The cryptocurrency market appears poised to end August on a positive note, yet it still remains below the significant $4 trillion threshold. The current total market capitalization stands at $3.87 trillion, still missing that psychological marker.

Traders are looking ahead to September with increased interest, influenced by anticipations of potential rate reductions that might enhance risk appetite. In this context, Made in USA coins are gaining renewed attention. While prominent tokens like XRP, Solana, Cardano, and Chainlink still hold the spotlight, there are three lesser-known Made in USA coins that could become active in September.

Stellar (XLM)

Stellar (XLM) is set to close August significantly in the red, with a decline of 8.7% over the month and 12.7% in the last week. However, despite this downturn, it could be one of the Made in USA coins to watch in September.

The primary factor driving interest is its real-world asset (RWA) growth, which surged by 12.9% in the past 30 days, reaching a value of $511.42 million. This positions Stellar among the few large-cap projects concluding August with a positive fundamental outlook.

Increased transaction volumes may be essential to sustain this growth, a target clearly outlined by the Stellar Development Foundation.

In an exclusive comment to BeInCrypto, Matt Kaiser, Stellar analyst at Messari, stated:

“By the end of 2025, the Stellar Development Foundation aims for Stellar to possess $3 billion in yield-bearing RWA’s on-chain and be ranked among the top ten chains in DeFi TVL. This could create a cycle where increased institutional capital enhances user engagement, leading to higher transaction volumes and greater ecosystem activity.”

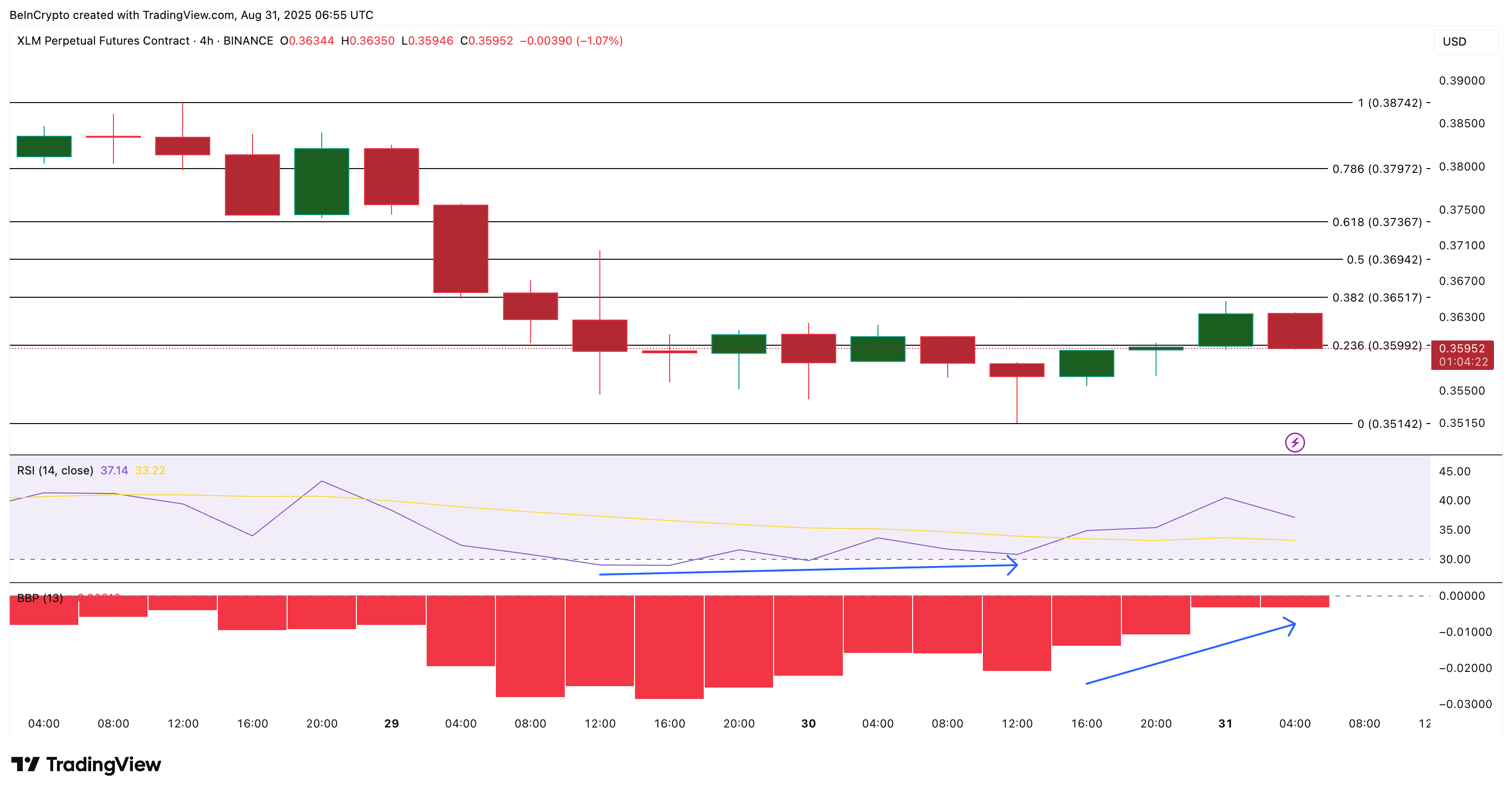

From a technical viewpoint, Stellar may be indicating a short-term bullish signal. The 4-hour chart shows a hidden bullish divergence, where the price dropped to a lower low while the RSI (Relative Strength Index, a momentum indicator) reached a higher low.

Simultaneously, the Bull-Bear Power (BBP) indicator — which assesses buying and selling pressure — has turned less negative, indicating that sellers are weakening. If this rare bullish setup continues, XLM could approach resistance levels at $0.36 and $0.37, with invalidation below $0.35.

Interested in more token insights like this? Subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter here.

A move above $0.38 would solidify the bullish setup on the daily chart as well.

Story (IP)

Story (IP), a layer-1 blockchain designed to secure intellectual property on-chain, has emerged as one of the top performers this year. The token has risen more than 30% in the last 24 hours, extending its three-month gains to 91%. Over the past year, Story (IP) has skyrocketed by over 300%.

This token’s growth is fueled by ongoing speculation regarding a potential buyback program and last month’s announcement of the Grayscale Story IP Trust, which has further bolstered the token’s bullish narrative and propelled it to a new all-time high just hours ago.

From a technical standpoint, Story (IP) has broken out of an ascending broadening wedge, a pattern often indicative of bearish reversals.

By surpassing the upper trendline, the IP price has invalidated the bearish forecast and confirmed that bulls remain in charge. This is further supported by the Bull Bear Power (BBP) indicator, which has risen even while prices consolidated, indicating underlying strength heading into September.

Currently, Story trades at $7.86, facing immediate resistance at $8.23 and the all-time high close to $9.09. A breakout above these levels would thrust the token back into price discovery mode, paving the way for new highs in September. This underscores Story’s position on the Made in USA coins’ list.

Conversely, the bullish outlook would crumble if Story falls below $6.84, with further risks emerging beneath $5.45.

Pi Coin (PI)

Pi Coin (PI) has been one of the laggards in 2025. The token has declined by 4.7% in the past month, increased by 8% in the past week, but remains down over 55% year-on-year. At $0.38, the overall sentiment remains bearish; however, September may keep traders interested in short-term surges.

Two developments have brought PI back into consideration as a noteworthy Made in USA coin: the recent protocol upgrade that introduced a Linux node and the launch of a Valour Pi Network ETP among eight new offerings, both of which have generated some positive momentum.

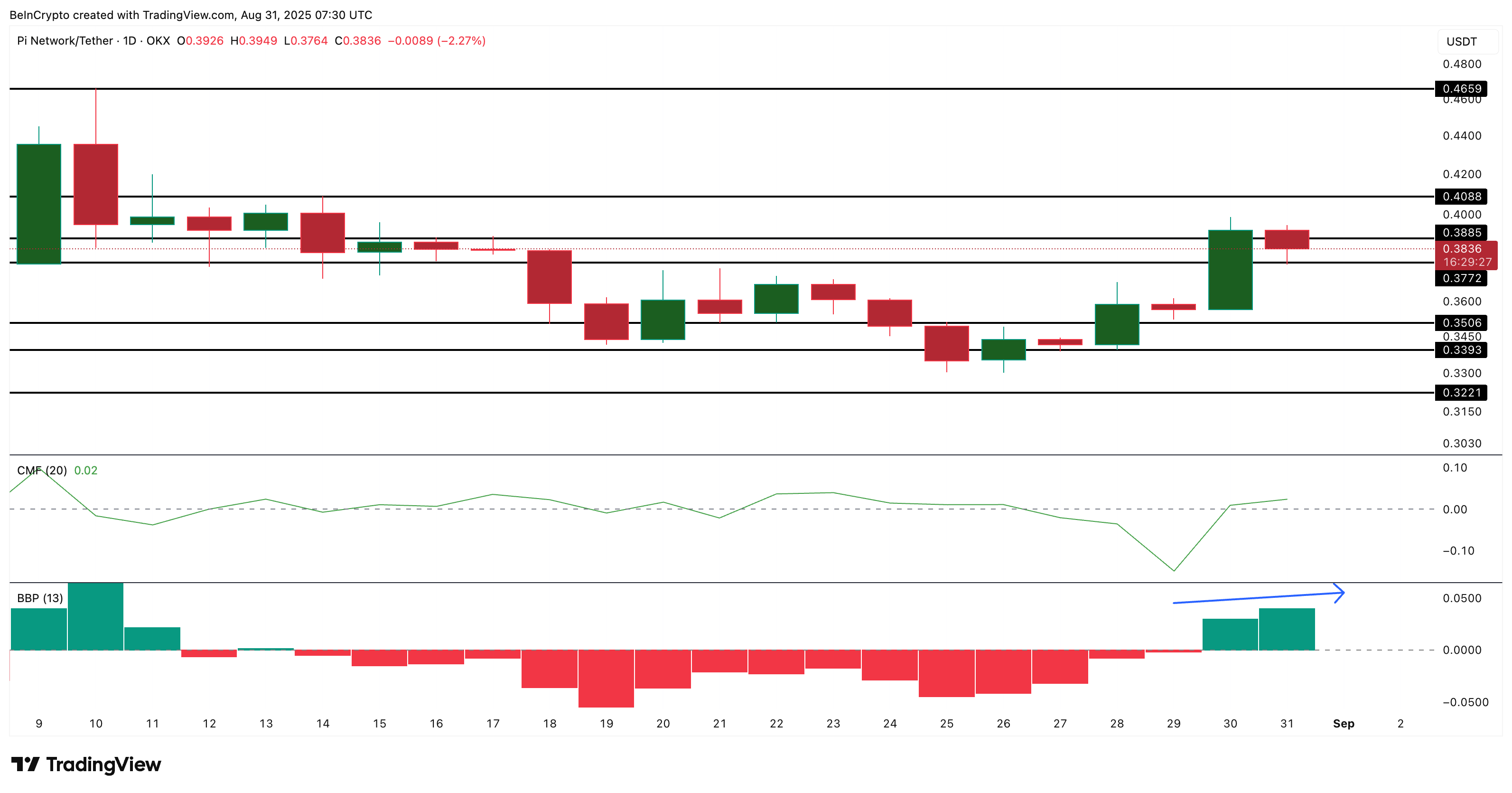

On-chain and technical indicators bolster the prospect for immediate moves. The Chaikin Money Flow (CMF) has crossed above zero for the first time in a while, indicating inflows.

A decisive rise above 0.05 on the CMF would confirm stronger buying momentum. Additionally, the BBP indicator has turned positive, suggesting increasing bullish energy.

If the positive momentum persists, PI could rally toward $0.46 — representing a 20%+ increase from current levels. However, falling below $0.33 would reignite concerns about new lows beneath $0.32.

For now, the market structure indicates traders might target Pi Network for quick intraday or swing opportunities in September rather than a lasting recovery, although it is essential to note that the overarching price framework for Pi Coin still leans bearish.

Disclaimer

In accordance with the Trust Project guidelines, this price analysis article is intended for informational purposes only and should not be construed as financial or investment advice. BeInCrypto strives for accurate, unbiased reporting, but market conditions can change without prior notice. Always perform your own research and consult a professional before making any financial decisions. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.