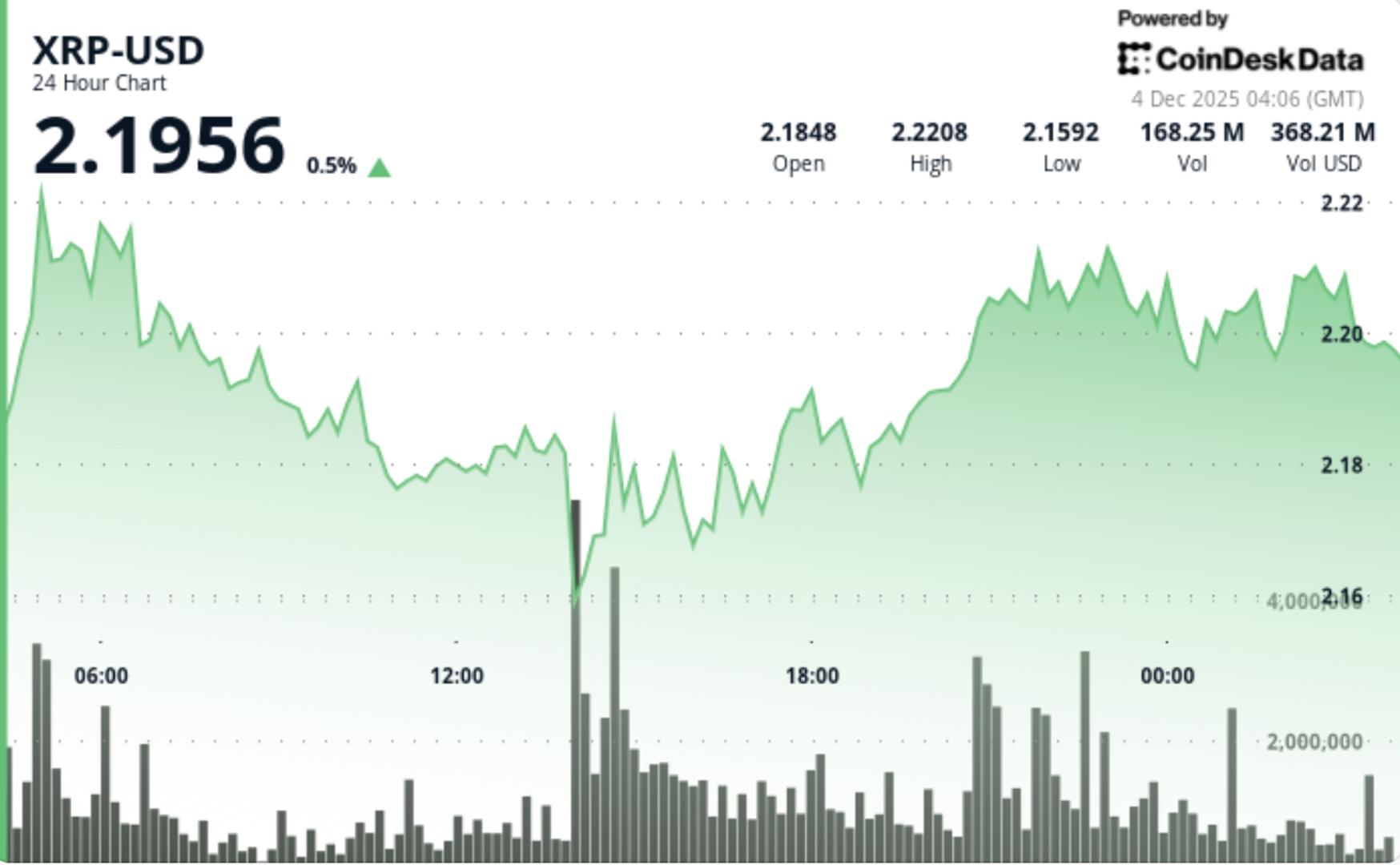

- XRP’s ascent past $2.197 signifies a definitive break from the micro-range that had contained price movements for the majority of the previous session.

- Consistent defenses of the $2.17 channel floor reflect ongoing demand absorption at lower price levels. This activity coincided with elevated funding rates, which surged over 120% in the last 24 hours. While this denotes increasing bullish conviction, it also highlights a rising leverage risk if the price fails to progress.

- The overall structure is solid: an inside-day breakout setup, rising channel support stemming from November lows, and a developing Power-of-3 progression indicating accumulation, manipulation, and expansion. XRP is currently positioned in the transition area between the second and third phases.

XRP fluctuated between $2.19 and $2.20 throughout most of the session until a brief liquidity sweep dropped the price to $2.15 during the day’s highest volume event. Buyers promptly absorbed this dip, pushing the token back above $2.17 and sustaining higher lows during each subsequent retest.

The breakout above $2.197 triggered a substantial move to $2.206, with hourly trading volume increasing from 450K to 553K. The price stabilized above $2.204 as the session ended, with $2.22 emerging as the next resistance to overcome.

Intraday momentum remains positive, though further upside continuation hinges on maintaining structure above $2.204 and steering clear of deeper tests around $2.17.

• The $2.204 micro-support is now the immediate pivot — maintaining above it keeps the breakout intact

• A move above $2.22 opens direct progression toward the $2.33–$2.40 resistance zone

• A rejection at $2.22 combined with rising funding rates heightens the risk of a leverage flush

• Falling below $2.17 would redirect attention back to the significant $2.00 psychological level

• Volume confirmation is crucial — consistent prints above 600K/hour would back another expansion phase