XRP surged past the significant $2.10 resistance level, driven by a powerful increase in trading volume, marking its most notable breakout in recent weeks as a convergence of technical and on-chain factors favored the bulls.

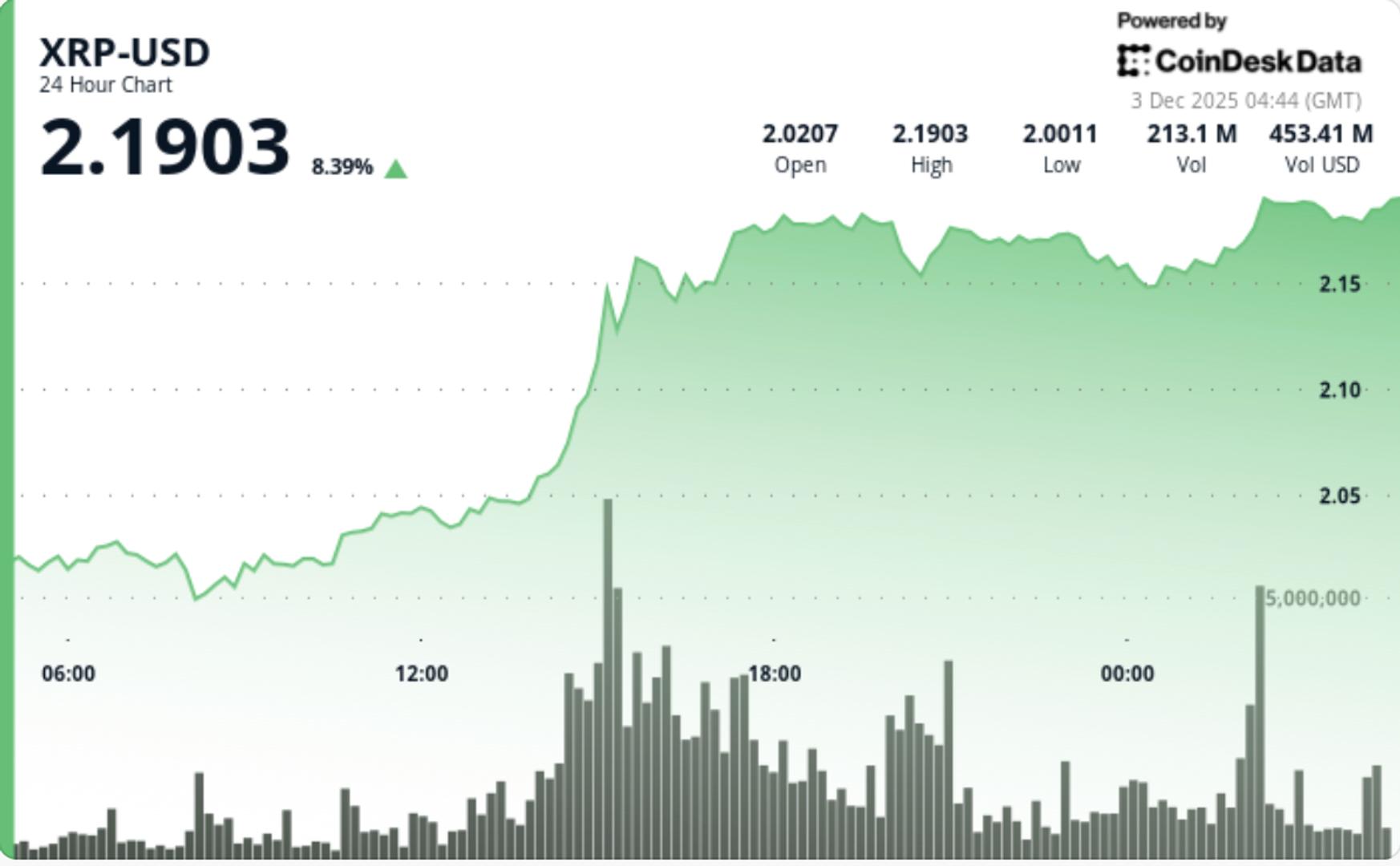

• XRP rose from $2.03 to $2.17 as buyers overwhelmed sellers at critical resistance points

• Volume spiked by 182% above the average during the breakout period at 15:00 GMT

• XRP Ledger network activity hit multi-year highs, with over 40,000 Account Set operations

• AMM-related activity increased as regulatory clarity encouraged developer and liquidity growth

• Institutional buying was evident through consecutive high-volume bursts exceeding 1M units

The breakout above $2.10 confirms the closure of a multi-day compression pattern that formed around the $2.00 support level. The volume increase—more than twice the 24-hour average—validates this movement and indicates substantial institutional involvement rather than mere retail speculation.

The rally established a distinct ascending pattern with consecutive higher lows at $2.00, $2.04, and $2.155. This upward trend reinforces the ascending triangle formation that has been developing for over six months. XRP is now approaching the upper boundary of this structure with an increasing likelihood of continuation.

Momentum indicators are turning bullish in ways unseen since major historical rallies. The weekly Stochastic RSI has crossed upward from the oversold area—a pattern mirrored before XRP’s 600% breakout in 2024 and its 130% rally in mid-2025. Coupled with rising network activity and record AMM engagement, the technical setup suggests growing bullish momentum rather than a brief surge.

XRP fluctuated within a $0.14 range, beginning the session at $2.03 before soaring to $2.17. The breakout occurred at 15:00 GMT during a 200.5M volume surge—by far the day’s highest trading activity. After surpassing $2.10, the token reached new highs at $2.181 during the 02:12–02:13 timeframe, backed by several volume spikes over 3M. A consolidation band formed between $2.155 and $2.180 as late-session trading indicated continued accumulation rather than distribution.

• $2.17–$2.18 is now the initial resistance; breaking through it paves the way to $2.33–$2.40

• $2.00–$1.98 continues to serve as the structural support zone and the invalidation level for the breakout

• Sustained volume above 1M per hour indicates genuine accumulation and lowers the chances of pullback traps

• The ascending triangle remains active with multi-month breakout implications

• The bullish cross on the Stochastic RSI combined with increasing network activity provides the strongest confluence since early 2024 rallies