In today’s crypto news, the Bank of North Dakota has revealed plans to launch its official stablecoin, the Roughrider Coin. Additionally, traders on BNB Chain are profiting as new memecoins surge, while analysts anticipate that Canary Capital’s Litecoin and HBAR funds are set to launch once the US government reopens.

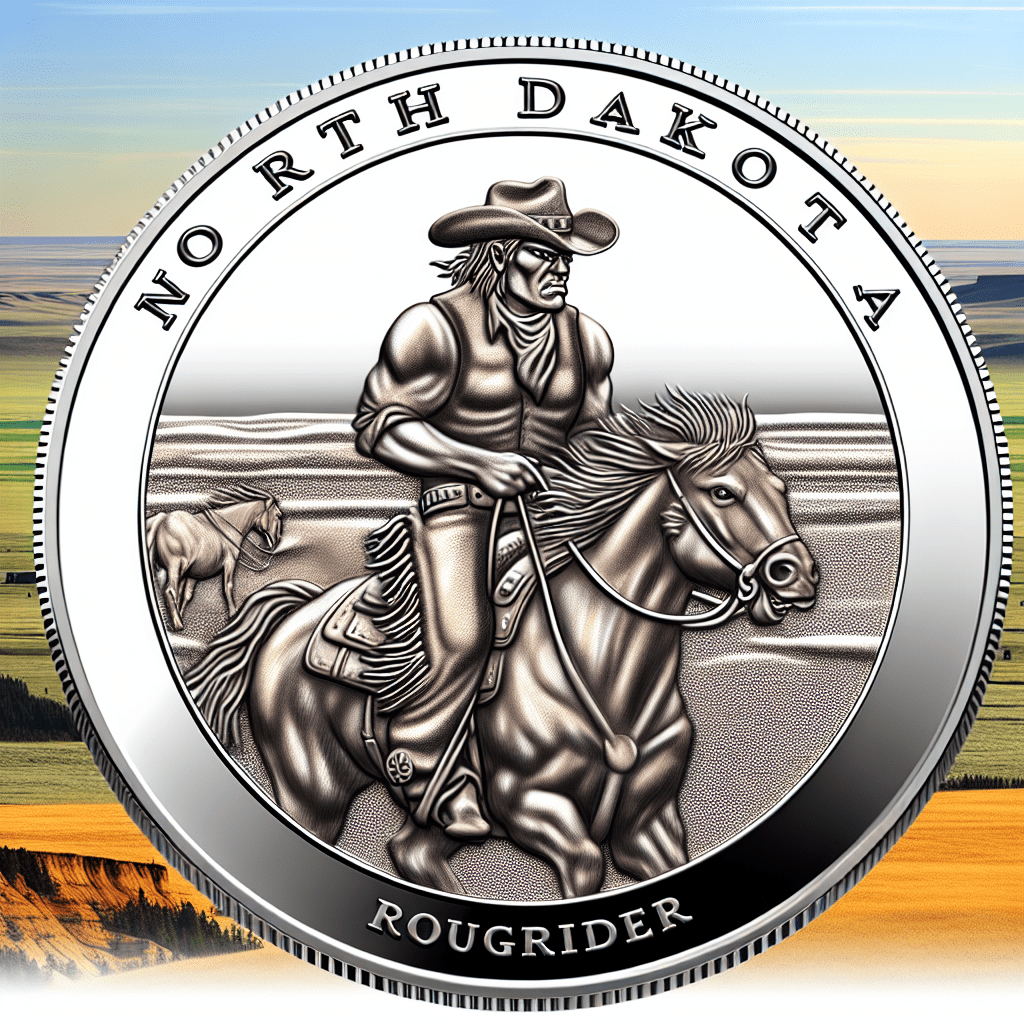

North Dakota and Fiserv Unveil State-Backed ‘Roughrider’ Stablecoin

The Bank of North Dakota is entering the stablecoin space with Roughrider Coin, a cryptocurrency backed by the US dollar, developed in partnership with payment processor Fiserv.

As stated in a Wednesday announcement, the token will be accessible to banks and credit unions in North Dakota in 2026, designed to facilitate interbank transactions, merchant payments, and cross-border money transfers.

In 2022, Fiserv reported processing approximately 35 billion merchant transactions. Its digital asset platform was launched in June, alongside a “white-label” stablecoin for banks. Roughrider Coin will utilize this infrastructure and Fiserv expects it to be compatible with other stablecoins.

The coin’s name pays homage to Theodore Roosevelt, who was US president from 1901 to 1909. In the late 1800s, Roosevelt led the Rough Riders, a unit that fought in Cuba against the Spanish Army. After his political career, he settled in North Dakota.

The Roughrider token will be the second state-issued stablecoin announced in the US this year, following Wyoming’s Frontier Stable Token (FRNT), which launched its mainnet in August on seven blockchains and confirmed Hedera as its issuer in September.

BNB Chain Memecoins Create New Millionaires This Week

Traders in the cryptocurrency realm have gained millions from small-cap memecoins on the BNB Chain over the past week, indicating a fresh influx of speculative capital driving the current market cycle.

One of the most successful investors is trader “0xd0a2,” who transformed an initial investment of $3,500 into $7.9 million, achieving a 2,260-fold return in just three days, according to blockchain analytics platform Lookonchain.

Another trader, “hexiecs,” turned a $360,000 investment into more than $5.5 million by investing in the recently launched “4” memecoin, which surged following a post from Binance co-founder Changpeng Zhao.

Other investors joined in, including trader “brc20niubi,” who converted a $730,000 investment into $5.4 million, registering a remarkable 1,200-fold return, as noted by Lookonchain.

This activity was preceded by a trade earlier in the week when wallet “0x872” made nearly $2 million in profits within mere hours after investing just $3,000 in the 4 token. The trader achieved a 650-fold return after Zhao reshared a post about the token to his 8.9 million followers on X on October 1.

Canary’s Litecoin and HBAR ETFs Ready for Launch Post-Government Shutdown

Canary Capital appears to be on the verge of having its Litecoin (LTC) and HBAR (HBAR) exchange-traded funds (ETFs) approved after submitting key final details on Tuesday, though they’re unlikely to launch during the ongoing US government shutdown.

The amendments included a 0.95% fee and the ticker “LTCC” for its Canary Litecoin ETF and “HBR” for its Canary HBAR ETF, which Bloomberg ETF analyst Eric Balchunas mentioned are typically the final updates before launch.

He further noted that with the US government shuttered and the Securities and Exchange Commission largely inactive, the timeline for approval is uncertain, although the filings are “looking pretty finalized to me.”

Meanwhile, ETF issuer Tuttle Capital has submitted applications for 60 new 3x ETFs, while GraniteShares has filed a range of ETF applications encompassing various assets, including Bitcoin (BTC) and Ether (ETH). ProShares has also joined the movement with a series of filings.

Balchunas stated there are nearly 250 ETF filings aiming to offer 3x leverage tied to cryptocurrencies, with issuers submitting so many applications at once because they are “financially beneficial.”