Fidelity Digital Assets forecasts that by 2032, 8.3 million BTC, representing 42% of the Bitcoin supply, will be considered illiquid.

Summary

- Fidelity Digital Assets anticipates that by 2023, 42% of the BTC supply will be illiquid.

- The predominant holders will likely be public companies and long-term investors.

- If these predictions hold true, they will significantly affect Bitcoin’s market price.

According to investment powerhouse Fidelity, Bitcoin might become more scarce than ever. On Tuesday, September 16, Fidelity Digital Assets released a report discussing the future landscape of the Bitcoin market. As per the findings, approximately 8.3 million BTC, equating to 42% of the total Bitcoin supply, could be with holders who are not inclined to sell.

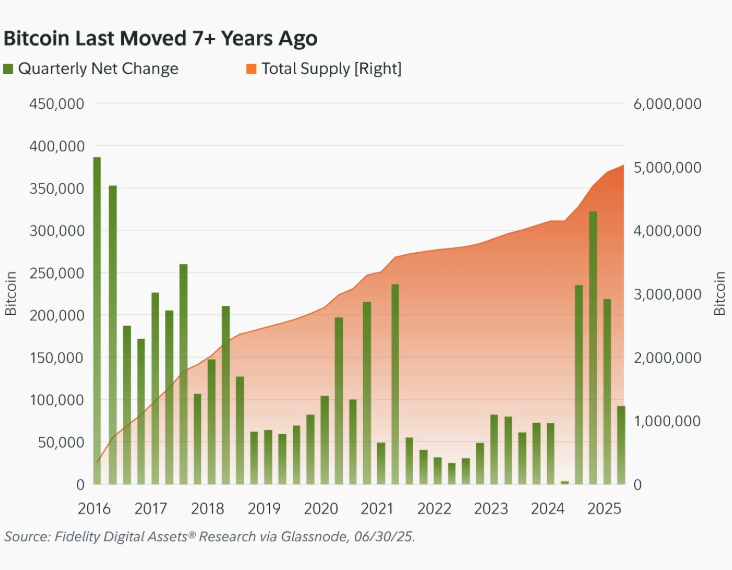

The main contributors to this growing illiquid supply are long-term investors and public companies. Significantly, Fidelity Digital Assets pointed out that the Bitcoin supply not moved for seven years or longer is on the rise, currently exceeding 350,000 BTC.

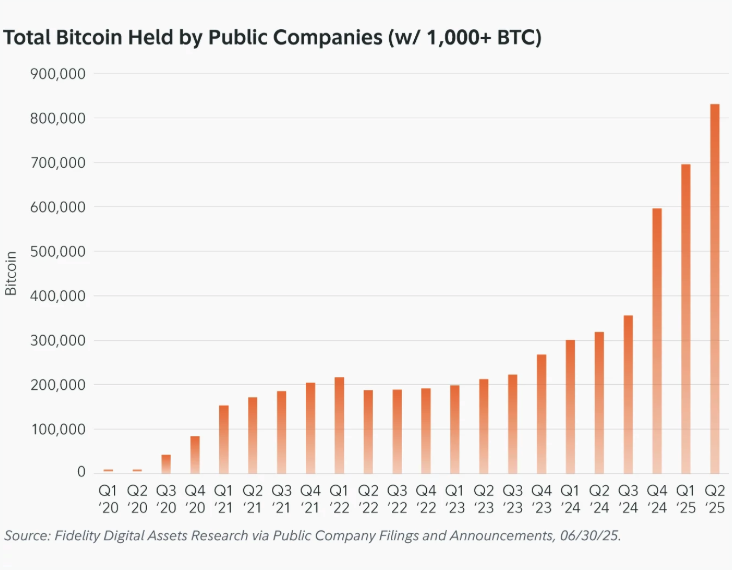

Public Companies Are Increasingly Acquiring Bitcoin

Public companies are also a major factor in the illiquid supply. Their Bitcoin holdings have surged since the fourth quarter of 2024, currently exceeding 830,000 BTC. Furthermore, most of these assets are held by the top 30 firms, according to Fidelity Digital Assets.

Both public companies and long-term investors have exerted upward pressure on Bitcoin prices. Moreover, the value of their combined holdings has more than doubled compared to the same period last year.

Assuming the accumulation rate over the past decade continues, Fidelity Digital Assets projects that by 2032, 42% of all Bitcoin could be illiquid. However, the report advises caution, as trends may shift. Notably, in July 2025, holders sold off 80,000 “ancient Bitcoin,” which had been held for over a decade.