A prominent cryptocurrency analyst has sparked renewed discussions with an ambitious buying strategy for Cardano (ADA), while market indicators suggest a more prudent outlook in the short term.

Related Reading

Analyst Presents High-Stakes Price Targets

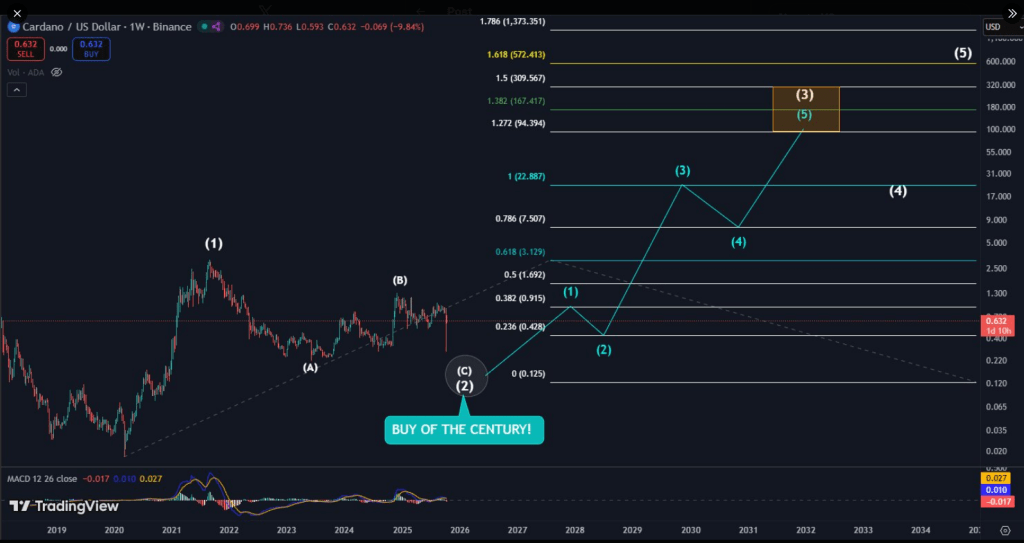

Mr. Brownstone claims that Cardano could present a rare buying opportunity if the price follows a particular trend. He pointed out strategic entry points and outlined a five-wave pattern that, according to his analysis, could propel ADA into three-digit figures.

As of the latest updates, ADA had increased by 4% over the past 24 hours, trading at approximately $0.67. This followed a more than 20% decline over the previous two weeks, with a sharp drop to nearly $0.27 on Binance on October 10.

Ambitious Wave Predictions

The analyst’s wave analysis indicates that ADA is expected to first bounce back to around $0.91 before retracing to about $0.42. His third wave projection is set at $22.89, translating to a 3,34% increase from the then-prevailing price.

$ADA ‼️ BUY OF THE CENTURY! ‼️

📢 The opportunity with Cardano could be transformative!

Q1 2026 might unveil one of the finest investments this century, acquiring $ADA for under $0.20

If such a decline transpires, price targets for the upcoming years could be:

🔷 Intermediate wave (3) =… pic.twitter.com/KgsTp6lapR

— Mr. Brownstone (@GunsRoses1987) October 18, 2025

A subsequent correction to $7.5 is anticipated, with a later threshold of $167 at the 1.38 Fibonacci extension. The chart’s most extreme projection reaches the 1.61 extension at $572 — a forecast that Mr. Brownstone associates with long-term cycles, expecting a possible fulfillment by 2034, approximately nine years from now.

His perspective indicates that one final significant dip near $0.20 could establish the groundwork for the entire market structure. He posits that a drop to around $0.20 — nearly a 70% decrease from the market price at the time of his analysis — could occur in early 2026.

Derivatives Indicate Lower Confidence

However, current market signals suggest a different narrative. Reports indicate that futures Open Interest for ADA has plummeted to over $112 million, marking the lowest point this year, levels not seen since November 2024, according to Coinglass data.

A decrease in Open Interest typically suggests that fewer new positions are being initiated. Simultaneously, short positions have surged while trader engagement has declined. ADA has corrected almost 7% in the past week and was trading around $0.65 at the time of this report.

Related Reading

High Aspirations, Significant Concerns

Overall, the situation presents a mixed outlook. The analyst’s model offers remarkable upside potentials: $22.89, $167.4, and the striking $572.4. However, these projections are based on a stringent wave interpretation and the expectation of strong buying following a drastic low close to $0.20.

Market depth and derivatives data have yet to favor such optimism. With lower participation and increased short interest, the current trends often suggest weaker short-term momentum.

The reports highlight contrasting perspectives: an exciting long-term vision amidst data that advocates for caution at present. Traders and investors are tasked with balancing wave analysis against tangible trading activity and the risk of prolonged subdued prices.

Featured image from Gemini, chart from TradingView