As Bitcoin (BTC) remains within the low $110,000 range, an essential on-chain metric has turned bullish, indicating the potential for an impending price rally that could push the leading digital asset to new all-time highs (ATH) shortly.

Bitcoin’s 600,000 Transactions Benchmark Takes Spotlight

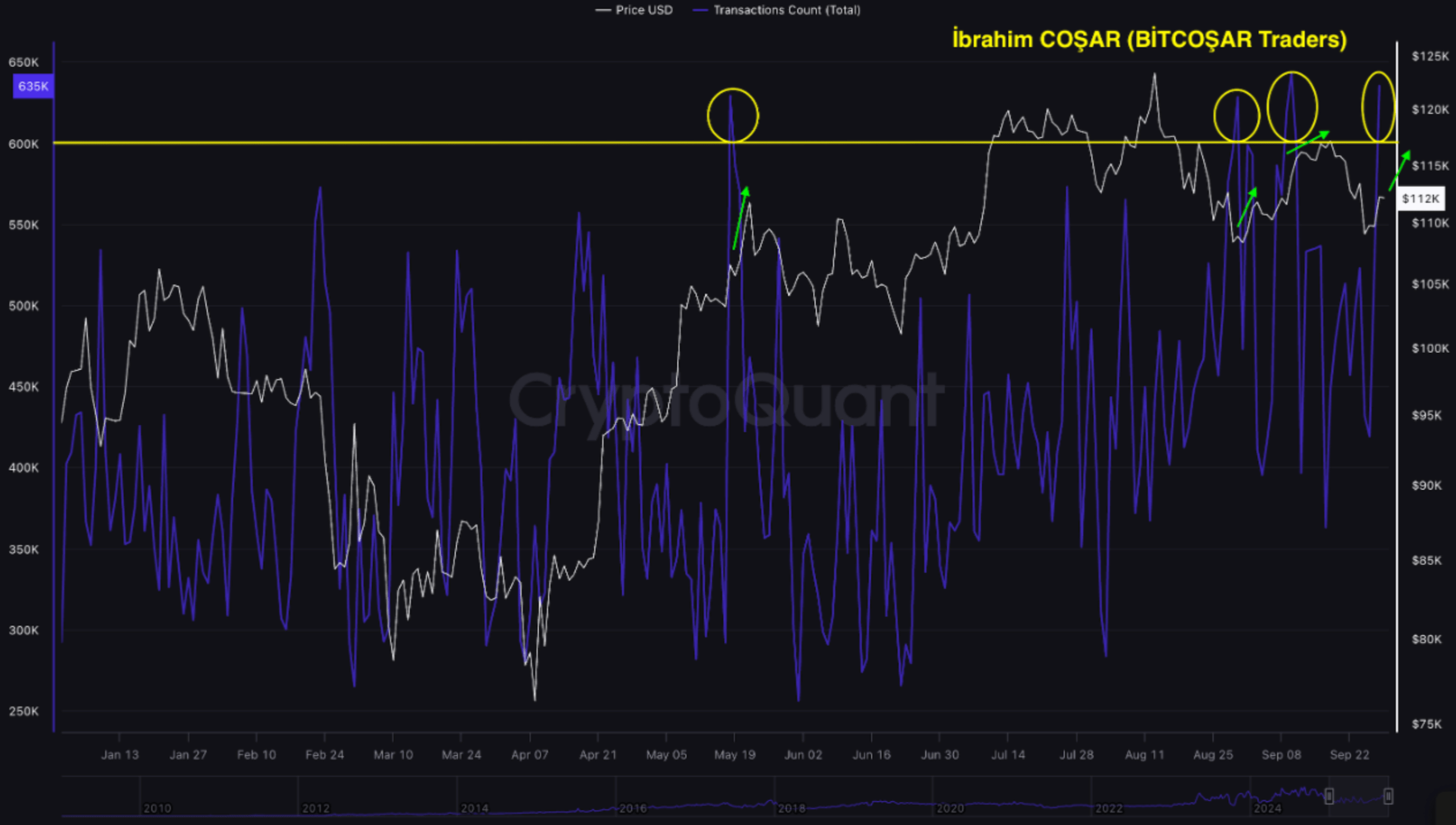

As per a CryptoQuant Quicktake post by contributor Ibrahim Cosar, a significant correlation between the price of BTC and the cumulative number of transactions over time is noteworthy.

Related Reading

The analyst presented a chart illustrating the connection between Bitcoin’s price and transaction totals. Remarkably, whenever the total transaction count exceeds the 600,000 mark—or even nears it—BTC’s price tends to initiate a rally.

The chart above depicts three prior instances in 2025 when BTC’s total transaction count surpassed 600,000, accompanied by subsequent price increases. In May, there was a notable price boost following a surge in Bitcoin’s transaction count.

Similar patterns of transaction count spikes and price hikes were observed in August and early September. The CryptoQuant analyst pointed out that this trend has become especially evident since Q4 2024. Cosar further remarked:

I have been analyzing on-chain data extensively, and it’s uncommon to find such a distinct pattern. The 600K transaction threshold appears to act as a signal that activates Bitcoin’s “price engine.” This is a personal finding, and the chart supports it clearly.

The analyst indicated that heightened transaction activity on the network is a primary indicator of Bitcoin’s fundamental usage and demand. As the number of transactions increases, the network becomes more dynamic and engaged.

Enhanced usage of the Bitcoin network creates inherent buying pressure on Bitcoin’s price, fueling the cryptocurrency’s bullish momentum. According to Cosar, the 600,000 transaction mark signals an “activity explosion” threshold leading to a “price explosion.”

However, the analyst emphasized that no single factor can entirely dictate BTC’s price, as it is influenced by a combination of various elements, including macroeconomic conditions, regulations, and trading activities.

Yet, the importance of an on-chain indicator with such a strong correlation to BTC’s price must be acknowledged. If the total transaction count rises above 600,000 once more, expect BTC to reach a new record high.

Is a Dip Below $100,000 on the Horizon for BTC?

Bitcoin’s struggle to decisively surpass its current ATH of $124,128 recorded on August 14 has raised concerns among bulls about the digital asset’s dwindling momentum. Currently, the cryptocurrency is at its most oversold condition since April 2025.

Related Reading

From a technical perspective, BTC has established a bearish evening star pattern on the weekly chart, increasing the likelihood of a price drop below $100,000. As of this writing, BTC is trading at $114,117, marking a 3.8% increase in the last 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com