A major decline in the crypto market has created significant turbulence within the industry over the past 24 hours, resulting in a wave of liquidations. Approximately 200,000 traders were compelled to exit their positions as Bitcoin dropped to its lowest point in seven weeks, leading to more than $900 million in liquidations within a single day.

Related Reading

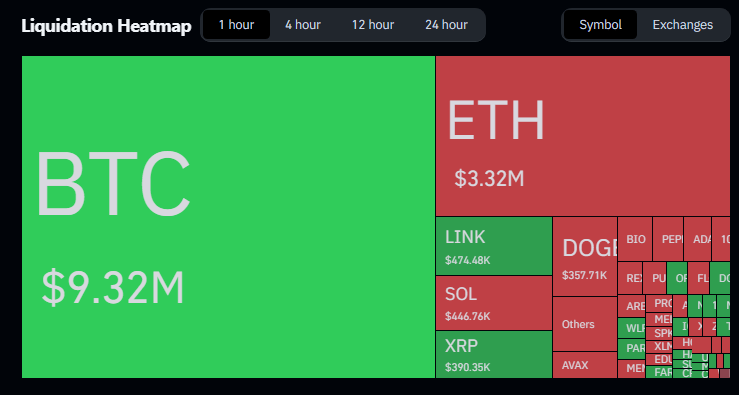

As reported by CoinGlass, the majority of these losses stemmed from long positions that failed to withstand the downturn.

Liquidations Impact Retail Traders

Reports indicate that a single large transaction triggered this downward spiral. A significant holder sold 24,000 BTC, which prompted a series of liquidations, according to Rachael Lucas, a crypto analyst at BTC Markets.

On Coinbase, Bitcoin briefly dipped below $109,000—marking its lowest level since July 9. Market participants quickly reacted to the shock, with long traders being the most affected.

Macro Signals And Market Response

A recent comment from Federal Reserve Chair Jerome Powell during Jackson Hole regarding possible interest rate cuts altered how some investors assessed risk.

Since Bitcoin reached an all-time high of just over $124,000 on August 14, the asset has seen a correction exceeding 10%. Data suggests that the drop following Powell’s address is around 7%.

The single-day decline for Bitcoin was recorded at nearly 3%, causing the total crypto market value to fall back below $4 trillion to approximately $3.83 trillion, with nearly $200 billion exiting the market.

Ether Remains Stable

Ether was trading near $4,340 and, for the moment, appears more stable than Bitcoin. While it did experience a decline, it did not surpass last week’s low. Institutional interest in Ether continues to be significant. Lucas mentioned that institutions are still focusing on Ethereum, even as traders reevaluate their risk in smaller coins.

Related Reading

Altcoins Suffer Greater Losses

Many smaller tokens experienced steeper declines than the major coins. Solana, Dogecoin, Cardano, Chainlink, and Sui were some of the hardest hit.

This resulted in losses surpassing the headline Bitcoin figures, leaving traders heavily invested in altcoins with larger drawdowns.

Thin weekend liquidity exacerbated the price fluctuations, intensifying the volatility compared to a more active trading day.

September’s Historical Context And Outlook

Additionally, there is a historical aspect to consider. September has often seen significant pullbacks in bull markets, with notable corrections occurring in 2017 and 2021.

Featured image from Meta, chart from TradingView