During the last week of August, investors aggressively accumulated various altcoins, withdrawing assets from exchanges and causing a significant drop in reserves.

As the altcoin season becomes increasingly selective, exchange reserve data may provide valuable insights for investors rebalancing their portfolios for the last quarter of the year.

1. Chainlink (LINK)

Data from Santiment reveals that Chainlink’s (LINK) exchange reserves fell to a one-year low in the final week of August.

Currently, about 186.6 million LINK are held on exchanges, a decrease from 212 million in July, indicating over 25 million LINK have been withdrawn in just over a month.

The launch of Chainlink Reserve in early August enhanced investor sentiment. As of August 28, Chainlink Reserve held 193,076 LINK tokens.

By the end of August, Chainlink announced a partnership with the US Department of Commerce, set to bring macroeconomic data like GDP and the PCE Index on-chain, which further reinforced accumulation momentum.

Recent charts show a clear shift over the past two months. Previously, LINK reserves on exchanges rose alongside price increases, indicating selling pressure. However, in recent weeks, LINK’s price has gone up while reserves have declined, signaling sustained optimism.

2. Numeraire (NMR)

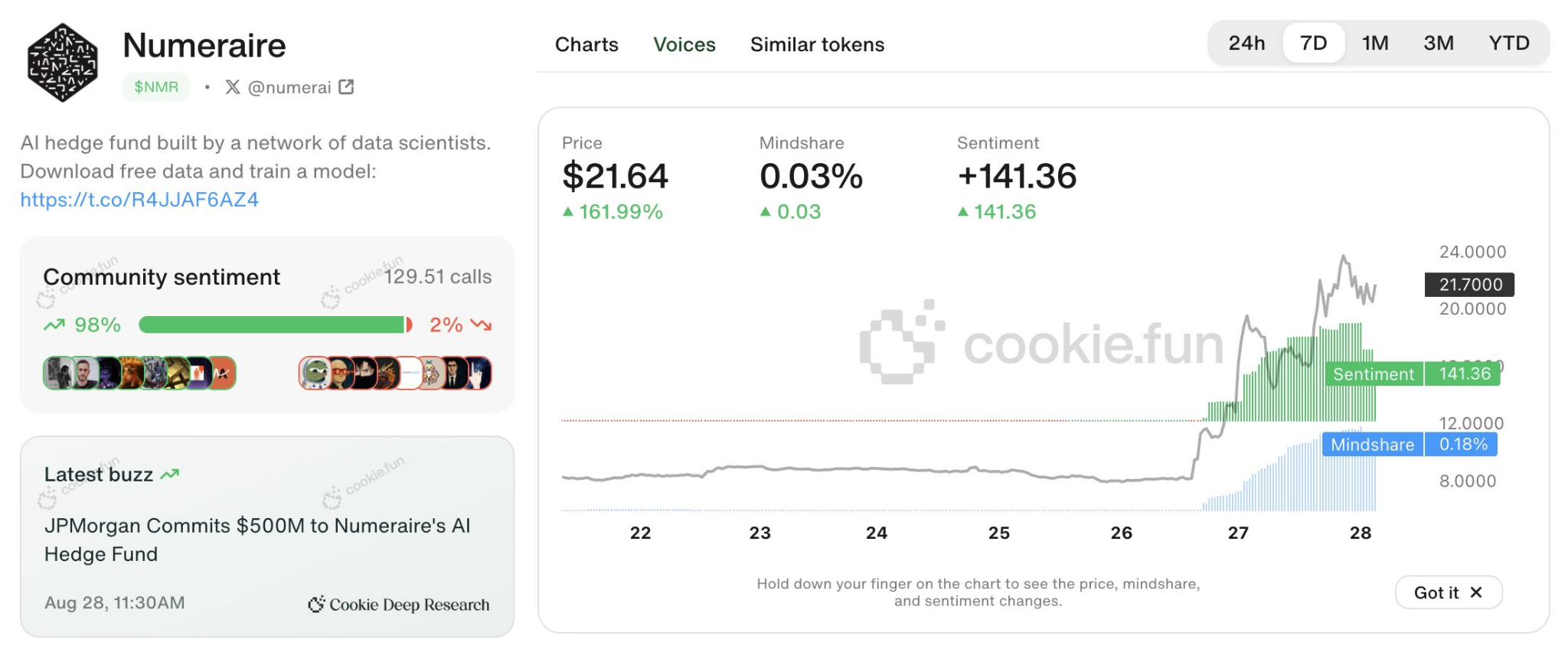

According to CoinMarketCap data, NMR surged 120% during the last week of August, with 24-hour trading volume skyrocketing from $460 million to over $1 billion. This substantial increase indicates a resurgence of investor interest.

Santiment data shows that NMR’s exchange reserves had consistently risen over the years, creating selling pressure that caused its price to drop from above $70 to below $7.

However, by the last week of August, NMR’s exchange reserves fell to 1.61 million, with approximately 350,000 tokens withdrawn compared to earlier highs this year.

While the decrease wasn’t drastic, it marked a crucial turning point that could hint at impending accumulation outside exchanges.

During the same week, Numeraire announced that JPMorgan, a leading player in quantitative strategies, committed $500 million in fund capacity, likely reviving positive sentiment.

Data from Cookie.fun confirmed a dramatic spike in mindshare and sentiment around NMR.

“JP Morgan committed half a billion to Numerai. Mindshare and sentiment jumped from near flatline to soaring levels after the news broke, and $NMR followed, climbing over 160% since. Indication of Wall Street’s growing influence on the crypto markets?” Cookie DAO stated.

3. Toncoin (TON)

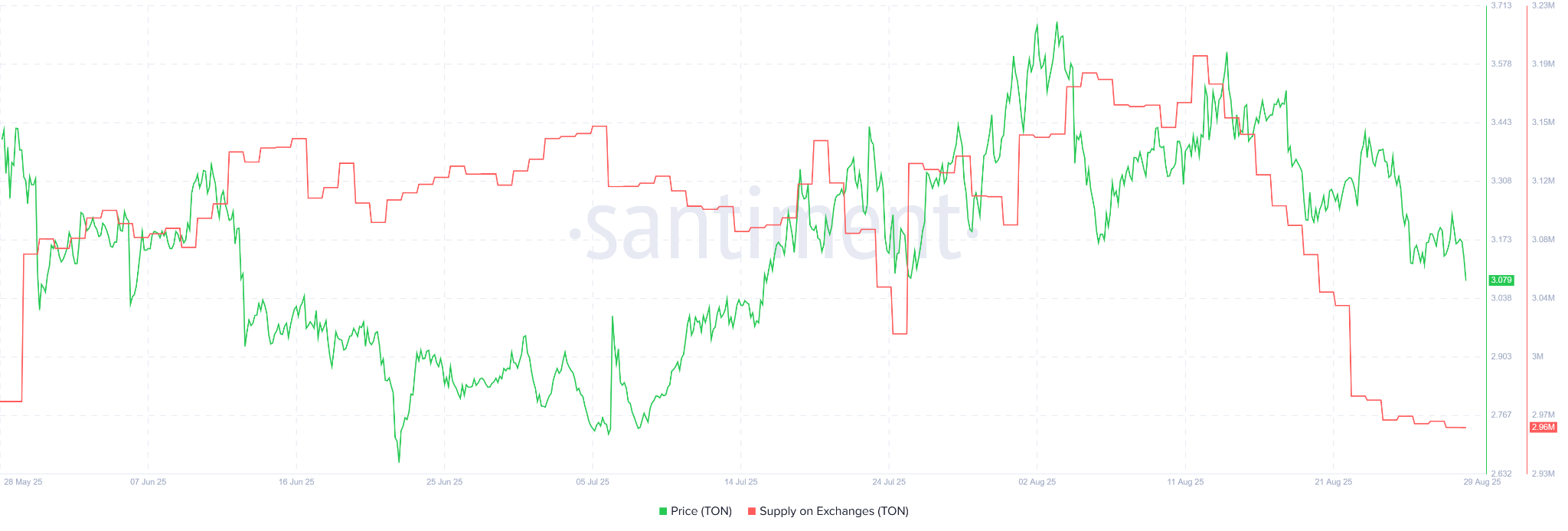

Santiment data indicates that Toncoin’s (TON) exchange reserves fell to 2.96 million in late August, the lowest level in three months. This followed a decline from 3.2 million just a week prior.

Despite TON’s price remaining around $3 for most of the year, this accumulation off exchanges could suggest the beginning of a new phase.

This decrease in reserves coincided with Verb Technology (NASDAQ: VERB) announcing the TON Treasury strategy, aiming to acquire more than 5% of Toncoin’s circulating supply. The company recently completed a $558 million private placement with over 110 institutional and crypto investors to primarily buy TON as its main treasury reserve asset.

Additionally, Robinhood listed Toncoin during the last week of August, attracting fresh US investor capital.

“Toncoin just listed on Robinhood. And it comes as no surprise. 36.2 million new users onboarded. Monthly active wallets on ton_blockchain have soared to 12.4 million, an impressive 110× growth. TVL rose from $537,000 in early January to a record $773 million by July. Over $1 billion USDT issued in circulation, the fastest milestone in Tether’s history.” — Mario Nawfal, founder of IBC Group, said.

The drop in exchange reserves for the three altcoins mentioned reflects the impact of US financial institutions and regulators. It also suggests that robust projects are more likely to gain mainstream acceptance through partnerships with government entities and leading financial organizations.

The post 3 Altcoins Show Declining Exchange Reserves in the Final Week of August appeared first on BeInCrypto.