The evolution of Bitcoin has always been a remarkable journey.

What started as a peer-to-peer digital cash system has gradually transformed into the premier digital reserve asset globally. Throughout this evolution, Bitcoin has drawn interest not only from cypherpunks and technologists but also from institutions, public corporations, and financial service providers eager to weave it into their operations and balance sheets.

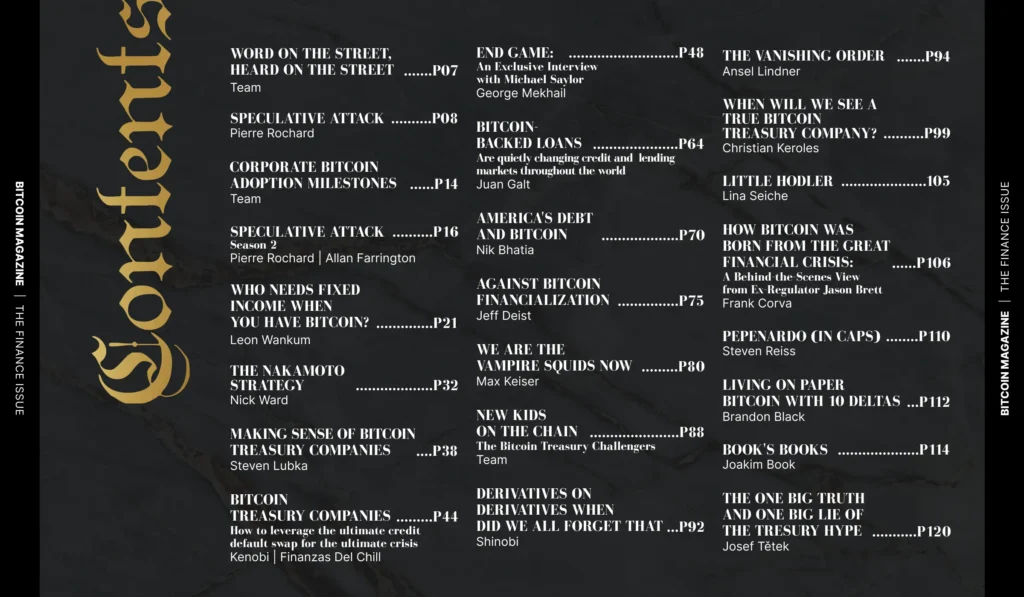

This edition, The Finance Issue, delves into one of the most intricate and significant chapters of Bitcoin’s ongoing evolution: its incorporation into the realm of corporate treasuries and mainstream finance. In recent years, the adoption by publicly traded companies, asset managers, and fintech platforms has reshaped the narrative. Bitcoin is increasingly viewed not just as a speculative investment or ideological pursuit, but as a strategic reserve, a treasury diversification mechanism, and a part of broader financial strategies.

The figures illustrate this progression. In a little over two years, the number of public companies holding Bitcoin has increased fivefold, with nearly 200 firms now collectively custodian to over one million BTC. Together, these companies represent more than $110 billion in value—an amount that rivals the reserves of certain nation-states. This institutional adoption highlights a trend few could foresee a decade ago:

Bitcoin is transitioning from the outskirts of finance to its core.

With this expansion arise critical questions. What does it imply for Bitcoin to become more ingrained in traditional financial systems? Does treasury adoption stabilize the asset and lessen volatility, or does it risk exposing Bitcoin to systemic vulnerabilities it was created to mitigate? How should investors, policymakers, and Bitcoin enthusiasts interpret the intersection of grassroots innovation and Wall Street involvement?

This issue unites a diverse array of contributors—macroeconomists, analysts, corporate treasurers, and market observers—to explore the opportunities and risks presented by financialization. Their perspectives illuminate the strategic choices affecting corporate balance sheets today and their possible implications for Bitcoin’s monetary future.

History reveals that periods of swift integration often align with times of significant uncertainty. Yet, these moments also signal stages of maturation. Regardless of whether one views this transition with hope or skepticism, it is undeniable that Bitcoin is now woven into the global financial landscape in ways that will influence its path for years to come.

We invite you to delve into these concepts with us in the upcoming pages.

Welcome to The Finance Issue.

— Mark Mason

Don’t miss your opportunity to acquire The Finance Issue — featuring an exclusive interview + photo series with Michael Saylor at his estate.

This excerpt is the Letter from the Editor highlighted in the latest Print edition of Bitcoin Magazine, The Finance Issue. We’re sharing it here as a preview of the topics discussed throughout the complete issue.