Key takeaways:

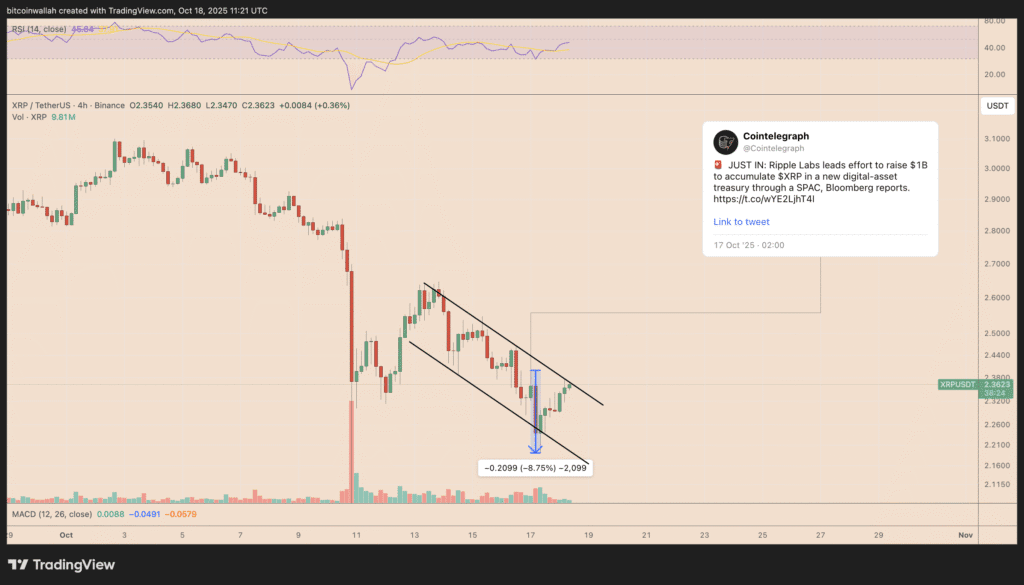

XRP price fell by 8.75% on Friday despite Ripple’s $1 billion acquisition plans.

A decline towards the $2 support level may occur in the coming days, as bulls hope for a rebound.

Ripple is said to be aiming to raise $1 billion to purchase XRP (XRP) for its digital asset treasury. This could position it as the largest corporate holder of this top-five cryptocurrency globally.

Nevertheless, XRP bulls largely overlooked the news on Friday, with the price dropping 8.75% following the announcement on October 17, continuing its downward trend, as depicted below.

Can XRP escape its ongoing downtrend this October?

XRP price seeks recovery after testing $2 support

Looking at the broader picture, XRP has been moving within a falling wedge pattern following last week’s market downturn, which liquidated over $20 billion in positions.

The price might still decline towards the $2 support level, coinciding with the wedge’s lower boundary and serving as a potential reversal area.

A breakout above the wedge’s upper trendline could lead to an upside target of $2.36–$2.75 range, marking a 5-20% increase from current price levels in October.

Related: Ripple acquires corporate treasury management firm GTreasury for $1B

This range includes levels holding up to $118.76 million in cumulative short leverages, according to CoinGlass data.

Potential short liquidations at these levels could generate momentum towards $3, a psychological resistance target that aligns with the upper boundary of XRP’s descending triangle pattern.

In contrast, a close below $2 would invalidate the wedge pattern, allowing for further downside pressure towards $1.65, which is the 0.618 Fibonacci retracement level, by the end of the month.

Long-term outlook: XRP remains poised for a breakout

On longer-term charts, XRP is still holding its ascending triangle breakout scenario, despite plummeting 60% during last week’s “black Friday.”

As of Friday, the cryptocurrency is above the triangle’s lower trendline near $2.25, looking for a rebound towards the upper trendline near $3.55.

A breakthrough above $3.55 with strong volumes could push the price up to $7.75, indicating a 250% increase from current levels by early 2026.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.