The sell-off on October 10–11, which wiped out around $19–20 billion in crypto within a single day, has sparked intense discussions on whether market dynamics or intentional actions transformed a macroeconomic shock into a wave of liquidations.

Was the Crypto Crash Deliberate?

On X, Uphold’s research lead Dr. Martin Hiesboeck claimed that the crash “is believed to be a targeted attack that exploited a vulnerability in Binance’s Unified Account margin system.” He asserted that collateral involving assets like USDe, wBETH, and BnSOL “had liquidation triggers determined by Binance’s own erratic spot market, rather than reliable external sources,” which set off a cascade once those assets detached from their pegs on Binance order books. He further noted that the event “was strategically timed to exploit the gap between Binance’s announcement of a solution and when it was actually implemented,” dubbing it “Luna 2.”

The crypto market crash on October 11 is believed to be a targeted attack that exploited a flaw in Binance’s Unified Account margin system.

The issue stemmed from using assets like USDE, wBETH, and BnSOL as collateral, whose liquidation prices were based on Binance’s own…

— Dr Martin Hiesboeck (@MHiesboeck) October 12, 2025

Binance has recognized significant price dislocations in those specific assets during the crash period and pledged to compensate affected users. In a series of updates released between October 12-13 (UTC), the exchange announced that “all Futures, Margin, and Loan users who held USDE, BNSOL, and WBETH as collateral and were impacted by the depegging from 2025-10-10 21:36 to 22:16 (UTC) will be compensated, along with any liquidation fees incurred,” with payouts “calculated as the difference between the market price at 2025-10-11 00:00 (UTC) and their respective liquidation price.” Binance also outlined “enhancements to risk controls” following the incident.

Related Reading

The depegging was extreme on Binance’s order books: USDe traded as low as approximately $0.65, while wrapped staking tokens wBETH and BnSOL also plummeted, severely devaluing collateral in Unified Accounts and prompting forced liquidations. Community posts and third-party market reports captured those price movements and their immediate effects on margin balances during the critical 21:36–22:16 UTC period.

Hiesboeck subsequently described the sequence of events as leverage clashing with fragile collateral mechanics rather than a straightforward price discovery situation. In a follow-up elaboration, he stated: “The Trigger: It all began with an external shock. A political statement (Trump’s new tariff threat) impacted the US stock market, causing fear to spill over into crypto… The Amplifier: …an excess of high leverage use… Domino Effect: …panic selling hit traditionally stable assets (like USDe and wBETH), leading them to ‘depeg’… The Lesson (and Binance’s Role): Analysts believe the true problem was not an attack, but poor design… [the] system liquidated [collateral] instantly at any price.” He added that “Binance is now working on a substantial compensation plan.”

Related Reading

The macroeconomic shock was indeed a plausible starting point. The liquidation wave on October 10–11 was triggered by new tariff threats from President Donald Trump against China, which led to a risk-off sentiment across various assets and a sharp deleveraging across crypto derivatives. The crash on Friday marked the “largest ever” liquidation event, with approximately $20 billion in liquidations occurring within a single day, resulting in over $1.2 billion in trader capital lost on Hyperliquid alone.

The technical debate centers around the “exploit” allegation. One perspective highlights a design flaw in how Binance’s Unified Account handled specific types of collateral: instead of relying on stable external pricing, liquidation benchmarks referenced internal spot pairs that became thin and chaotic at the critical moment. Critics assert that this design created a cycle where depegging collateral triggered further liquidations, which flooded more of the same unstable collateral back into the market.

In response, Binance has indicated it will revise pricing logic for wrapped assets and has started compensating users who were liquidated or experienced confirmed losses during the defined timeframe. Ethena’s team, whose synthetic dollar USDe was central to the volatility, argues that the issue was confined to Binance’s pricing/oracle mechanism rather than a fundamental flaw in USDe’s structure.

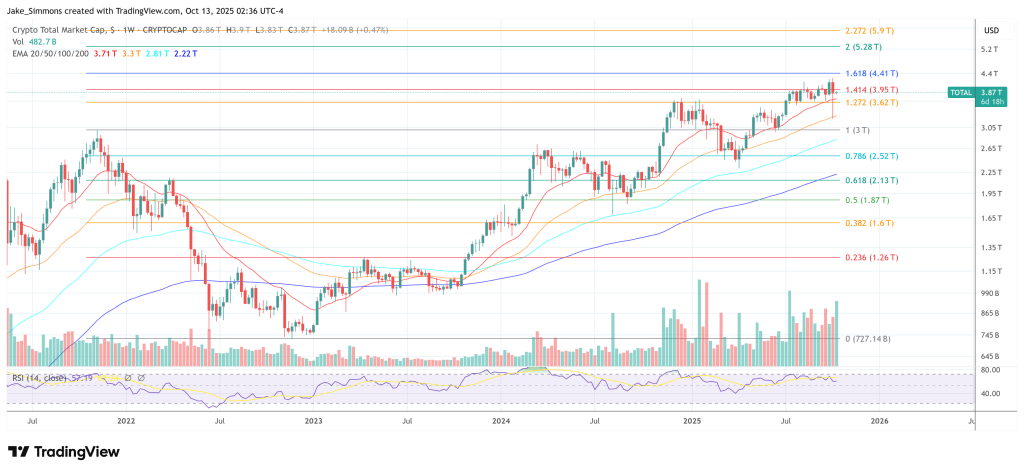

As of now, the overall crypto market capitalization has rebounded to $3.87 trillion.

Featured image created with DALL.E, chart from TradingView.com