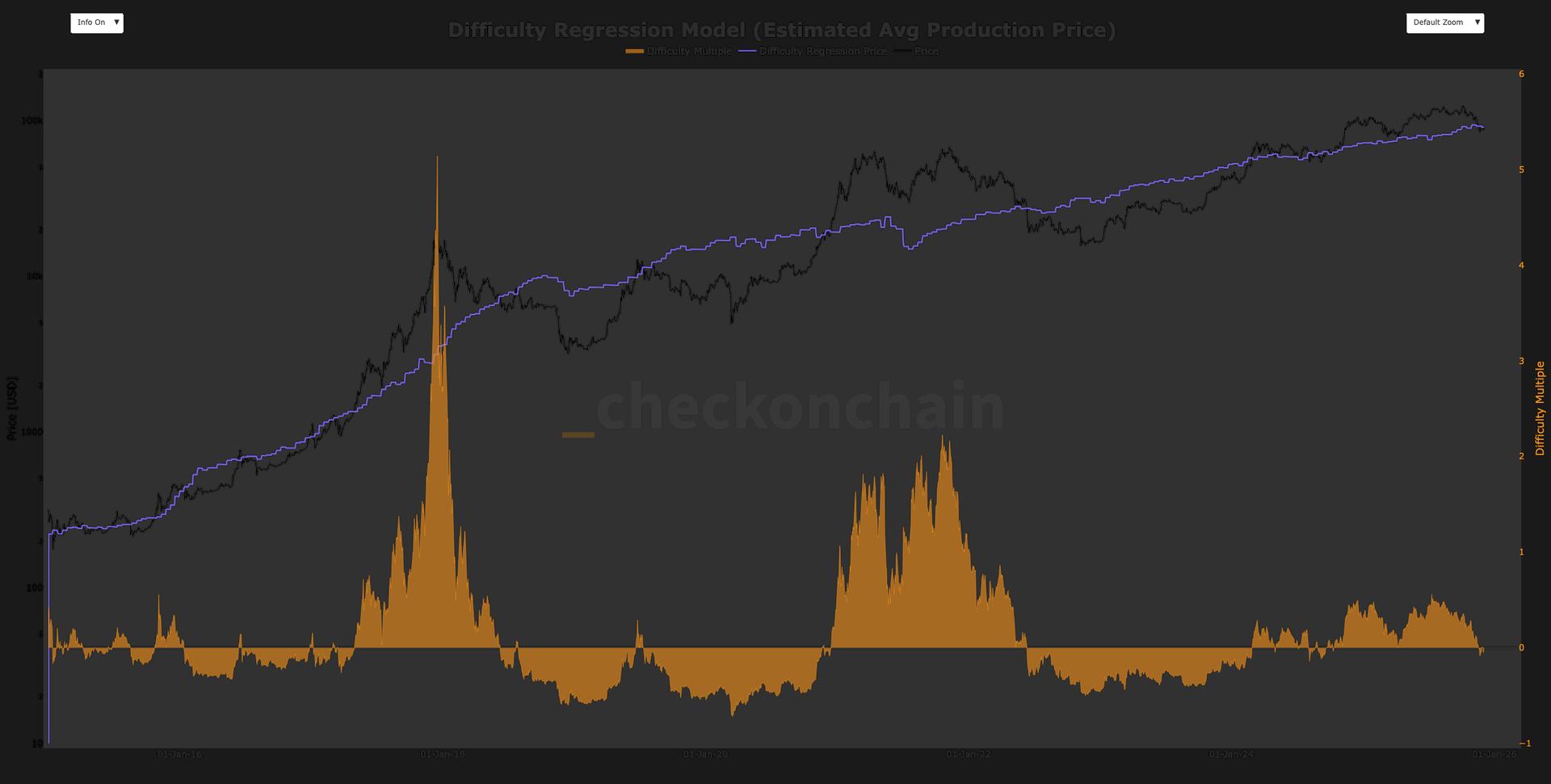

Bitcoin remains closely aligned with the Difficulty Regression Model, as indicated by checkonchain.

This model evaluates the all-in sustaining production cost for the network, using mining difficulty as a key measure of price by encompassing all significant operational factors into one metric. This provides an industry-wide estimate of the average expense required to generate a single bitcoin without needing extensive details regarding hardware, energy costs, or logistics.

The current model estimate is around $92,300, closely reflecting the spot bitcoin price. It was briefly disrupted when bitcoin dipped to approximately $80,000, but it has since bounced back to align with the model’s valuation.

Bitcoin’s price tends to maintain a bullish trend when it trades above the model and often transitions into a bearish market when trading below it.

In April 2025, bitcoin fell to nearly $76,000 and rebounded right at the model value, serving as a critical support level. During much of 2025, it traded at a premium of about 50% over the model, while throughout 2024, its price remained close to the model.

During the bear market of 2022, bitcoin traded at a discount of up to 50% under the model. In contrast, earlier bull markets saw the price significantly exceed the model, with bitcoin’s price doubling it at the peak in 2021 and quintupling it in 2017.

As bitcoin matures as an asset, such high premiums seem to be behind us.

Overall, the model implies that bitcoin is presently valued close to its production cost, which may be interpreted as a fair value range. Valuations based on Metcalfe’s law also suggest that bitcoin is near fair value around $90,000, further supporting this conclusion.