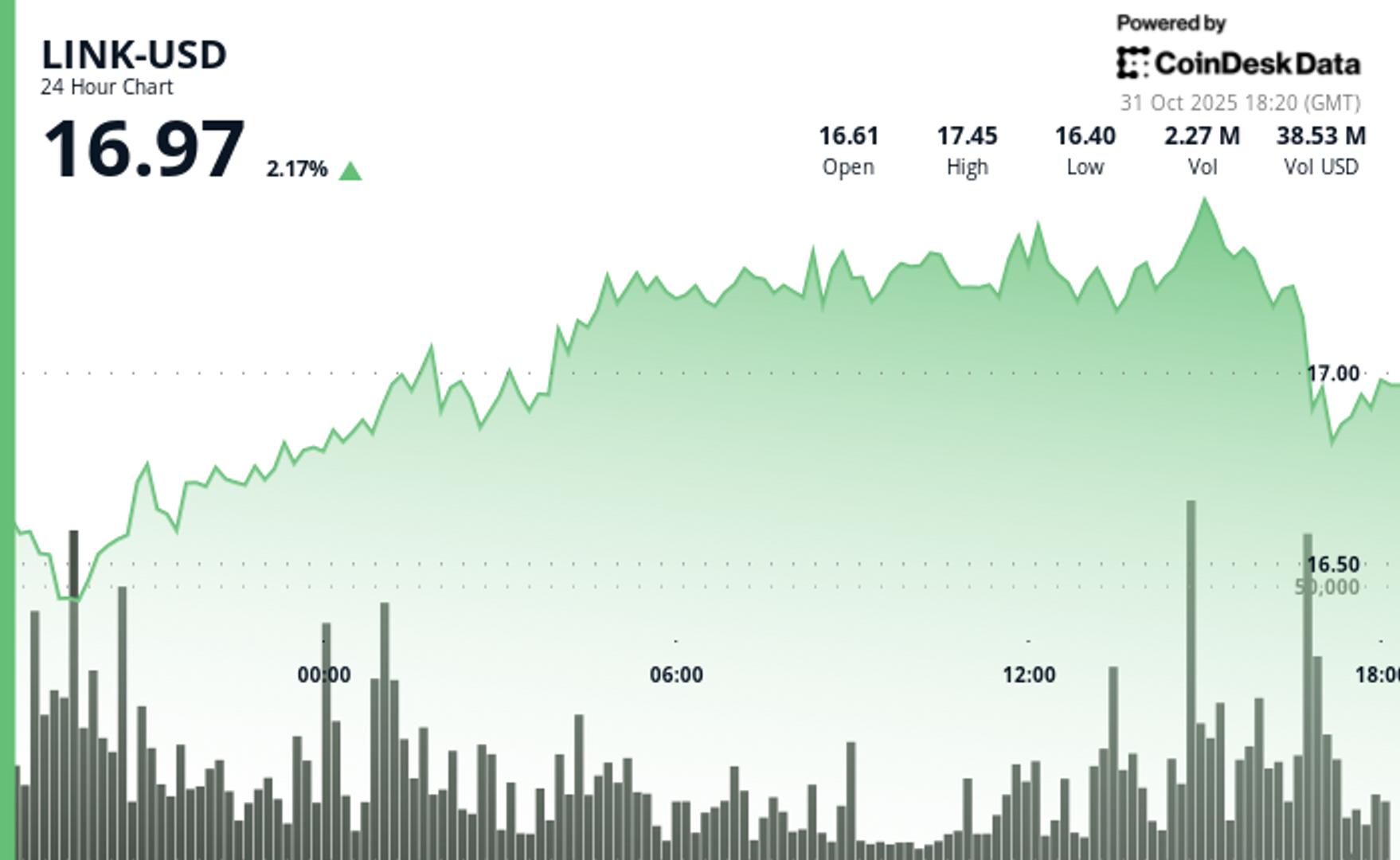

The native token of the Chainlink oracle network increased by 3.6% on Friday, recouping some of Thursday’s losses as traders responded around a crucial support level.

LINK temporarily surpassed the $17 mark with a significant uptick in trading volume — approximately 3 million tokens exchanged hands during a morning surge — indicating renewed buying interest, according to CoinDesk Research’s market insights tool. However, weakness in U.S. trading hours caused LINK to drop back below $17. At the moment, the token is trading at $16.96.

In other news, Stellar (XLM), which focuses on payments, has announced its integration of Chainlink’s Cross-Chain Interoperability Protocol (CCIP), Data Feeds, and Data Streams. This integration allows developers and institutions on Stellar to access real-time data and reliable cross-chain infrastructure for tokenized assets.

With over $5.4 billion in quarterly Real-World Asset (RWA) volume and a rapidly expanding DeFi presence, Stellar’s adoption of Chainlink tools indicates a growing demand for secure, interoperable financial frameworks.

Key technical levels to monitor:

LINK is currently positioned near-term support at $16.37, with upside targets at $17.46 and $18.00. The ability of the token to sustain Friday’s rebound may hinge on broader market trends and continued buying interest.

- Support/Resistance: Strong support exists at $16.37 after multiple successful tests, while $17.46 has shown repeated rejection patterns.

- Volume Analysis: A 78% surge in volume during the breakout attempt confirms interest from institutional investors, alongside significant selling volume indicating position rebalancing.

- Chart Patterns: A late-session flush-out pattern creates a classic oversold setup for accumulation strategies.

- Targets & Risk/Reward: Staying above $16.89 targets a retest of $17.46, with potential upside to $18.00, while downside risk is limited to $16.37 support.

Disclaimer: Parts of this article were created with the help of AI tools and reviewed by our editorial team to ensure precision and adherence to our standards. For further details, see CoinDesk’s complete AI Policy.